The USA employment figures for October were announced today, November 6 at 1:30 pm UTC. The non-farm payroll (NFP) report mirrors the economic standing of the United States.

November NFP report reflected a 638,000 rise in non-farm payrolls in October. This is slightly higher than the predicted 600,000 by economists. A higher number could have been great for long indices, crude oil, and commodity dollars. With the expectations met, the precious metal markets could continue to climb. Gold was up by 2.17% yesterday and continued to gain by 1.98% so far today (2:00 pm UTC).

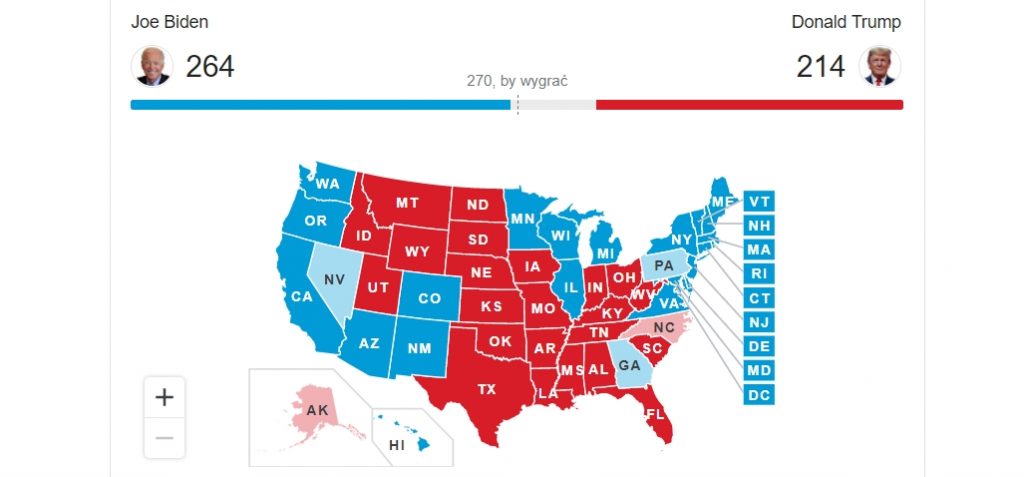

Ahead of the report, volatility in markets rockets as investors are pinned to the US election results. Trump and Biden are battling in key battleground states, and Biden has a razor thin lead. Unexpectedly, Biden’s support turned out stronger in Georgia, a steadfast Republican state. Biden leads in Georgia, Pennsylvania, Nevada, and Arizona with tight votes particularly in Pennsylvania, which Trump couldn’t afford to lose. Biden needs 6 more electoral votes to win.

Meanwhile, the Federal Reserve reminded yesterday that the rising cases of coronavirus in the USA and Europe would prompt the need for more fiscal and monetary easing. Federal Reserve Chair Jerome Powell insisted that America would have a stronger recovery with more fiscal support. It’s a plea for several months now. However, the election results could prevent a clearer path for more stimulus.

Amid the Fed’s plight, precious metals gained the most yesterday, with silver closing with a 5.05% increase. Today (as of 2:00 pm UTC), XAGUSD (silver) continued on the green and gained 1.47%. The US dollar is down against its major contenders in a risk-on market. If the US dollar weakens more, USDJPY could suffer the most, with AUDUSD speeding in the opposite direction.

[button link=”https://app.simplefx.com/instruments/AUDUSD/chart” size=”medium” target=”new” text_color=”#eeeeee” color=”#df4444″]SELL AUDUSD[/button] [button link=”https://app.simplefx.com/instruments/AUDUSD/chart” size=”medium” target=”new” text_color=”#eeeeee” color=”#3cc195″]BUY AUDUSD[/button]

According to Wall Street analysts, if stimulus will be limited or blocked altogether, it could push the Fed to keep the short-term interest rates near zero for a longer period to cushion the absence of government spending.

Volatility is soaring with the US election approaching the finish line and the NFP report just released today. Get your accounts ready to profit in the coming weeks!