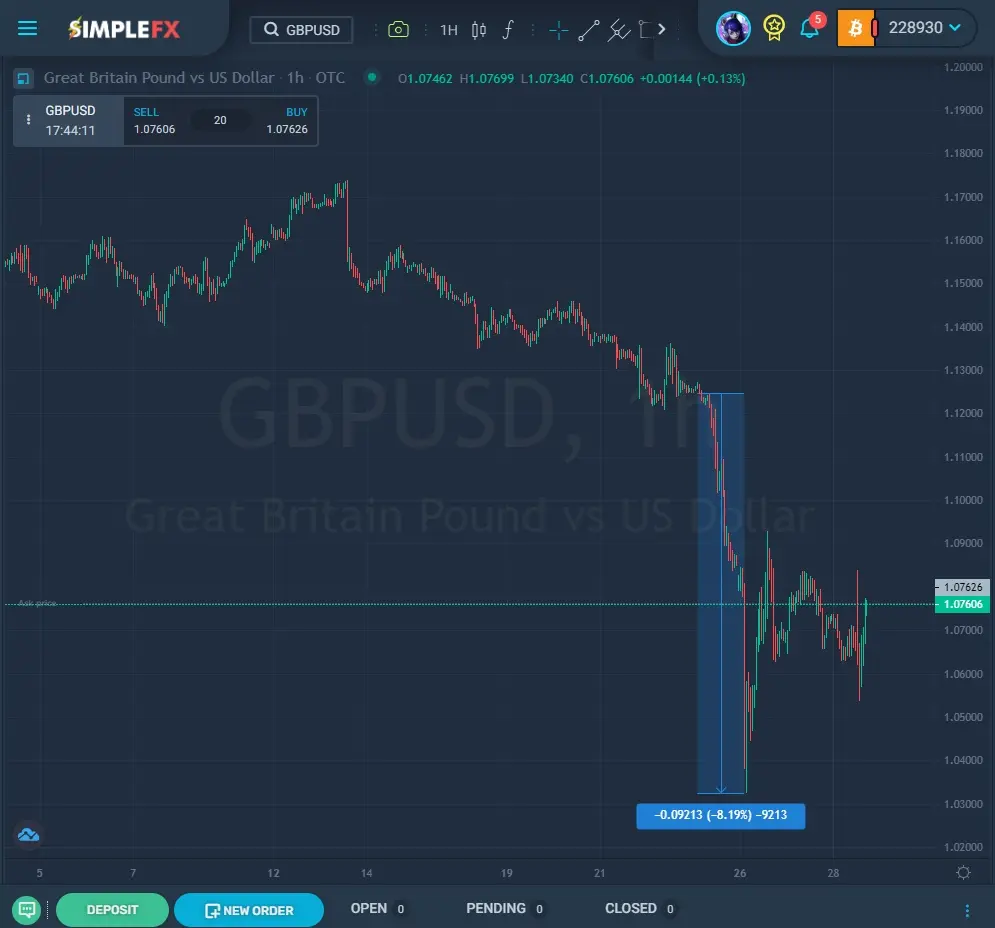

GBPUSD crashed on Friday, and the downtrend continued at the beginning of the week. At some point, GBP lost 8% in less than three days. The strong dollar and struggling US economy resulted in the pound sterling dropping 15% in the last three months.

On Wednesday, the yields of the UK gilt (the equivalent of the treasury bonds) have risen the most in 65 years. If a government needs to pay higher interest rates on borrowing money, the economy is in big trouble.

The conservative British government led by the newly elected prime minister Liz Truss made a controversial decision to introduce extreme tax cuts to stimulate the lingering economy and prevent it from falling into recession. The problem was the cuts lacked funding and was criticized by the International Monetary Fund as threatening the stability of the GBP.

As expected, this proved to be a self-fulfilling prophecy, and GBPUSD crashed last night, going -3.66% around 2 a.m. UTC.

According to experts, the Bank of England may be pushed to purchase the bonds. The Bank of England issued the following statement:

“Were dysfunction in this market to continue or worsen, there would be a material risk to UK financial stability. This would lead to an unwarranted tightening of financing conditions and a reduction of the flow of credit to the real economy”.

“In line with its financial stability objective, the Bank of England stands ready to restore market functioning and reduce any risks from contagion to credit conditions for UK households and businesses.”

Today BoE started to buy long-dated bonds to calm the markets. The problem is also the lack of aggressive monetary policy. Aggressive means raising the interest rates to prevent inflation, but at the cost of slowing the economy as the borrowing cost rises.

The plan is to buy back bonds for two weeks just to stop the panic sale of the pound sterling. The problem is that the market is in a sort of a spiral. A weaker currency makes it more challenging to finance British debt. According to a senior rates strategist at ING, Antoine Bouvet, the BoE may be forced to continue with the bond purchases program beyond the two weeks.

The UK has a problem since its two leading institutions seem to fight and do opposite actions. The Bank of England fights inflation while the Treasury (the department responsible for public finance and economic policies) is trying to stimulate the slowing economy.

From September 28, the Bank will temporarily buy UK government bonds that mature long into the future to stabilize market conditions. We will buy as much as necessary to achieve this goal, and HM Treasury has promised to cover any losses we incur.

The Bank of England’s financial policy committee expressed concerns about the gilt market. It urged that action be taken and praised the Bank’s intentions to make rapid and targeted purchases in the sparkling market based on financial stability. These purchases will have a strict time limitation. They are intended to address an issue in the developed long-dated government bond market.

Auctions will continue until October 14. Once risks to market functioning have been deemed to have decreased, purchases will be unwound in a smooth and organized manner. These temporary and targeted financial stability measures have been shared with the monetary policy committee.

The Monetary Policy Committee plans to change interest rates as much as necessary to sustainably return inflation to the 2% target in the medium term.

The Bank’s Executive has postponed the start of gilt sale operations that were initially scheduled to begin next week in light of current market conditions. The Bank will issue a market notice within the next few days providing operational details. The annual £80 billion stock reduction target set by the MPC is immune and unchanged. In light of present market circumstances, the Bank’s Executive has postponed launching gilt sales procedures planned to start next week. Gilt sales operations will begin on October 31 until further notice from the Bank. A market notification will be published shortly with additional information regarding operational procedures.