The British Pound has been bought by investors in anticipation of a Bank of England rate hike on Thursday, February 03 which takes it to multi-year highs, but the UK currency could be challenged by economic disappointment later in the year say, economists.

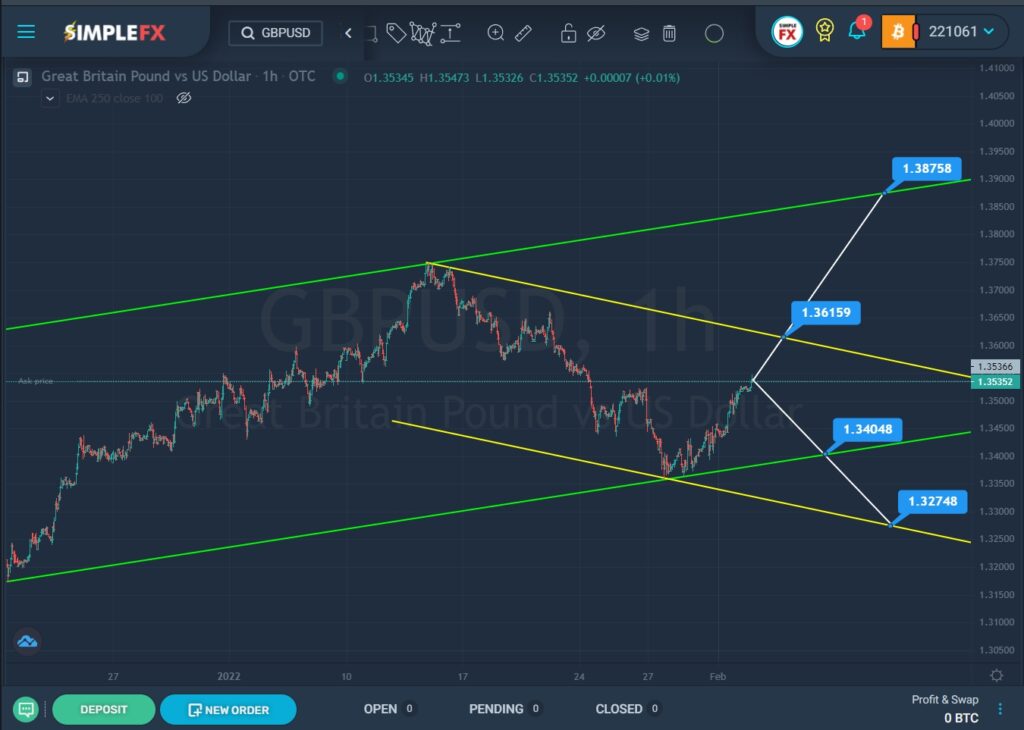

Apparently, for the GBPUSD currency pair, we see an upward movement of the market within a large green channel.

In the second half of January, the price reached the upper green line, but then we saw a market reversal and a rapid fall to the lower green wall. This gap describes the descending channel of yellow color.

Not so long ago, the price reached the lower lines of the two channels, but the bears could not break through these support lines and surrendered their positions to the bulls.

Most likely, in the near future, the price will rise to the resistance level of 1.361, which is located on the upper yellow line. With a successful breakdown of this level, the market can continue to grow towards the upper green line and the resistance level of 1.387.

Alternatively, it is assumed that the bears will still try to take over the market. If they manage to send the price to the lower line and the support level of 1.340. Then they may have an opportunity to bring the market to the next important level of 1.327, which is located on the lower yellow line. But first, they need to break through the support level of 1.340.