Join now to stay ahead of the curve and maximize your gains during this historic event.

The Bitcoin halving in April 2024 has now passed, bringing with it a range of outcomes that align with historical trends and current market dynamics. While it's crucial to acknowledge that past events don't guarantee future results, here are some expanded insights into what might happen:

It is worth remembering that each event is uniquely influenced by various market factors, making it a focal point of interest for investors, analysts, and enthusiasts alike.

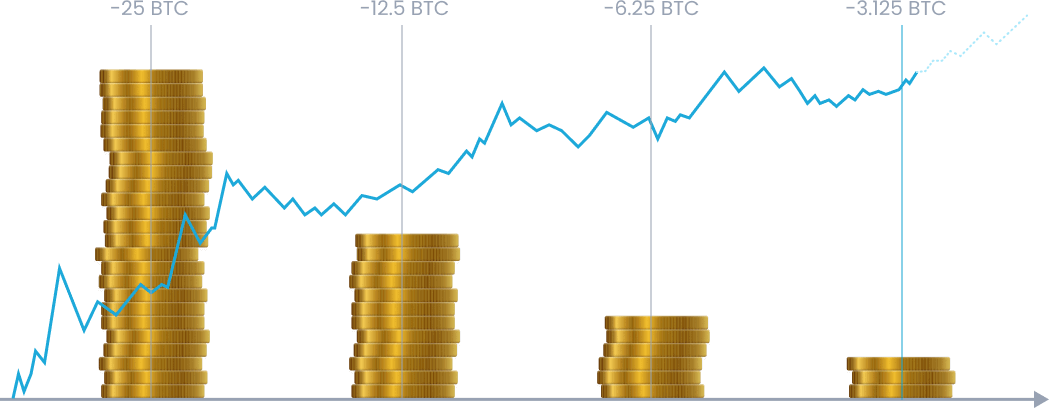

In previous times, the price of Bitcoin after halving was highly volatile. However, after a couple of months, it eventually reached significant growth compared to the value from before halving. Investors should pay attention that the 2024 Bitcoin halving may resolve in a different way, and every trading decision needs to be considered carefully.

Want to know a "bit" more about Bitcoin Halving? Check out our blog.

Join now and start trading with SimpleFX!