For the time being, gold prices seem steady as bullish and bearish forces balance out. On one hand, a faster monetary policy tightening by Fed (bad for gold and crypto), on the other, safe-haven demand in the reaction to the escalating tension over Ukraine, which favors gold and silver.

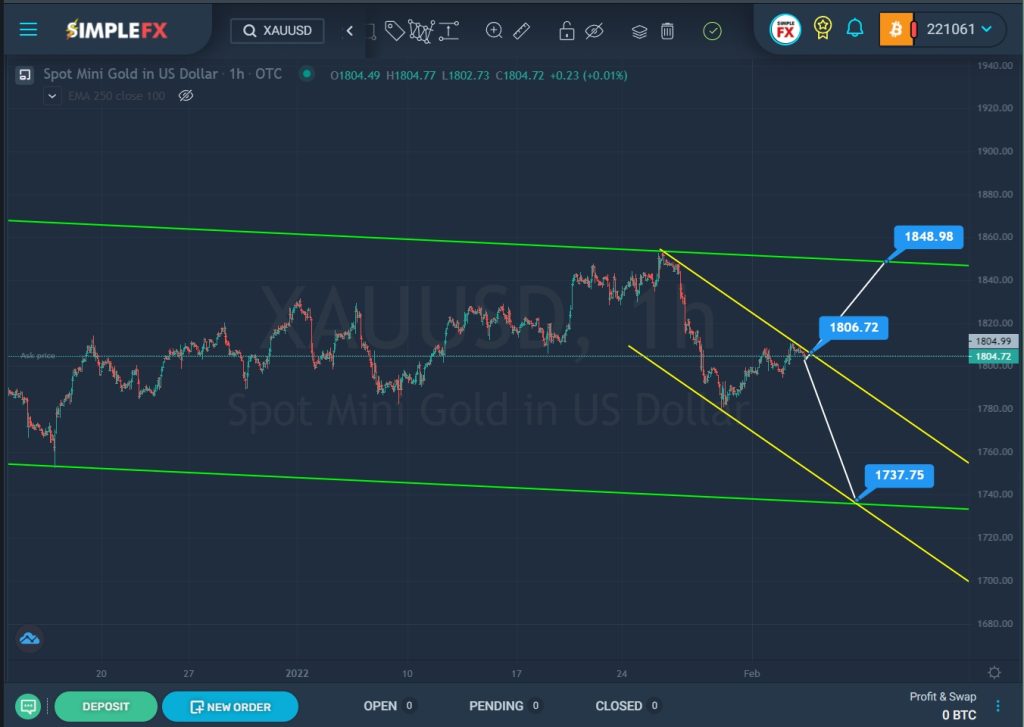

SimpleFX XAUUSD Chart Analysis: February 3, 2022

For the XAUUSD pair, we see the development of a downtrend, which is formed inside a large yellow channel. The last section of the chart shows a downward price movement inside a small green channel, which began in the second half of January.

Since the second half of January, we have been seeing a decline, which may predict the continued depreciation of XAUUSD in the following weeks. It is possible that the bears are targeting the support level of 1737.75, which is located on the lower green line. Also at this price point, we see the intersection of the yellow and green lines.

However, the price is currently near the upper line of the yellow channel. And there is a possibility that the resistance level of 1806.72 may be broken. In this case, the way will open for the bulls to the upper green line and the resistance level of 1848.98. If the lower green line is not broken, the price will push off from it and continue moving according to the first scenario.

When confirming the upward movement of the price, we can consider opening deals for purchases. If a bearish trend is confirmed, then we can make money on sales.