The Turkish elections will take place on May 14, 2023. Turkish citizens will elect the president and parliament. How will their result affect day traders and investors? How will the Turkish election impact Lira and Stocks? Will the value of the Turkish lira fall even lower? Let’s examine the benefits and risks of the upcoming elections.

Table of contents:

This Sunday, May 14, Turkey will hold its biggest election of the year. The voters select a new President and parliament. The presidential candidate who obtains 50% of the vote will win, while a run-off election will occur on May 28 if no candidate receives a majority. But how will the Turkish election impact markets worldwide?

Turkish Economy Suffers from Weak Lira and Low GDP Ahead of Election

This year’s Turkish election is a highly awaited event. Incumbent President Erdogan and the AK Party have been in power for the past twenty years. Still, they are now facing strong resistance from Kemal Kilicdaroglu and a unified opposition party who have promised to restore Central Bank independence, reverse unorthodox economic policies, and improve US ties.

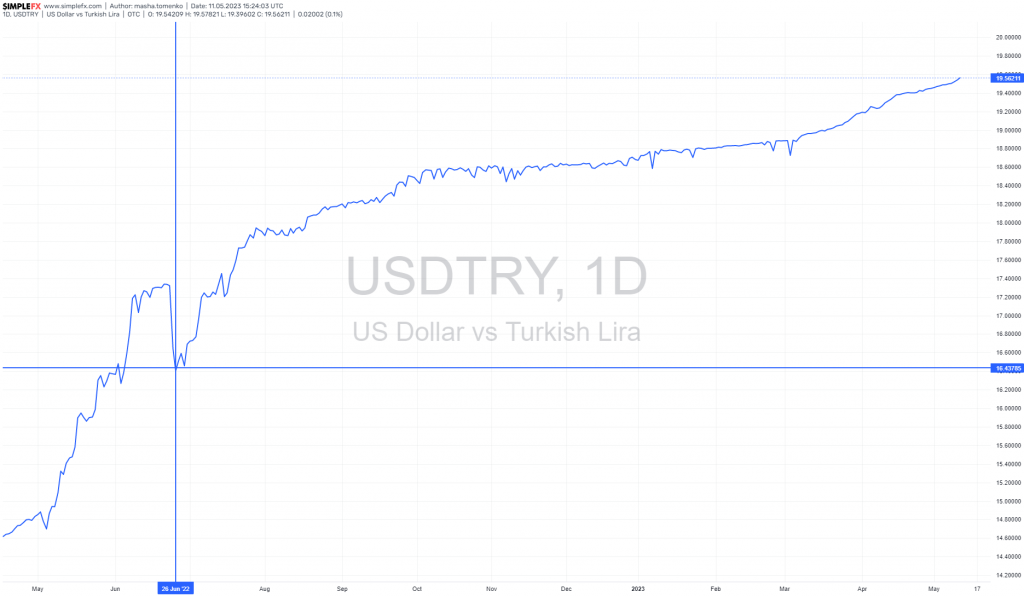

Unfortunately, the Turkish economy has suffered from a weak Lira and low GDP, further exacerbating the tragic earthquake in February. Erdogan’s failure to hike rates was a major contributor to the lira’s historic fall. The USDTRY price rose from c. $4 per dollar in 2018 to c. $18 per dollar in 2021.

Will the Election Lead to a Rally of the USDTRY?

The Turkish Lira has seen a dramatic 80% decline against the US dollar in the past five years, and the forward markets are expecting even more weakness. With a $1 trillion GDP, Turkey is a top-20 global economy, and its currency market trades similar volumes to that of the Israeli Shekel and Hungarian Forint.

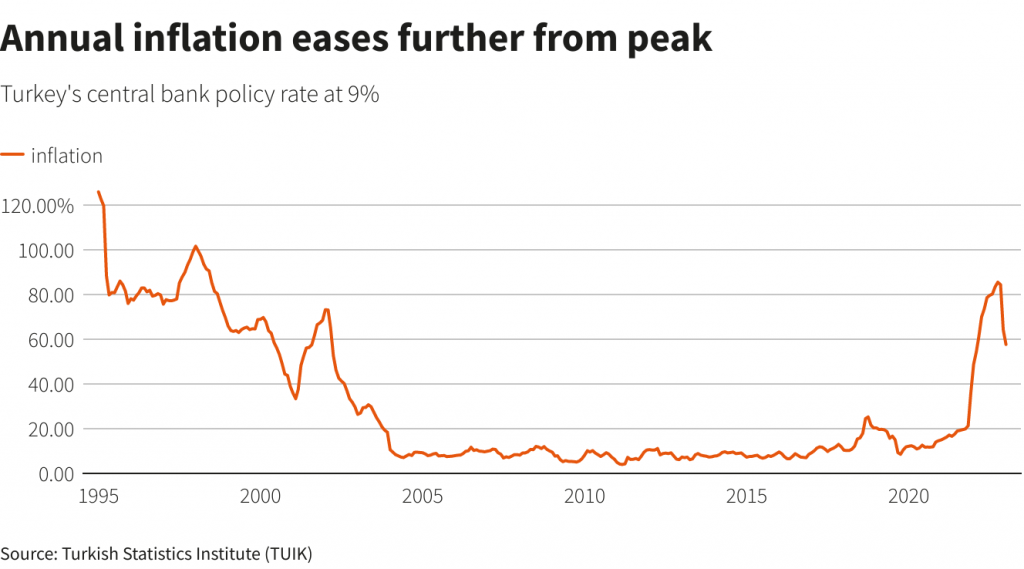

Due to high inflation of 45%, low-interest rates of 8.5%, and both a current account deficit and a budget deficit, the Turkish central bank has taken macro-prudential steps to control the FX. If the election returns to standard economic strategies, the USD/TRY could rise at first.

Foreign Investors Have Limited Exposure to Turkish Stocks

Foreign buyers have little access to Turkish stocks because the Turkish stock market only makes up 0.6% of broad emerging market stocks (EEM). In the same way, foreign-listed stocks do not have much of an impact on the local market.

Spanish banking giant BBVA owns 49% of Garanti, the third biggest bank in Turkey, which accounts for around 15% of the company’s income. More than 10% of Turkey’s GDP comes from the tourism business. But it is only about 1% of the worldwide business of big hotel and flight companies like Hilton and Wizz Air. Neighboring Greece may also experience some effects, especially for companies like Star Bulk and TOP Ships.

How Will the Turkish Election Impact Day Traders?

The upcoming Turkish elections could be good and bad for day traders. Both for those who buy and sell Turkish Lira (USDTRY) and Turkish stocks. The Turkish Lira has lost a lot of value against the US dollar in the past five years. However, it may still be an excellent time to buy it if you want to invest. On the other hand, people are still determining how the election will turn out, and the new President and Parliament may change economic policies, which could make the Turkish Lira even less valuable. Also, foreign-listed stocks have little local influence, which makes it hard to buy Turkish companies.

Regarding threats, the Turkish elections could make the Turkish Lira and Turkish stocks more volatile. In addition, Turkish stocks represent a small portion of the overall developing market equities, making it tough to buy Turkish stocks. Lastly, the election result could also affect nearby countries like Greece since tourism is a big part of Turkey’s economy.

How Will The Turkish Election Impact Lira and Stocks: A Conclusion

In conclusion, the outcome of the upcoming Turkish election is uncertain. It could change economic policies. It could make the Turkish Lira and stocks more volatile and affect countries like Greece that are close by. The election could be good or bad for day traders and foreign investors, depending on the outcome. In the end, the election will be a turning point for the economy and politics of Turkey and the rest of the world.