Many believe that trading anything is a complex process, reserved only for pros. Such a notion cannot be further from the truth, as margin trading makes the job easy and profitable. How can one start the trade then? We made this guide to specifically answer this question by focusing on the best investment platforms.

Our readers can expect to find information regarding trade in terms of trading platforms available, required features they should have, and how to determine the best choice in the market. We provide tools of analysis in this article so our readers can make good decisions on where to start trading.

What Makes Trading Awesome?

So, what makes trading an awesome investment opportunity? It is easy for even beginners to use, as most work is done by the platform you wish to fund. Traders create an order, specifying the asset, price, limitations, and time you want to implement in the market. Then, the platform carries out your instructions in your stead, in real-time.

[button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#3cc195″]Try the best trading app for begginers[/button]

You do not actually need to work out the market ways nor should you open position yourself. The platform does that, allowing you time to analyze the industry properly. More importantly, all markets fluctuate in value. If you have time to investigate, downturn trends would still propose profits for you. Prices go up and down, meaning that you can make money even in the falling markets.

How Do I Start?

As with any other investment opportunity, traders should first understand what they need to look for in day trading. You start with understanding how they work and why the features of platforms are important. Opening an account at your chosen platform is the last step.

Understand how margin trading Works

Online trading is much easier than traditional trading. Rather, you create an account at the website, which serves as an agreement acceptance. Then, you create an order in that specific platform, which is an instruction for the company to enter the market and do its own order mirroring perfectly your instructions.

The profit and loss depend on real market trends and on real results. The company, in most cases, would not make have you pay any sort of trade fees but implements spread from the very beginning. In such a way, it shields itself from losses. Spreads are also part of the main revenue stream for a platform, as well, which traders should also account for when watching price movements.

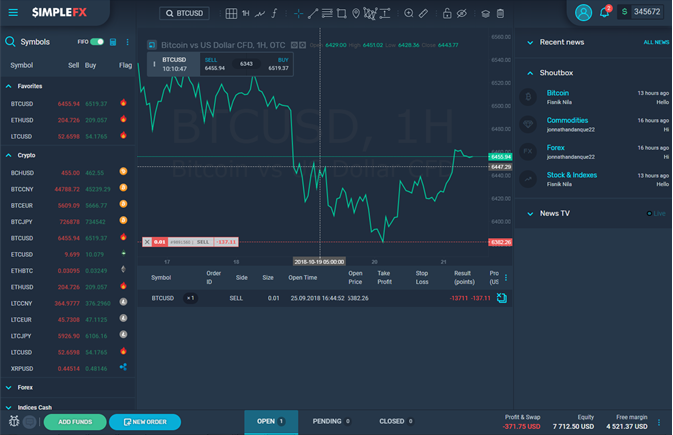

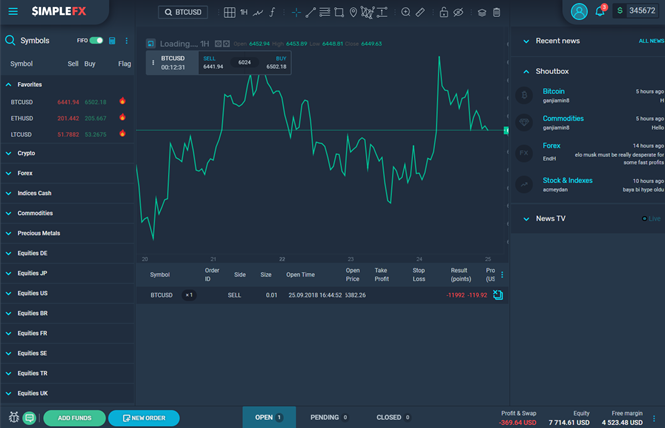

Closing an order, you decide on when the investment should end and at what price level. Many apps offer these types of transactions for a variety of online assets. SimpleFX, for example, offers commodities, stock exchanges, cryptocurrencies, Forex currency pairs, and others.

Big Players in the Market

Now that you understand how works, it is time to dig deep into the meat of the matter – platforms. Apart from SimpleFX, there are popular choices in the market that offer similar services, them being Plus500, eToro, AvaTrade, Xtb, Cityindex, and Markets.com.

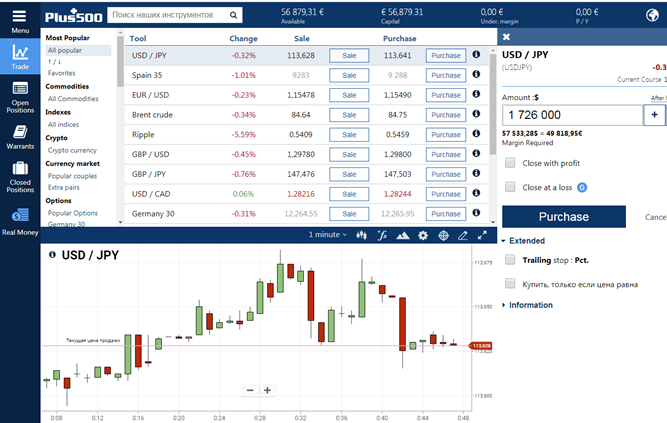

Plus500

Based in the UK, Plus500 comes as one of the most popular European trading apps, offering services to over 70 countries, including EU. Verification of account’s identity is a must while payment methods include credit & debit cards, PayPal, Skrill, and bank accounts.

The platform deals with Shares, Indices, Forex trading, and Cryptocurrencies, though margin trading is not available at this moment. You can read more about this platform in our guide about comparing SimpleFX and Plus500.

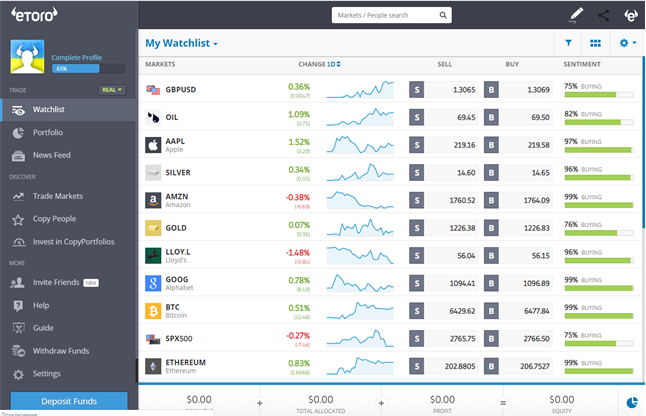

eToro

eToro is one of the most popular platforms in terms of social features it provides. The website has a “copy people” function, where traders use orders made by the leaders in the market. That way, beginners get to know how certain assets behave and earn money at the same time. Verification is required from all accounts, while accepted payment methods include credit cards, bank transfers, Neteller, Skrill, and Union Pay.

In our separate guide about eToro, you can get more information about this social trading platform.

[button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#3cc195″]Try the best trading app for begginers[/button]

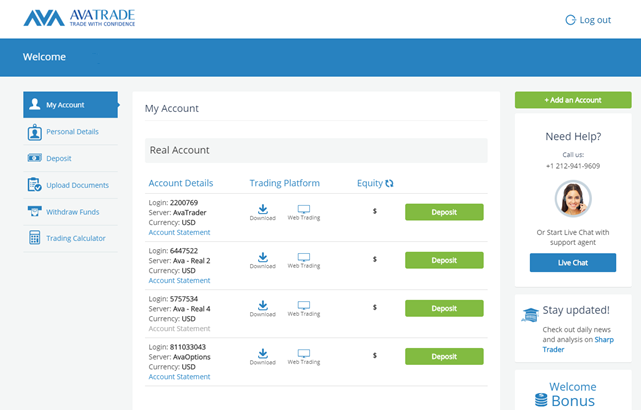

AvaTrade

Regulated by the Central Bank of Ireland (CBI), AvaTrade offers a variety of asset choice for trading. The company works only with accounts that have verified their identities. Accepted deposit/withdrawal methods are credit/debit cards, PayPal, WebMoney, Wire Transfer, Skrill, and Neteller. The company offers MetaTrader 4 for a desktop trading as well. Additionally, AvaTrade does not offer one platform for all assets but divides them into separate entities, including:

- AvaOptions

- AvaTradeAct

- Floating Spread

- MetaTrader 4

- Mirror Trader

Xtb

This European broker offers much the usual products for investment, including Forex, indices, commodities, equity, ETFs, and crypto. Much like other platforms, apart from demo accounts, users need to provide proof of residence and identity to fund their balance. The highest leverage rate is 200x, while platform accepts deposits from bank transfers, credit cards, PayPal, Skrill. Apart from web trading, xStation 5 desktop platform is available as well.

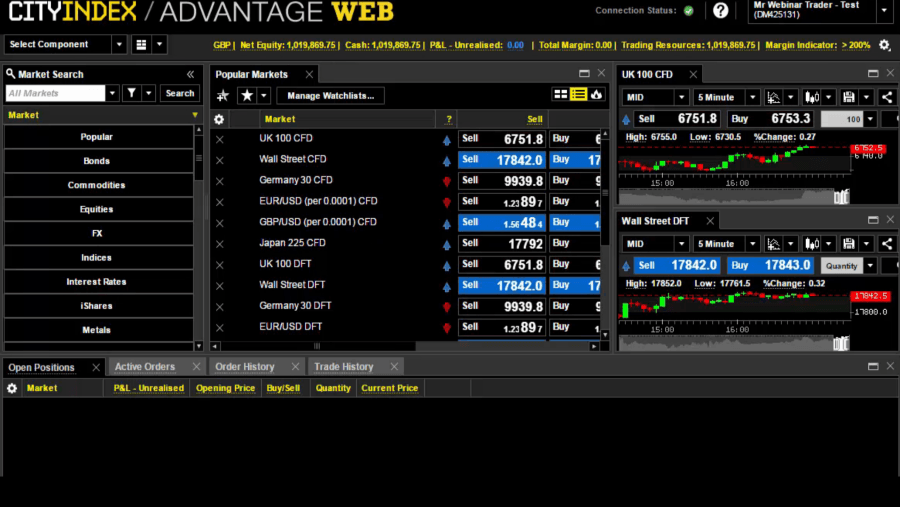

Cityindex

This platform deals with a variety of trade options, including indices, Forex, shares, commodities, bonds, interest rates, and options. Apart from WebTrader, clients have the opportunity to trade through MT4 and mobile apps as well. Verification starts at the registration phase, leaving out the option of anonymous spread betting and investment. Deposits are possible through credit/debit cards, as well as direct bank transfers.

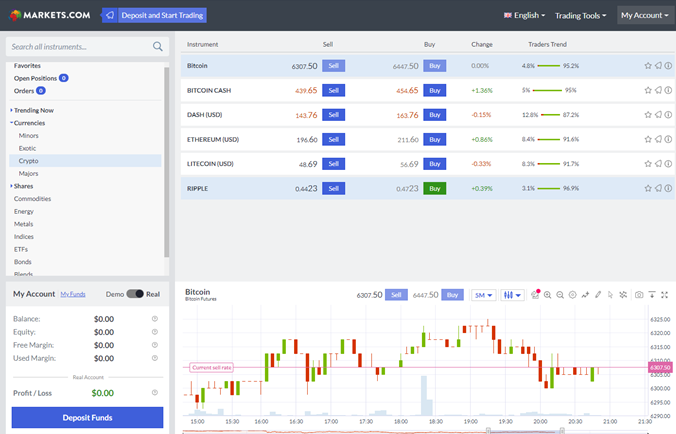

Markets.com

Markets.com offers a 30x leverage rate for all of its assets, which include stocks, indices, Forex, commodities, and Cryptos. Accepted funding channels are Credit Card, Wire Transfer, WebMoney, Skrill, and Neteller. Verified accounts can trade in this platform, much like with others (with exception to SimpleFX).

What Features Should I Look For

The website you agree to work with needs to have certain features available. Thus, we compiled a list of features a platform should have for clients.

Tight spreads – the smaller price difference between buy and sell value, the better.

Mobile application trading – the availability of downloadable phone apps for iOS and Android users.

Leverage rate – a variety of leveraged products (borrowing power from the platform), with large enough rates. Careful with those, as there are significant risks, with chances high of losing your money due to fluctuations in the market.

Stop-loss protection – the platform should have an automatic limitation on funds, so you do not get a negative balance.

Fully functional demo account – where you can try out your trades before actual investments

No minimum deposits – some might require quite hefty transfers, which is not what is about. Check out those that have no minimum requirements to get you started.

A number of Deposit/withdrawal options – Safe and secure transfers with many payment and withdrawal options.

Professional support: should not only have a ticket system but a reliable support team, with live chat tool available as well.

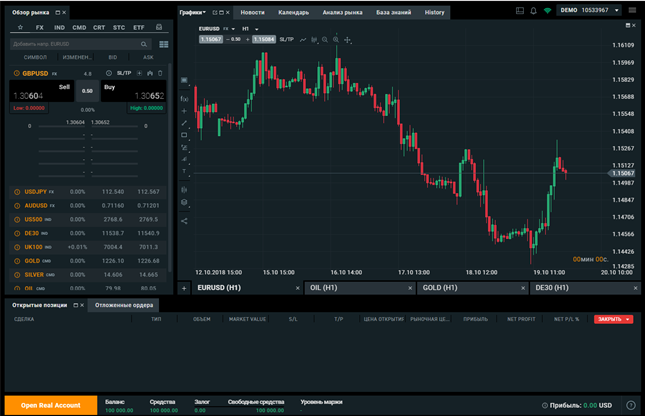

Although a smaller player when compared to big platforms mentioned in this article, SimpleFX is one of the fastest growing marketplaces right now. The reason is quite simple, as its WebTrader holds all of the above-mentioned features. With all necessary tools available, traders do find the SimpleFX platform attractive. Give it a try, as there is a demo account version available to practice out your trade knowledge before you invest real money.

[button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#3cc195″]Try the best trading app for begginers[/button]