Pyramid schemes are one of the most common and well-researched financial scams. Many examples of this are in action, and people still fall for it. In this text, you will find out what this scheme is, its structure, and how it works. I will also give some prominent examples of pyramid schemes that have made headlines worldwide.

Table of contents:

1. What Is A Pyramid Scheme?

A pyramid scheme is a deceptive business model that promises participants the opportunity to earn money primarily by recruiting others into the scheme rather than selling legitimate products or services. It recruits individuals at the pyramid’s base and requires them to make an initial investment or buy into the scheme.

2. How Does Pyramid Scheme Work?

In general, most pyramid schemes operate similarly, using similar models and tools:

2.1. Recruitment

The scheme’s originator or recruiter entices people to join the scheme by promising high returns or substantial profits quickly. They often use persuasive tactics to convince individuals that they can earn significant amounts of money through minimal effort.

2.2. Initial Investment

To join the scheme, participants must usually make an initial investment or purchase a starter kit, which often includes overpriced products of questionable value. This investment is typically passed up the pyramid to those higher up in the scheme as commissions.

2.3. Recruitment Incentives

Participants are encouraged to recruit others into the scheme. They earn commissions or bonuses based on the number of people they recruit or the investments made by their recruits. The more people they bring in, the higher their potential earnings.

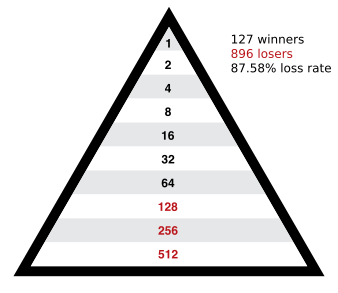

2.4. Pyramid Structure

The scheme relies on a hierarchical structure, where each level doubles in size compared to the above level. The person at the top of the pyramid enjoys the most significant financial gains since they receive a portion of the investments made by all participants below them. As the pyramid expands, it becomes increasingly challenging for new recruits to find enough people to join, resulting in most participants being unable to recover their investments.

2.5. Unsustainable and Collapse

Eventually, the pyramid scheme becomes unsustainable because the number of potential recruits diminishes. At this point, new investors cannot be found to provide funds for the earlier participants. As a result, the scheme collapses, leaving the majority of participants at the bottom of the pyramid with financial losses.

It’s important to note that pyramid schemes are illegal in many countries as they are considered fraudulent practices. They rely on constant recruitment and lack a genuine product or service, making them unsustainable and inherently exploitative. Participants at the lower levels are typically the ones who suffer the greatest financial losses when the scheme inevitably collapses.

Read also: Lehman Brothers And The Financial Crisis 2008

3. Financial Pyramid Structure

The structure follows a hierarchical pyramid-like shape in a pyramid scheme, with the scheme’s originator or a few individuals at the top and multiple layers of participants below them. Here’s a breakdown of the typical structure:

3.1. Originator/Top Level

At the top of the pyramid is the scheme’s originator or a small group of individuals who initiated the scheme. They are the ones who benefit the most financially since they receive a portion of the investments made by participants at all levels below them.

3.2. Level 1

The second level consists of individuals recruited by the originator or top-level participants. These participants invest their money or buy into the scheme and become part of the network.

3.3. Level 2

The third level comprises individuals recruited by participants from Level 1. Each Level 2 participant invests money or buys into the scheme, with a portion of their investment going up the pyramid as commissions.

3.4. Level 3

The fourth level consists of individuals recruited by participants from Level 2, who make their investments and continue the cycle.

3.5. . Subsequent Levels

The pyramid expands downward with each level as participants recruit new people. More people in a row recruit more participants, and as the pyramid grows, the number of participants at each level increases.

Importantly, as the number of participants at each level increases, the earning potential decreases for those at lower levels. People at the top of the pyramid benefit the most financially because they get a share of the money earned by participants at all levels below them.

Since the pyramid relies heavily on recruitment, it becomes increasingly difficult to maintain as the number of potential recruits dwindles. Ultimately, the scheme collapses when new participants cannot be found to provide funding to the earlier participants. This causes financial losses for most participants, especially those at the bottom of the pyramid. They lose the fastest.

4. Financial Pyramid and Ponzi Scheme: Differences

A financial pyramid and a Ponzi scheme are both types of fraudulent schemes, but they have some key differences. A financial pyramid primarily relies on recruitment and the continuous influx of new participants to generate revenue. The structure resembles a pyramid, with the scheme’s originator or a few individuals at the top and multiple layers of participants below them. The scheme eventually collapses when it becomes unsustainable due to a lack of new recruits, resulting in financial losses for most participants.

A Ponzi scheme was named after Charles Ponzi, an Italian-born swindler. In this scheme, the fraudster promises high returns to investors and uses funds from new investors to pay off earlier investors. The scheme relies on the continuous influx of new investments to maintain the illusion of profitability. The fraudster may fabricate investment strategies or use a legitimate investment vehicle to deceive investors.

However, unlike a pyramid scheme that heavily emphasizes recruitment, a Ponzi scheme primarily focuses on investment returns. It inevitably collapses when the flow of new investments slows down or stops, and the fraudster cannot meet the demands of existing investors, resulting in substantial financial losses for participants.

Read also: The Wirecard Financial Scandal: Causes, Course, and Consequences

5. Pyramid Scheme Examples:

5.1. An Example Of Bernie Madoff’s Ponzi Scheme

Bernie Madoff, an American financier, orchestrated one of the largest and most infamous pyramid schemes in history. Operating for several decades, Madoff promised consistently high returns to investors. However, instead of investing their money, he used funds from new investors to pay off older ones. When the scheme collapsed in 2008, investors lost billions of dollars.

5.2. TelexFree Pyramid Scheme

TelexFree was a pyramid scheme operated in various countries, including the UK. It claimed to offer Internet telephone services and encouraged participants to invest in their VOIP (Voice Over Internet Protocol) packages. However, most of the company’s revenue came from recruiting new participants rather than selling VOIP services. TelexFree collapsed in 2014, resulting in significant financial losses for participants.

5.3. The Example Of OneCoin’s Financial Pyramid

OneCoin was a cryptocurrency-based pyramid scheme that operated globally. It claimed to provide an alternative to Bitcoin but lacked transparency and credibility. Participants were encouraged to invest in OneCoin packages and recruit others into the scheme. However, the scheme eventually collapsed in 2017, and its founder was arrested on fraud and money laundering charges.

5.4. Herbalife Case

While Herbalife is a well-known multi-level marketing (MLM) company, it has faced allegations of operating as a pyramid scheme. The company sells various health and wellness products, but critics argue that its emphasis on recruitment and earning potential primarily through recruiting rather than product sales resembles pyramid scheme characteristics. Herbalife has faced legal scrutiny and settlements related to these allegations.

Read also: Greedflation. How Corporations Fueled Global Inflation

6. Pyramid Scheme: What It Is And How Does It Work. A Take-Home Note

By now, you should clearly understand what a pyramid scheme is, how it works, its structure, and its effects. It’s important to remember that pyramid schemes are illegal in many countries as they are considered frauds and lack a legitimate product or service. Making an initial investment with the promise to become wealthy quickly is a sign of a pyramid scheme. Therefore, avoiding such schemes is essential to protect yourself and your finances. To safeguard your investment, do thorough research and consult with a financial professional before making any investment decision.