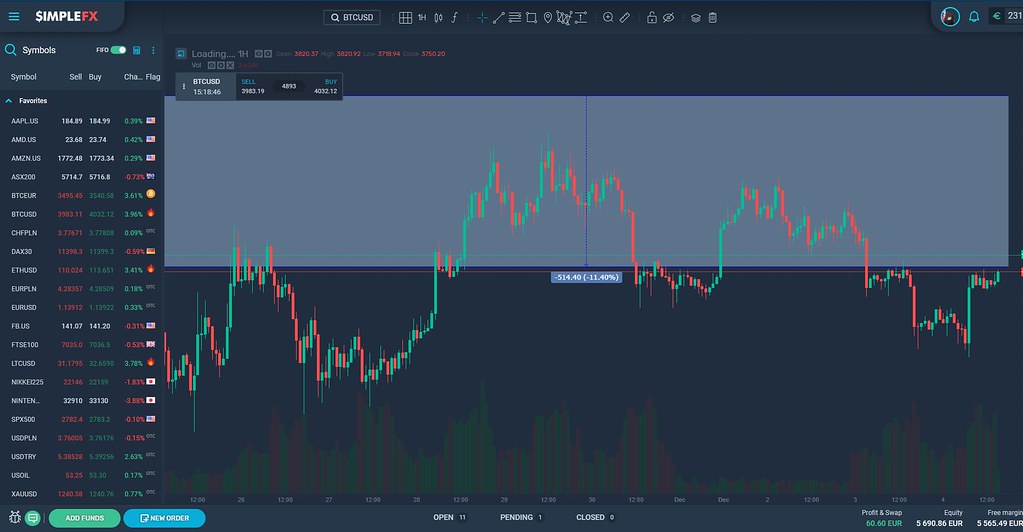

The recent cryptocurrency crash at the end of November – when Bitcoin lost over 80% of its peak value in January and broke through the $4000 floor – made crypto mining unprofitable for small players. Bitcoin is simply too cheap. At today’s computing power and energy prices, the minimum level of mining is estimated at $4,500. As it usually happens in business, this led to a market consolidation.

Over 100,000 miners have stopped using their computers for encryption and 1.4 million servers securing Bitcoin transactions have been paused since September, according to estimations by Autonomous Research LLP and Fundstrat Gobal Advisors LLC. How it will affect will add a new block of transaction records to the public ledger?

Why mining is so important?

Mining’s primary goal is to provide the necessary computing power to secure the cryptocurrency system form frauds by hashing – to make it computationally impractical to modify the ledger.

Mining also increases cryptocurrency’s coin base. For their work miners are paid for providing security to the system. The more people participate in mining – the safer the system is. However, the increased total hash power provided by miners does not increase the supply of Bitcoin (unlike in conventional mining).

Bitcoin mining is so called because it resembles the mining of other commodities: it requires exertion and it slowly makes new units available to anybody who wishes to take part. An important difference is that the supply does not depend on the amount of mining. In general changing total miner hash power does not change how many bitcoins are created over the long term.

Miners look for a hash with a numeric value lower than “the target” a specified number. When this happens a new block is mined. This is achieved with blind tries. Finding a hash with a value lower than the target takes millions of billions of tries.

Bitcoin hash rate is falling

Crypto mines are closing, but the system adjusts. The dropping hash rate is making it easier for the working mines to earn Bitcoins. Unfortunately, at the same time, the whole system is getting more fraud-prone.

While still cracking the hash is practically impossible, the potential for so-called 51-percent attack is growing. In theory, a cartel of miners could reverse transactions, stealing money from Bitcoin owners. This kind of scenario has already happened with smaller altcoins (Bitcoin Gold and ZenCash).

It’s time to watch carefully the biggest Bitcoin mining conglomerates. Companies such as China-based Bitmain Technology, F2Pool, BTCC, Elgius, Slush Pool, or Salcido Enterprises. Still, it seems that supporting Bitcoin long term value is in their interest, as they profit heavily from the cryptocurrency appreciation.