If you are interested in Bitcoin, you can capitalize on your knowledge of the cryptocurrency market. Everyone that owns Bitcoin knows the pains of its high price volatility. Even if you believe in the project long term it’s hard to bear all the ups and downs.

Just take a look at the spike and downfall of Bitcoin price at the break of 2017/2018. It’s brutal. That is why any Bitcoin enthusiast should consider day trading the coin. Why? It helps you profit from the price change no matter if it goes up or down. You can take a long position (predicting the price will go up) or a short position (assuming it will go down).

[button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#3cc195″]Try the Best Trading App for Begginers[/button]

You don’t need a deep knowledge of technical analysis. Tracking the most important events and news about Bitcoin can be enough to profit. However, it’s important to understand the basics of day trading cryptocurrencies. Here’s a short guide.

How does margin trading work?

In practice, you can not only profit from the prices moving up or down but also trade with leverage. On SimpleFX you can trade Bitcoin with 1:5 leverage. This means that you can make a trade worth $500 with just a singe dollar deposit. Of course, if you take a short position and the price goes up, your $100 will disappear five times as quickly, but if it goes down, you’ll earn five times more.

The good thing about margin trading with SimpleFX WebTrader is that your live account has no minimum deposits requirements. It is important for beginners as you don’t want to put much money until you get the hang of it. Margin trading with leverage is risky, however, you will never lose more than you paid in. That is why no minimum deposits and fast, secure transfers are crucial.

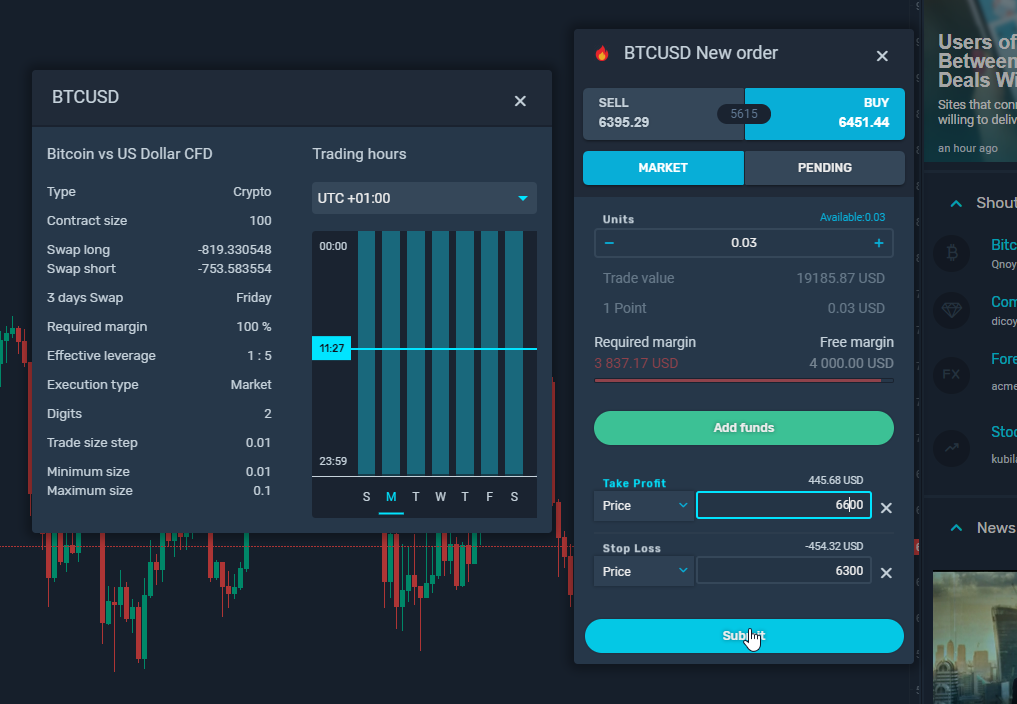

Making an order with SimpleFX WebTrader you can set “stop loss” and “take profit”. These are both security brakes for your investment. The first will close your position in case things go not your way. Let’s say you took a long position on Bitcoin at 6,388 USD. You expected the crypto to go up. You can set a stop loss at 6,300 as a safety net.

Take profit is also useful, as the prices never go up forever. At some point, big players want to cash in, and you can do it too. Using the example above you can set “take profit” at 6,500 USD. Your order will be closed automatically when the price reaches this level.

Making a Bitcoin order

Suppose you want to buy a Bitcoin assuming the price will go up. If you just started trading an instrument with SimpleFX WebTrader, it’s good to open both an order window and “Symbol information” window. You can do it just clicking at the symbol.

In this example, we are using a fully functional SimpleFX WebTrader Demo Account. We have $4,000 deposit.

The contract size is 100 and this means that when buying 0.01 Unit of Bitcoin you are in fact buying 1BTC. Since the leverage is 1:5 and the required margin is 100%, you just need 1279USD to buy one Bitcoin. The deposit of $4000 allows you to buy three Bitcoins. The trading volume is five times bigger.

Now, at the BUY price of $6451.44 let’s set the “Take Profit” at $6000 and “Stop Loss” at $6300. These are the order limits. If you’re right and the Bitcoin Price will go up to $6600 you’ll earn 445.68USD. If it goes down to 6300 before, your order will be closed to avoid further loss.

At SimpleFX WebTrader we promote reasonable day trading. Offering powerful trading tools with high leverage we also included Negative Balance Protection feature. We close your transactions before you reach reaching a negative balance on your account.

How to start?

At SimpleFX we do our best to create the easiest trading tool for beginners. We are convinced that SimpleFX WebTrader is the best app to start day trading Bitcoin.

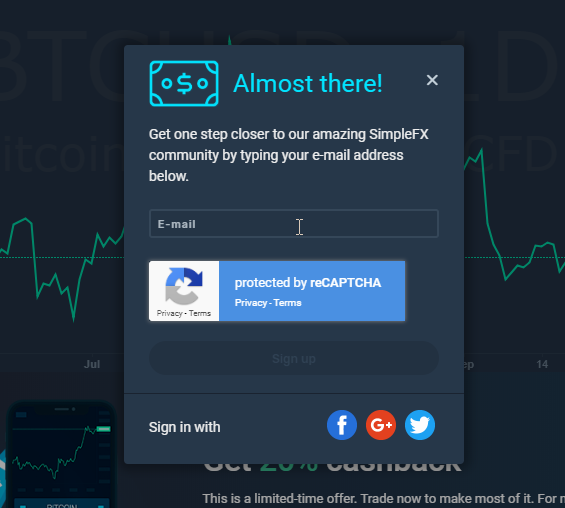

The best way to start is to set up a fully functional demo account. You just need an e-mail to do it.

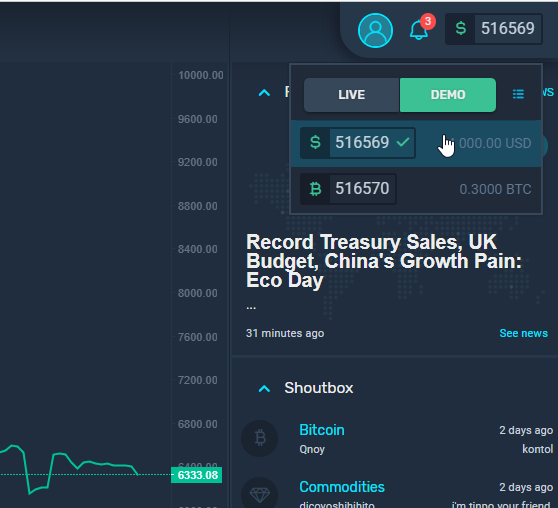

Once you receive a confirmation e-mail and verify your account, you’ll get an access to two demo accounts. One in Bitcoin and one in USD.

This is all you need to learn day trading. Use them and follow our tutorials to make the first orders, and start making profitable trades. You can follow the tutorials on SimpleFX Blog.

At this point, SimpleFX once again beats the competition, as we have no minimum deposits. This is a crucial feature for beginners as you can try with funds as small as you like. Each time you are protected by the Negative Balance Feature.

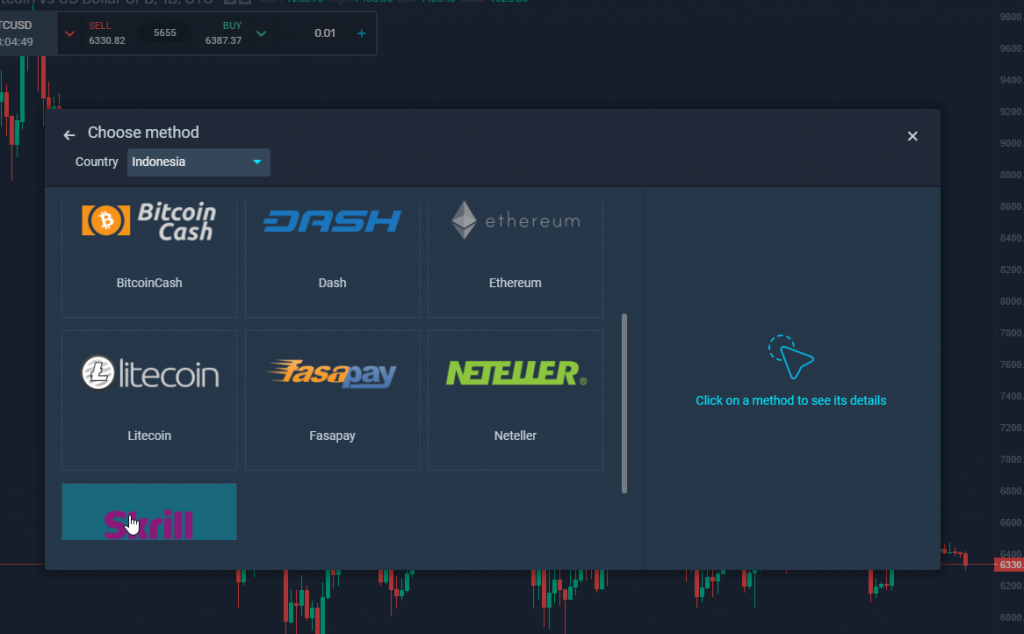

We support a wide range of transfer services from Skrill to local suppliers depending on where you trade from. Most importantly these are all safe, secure and very fast services, which makes it convenient for you to deposit even the smallest sums.

How successful traders make their decisions

Before you start trading with real money, here are some key pieces of advice:

- Keep yourself well-informed on both the basic trading processes and Bitcoin market

- Always deposit sums small enough it won’t affect your lifestyle if you lose them

- Invest time. If you want to be able to become proficient day trader you need to invest full time for at least some period

- Focus on one instrument at the beginning. If you are into Bitcoin, stick to it for a while.

- Calculate risk and be realistic about profits, since even successful traders succeed in just 50-60% of their trades.

[button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#3cc195″]Trade with no Minimum Deposit[/button]

Beginner Bitcoin day traders should get a hang of the basics before they getto more complex technical indicators and Bitcoin trading strategies. Start small, stay informed, monitor the market and take advantage of any opportunity you see. Invest time, than money. Start making successful demo transactions, then move to invest small amounts on your live account, and only then take a chance with some real money. The more virtual training money you make, the less probable it is for you to lose real money.

I hope with this tutorial I’ve encouraged you to stop wasting time on Bitcoin exchanges and start profiting from any Bitcoin price movements.