Short selling is a strategy for traders who know how to speculate on stock prices that are likely to fall short. It is said to be fun for big boys, but everyone started sometime. Therefore, you need to know more about this investment strategy. In this article, you will learn what is short selling and learn about hypothetical situations when you can apply it.

Have you ever noticed a bubble before it bursts? Or merely an overpriced asset when there was “no way it should be valued that high.” Have you ever wanted to put your money against the wrong herd sentiment? How to make money when everyone is buying and pumping the asset that, according to you, is already overvalued?

The answer is simple – shorten it. In this post, I will explain what is short selling and how you can profit from it.

What Is Short Selling?

Short selling is a trading strategy. The person using it speculates on a decline in the share price or other security. It is not a piece of cake, so experienced traders and investors mainly use it.

The short selling strategy became famous thanks to trading. The advantage of trading and investing apps, such as SimpleFX, is they give you an opportunity of making a profit whenever the market goes up or down.

Before, individual investors could only buy an asset hoping its value would go up and they would be able to sell it at a higher price. Now you can shoot and deal quickly with a trading account run in dollars or cryptocurrencies with no minimum deposit.

A Great Way To Hedge

Let’s say you are a long-term Bitcoin believer. You hold the coins because you assume that they will become future money or future gold. In the long term of years or even decades, its value should explode according to this scenario.

Of course, like any other cryptocurrency investor, you observe the market trends, so you can predict in which periods the bears will take over, forcing a downtrend. As a long-term Bitcoin investor, you could temporarily hedge your central position (keeping the cryptocurrency for a longer time) by opening a short place. You can even do it with leverage to benefit the most.

A Short Selling: How Does It Work?

Using short selling investing strategy, you can make money on your predictions on the future of companies, currencies, or commodities going down. A downfall is often easier to spot than a rise.

While in a traditional extended position trading, you want to buy low and sell at a higher price, to make a profit with short selling, you need to think the other way around. You sell first and buy the asset later to close an order. You want to repurchase the stock, currency, or commodity at a lower price than you had first sold it.

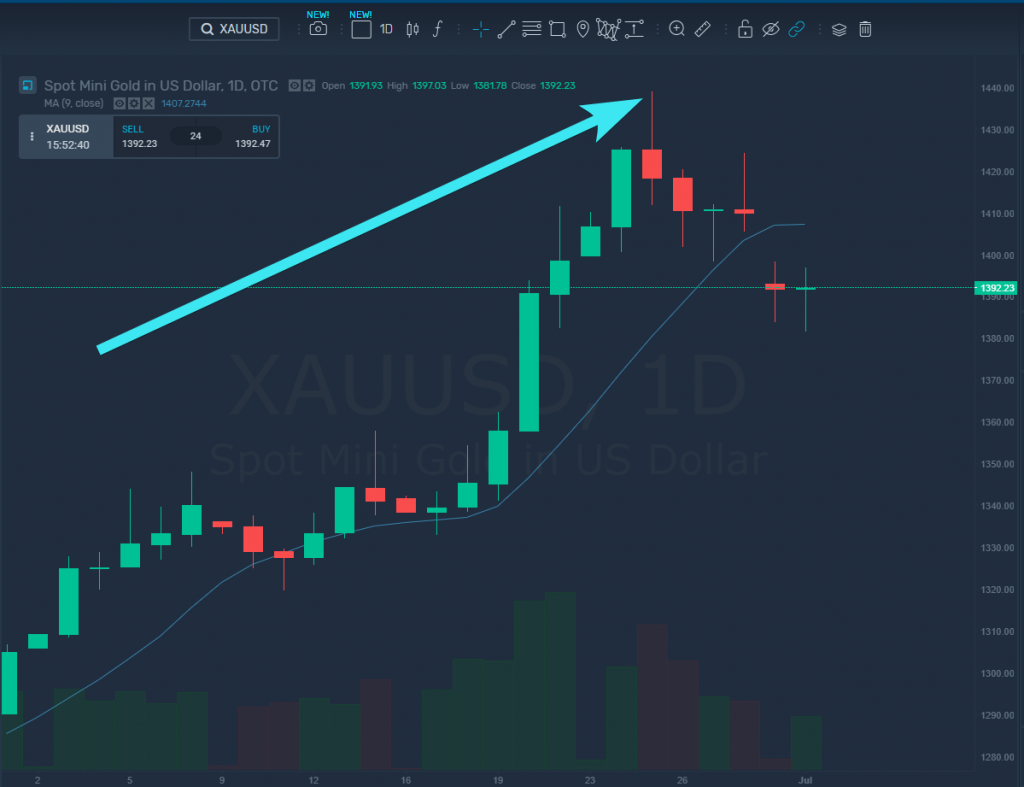

When short selling, your position is opened by borrowing shares of a stock or other asset. The loss limit is the main difference between short and long positions. While directly buying assets, it’s limited by the buying price. If you purchase an ounce of gold for $1440, you can lose exactly $1440 if, somehow, the metal price goes down to zero.

A Few Examples of How To Start Short Selling

If you are shorting gold at $1440 per ounce, your loss is unlimited as there’s no cap for the price of any tradable asset. It would help if you never forgot to set a “stop loss” value to your order when opening a short position.

Fortunately, trading and investing apps, such as SimpleFX, offer negative balance protection to their accounts. You may open as many accounts as possible (with no minimum deposits). On each one of the accounts, even if you forget to set any stop loss value, your exposition is equal to the money you have paid into the account you are trading with.

How To Open A Short Position?

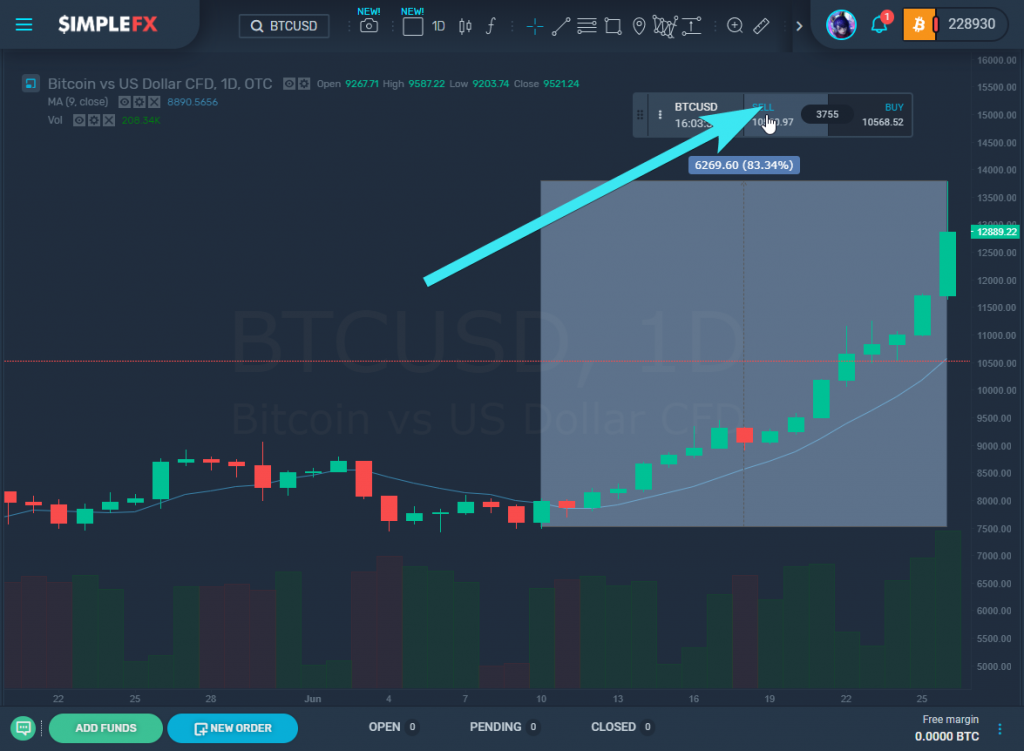

Let me give you a recent example. A few days ago, a mindful Bitcoin observer could have noticed that the BTCUSD climbing 83% in just two weeks may be enough for this rally. Maybe it’s time for some investors to take profits; perhaps some big players would like to buy some more at a discount. If the hypothetical trader wanted to profit from this scenario, the wise thing to do would be to open a short position.

Just click the “Sell” button on your trading app. Then set the size of your order, but even more importantly, set the stop loss price. In the case of short selling, it should be higher than the actual price you are selling an asset at. At the point from our example, one could set the stop loss at somewhere between $15,000 and $18,000.

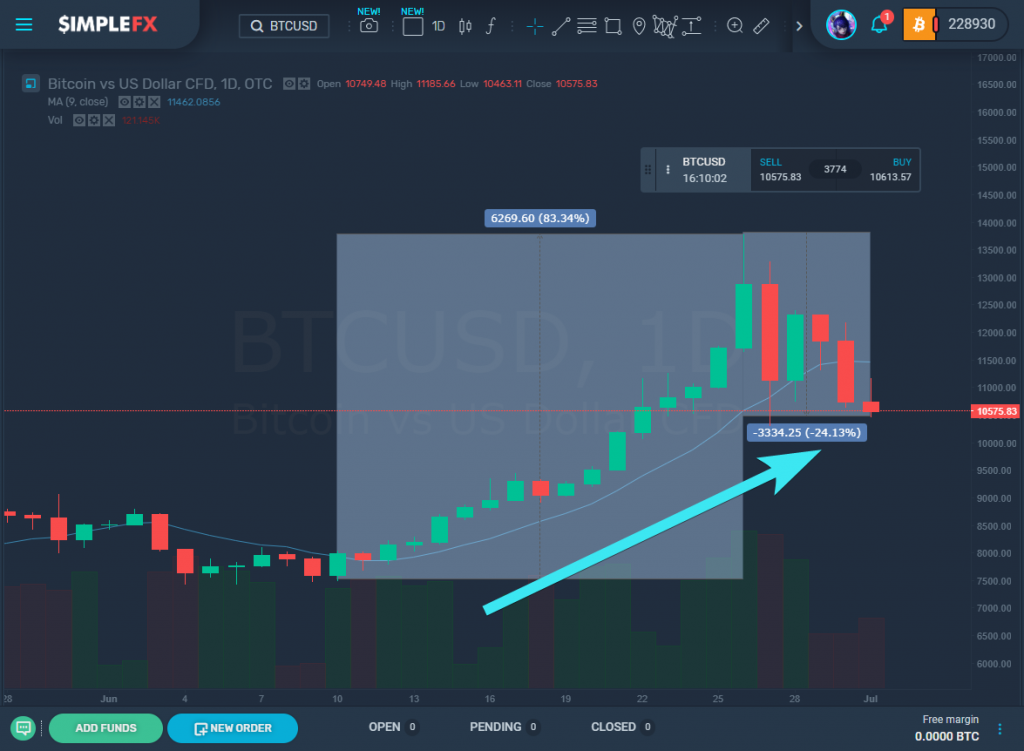

The Bitcoin believer, who had a long bullish position on crypto (mainly by holding the coins long term), managed to make a 24 percent profit in just five days.

A Hedging Strategy For High-Volatility Markets

The excellent point is that even if they were wrong, and the price would go up through the “stop loss” points, it would still be worth it as the primary investment would increase its value. It is one of the hedging strategies every trader dealing with high-volatility markets should use.

If you want to practice shorting stocks, Forex pairs, or cryptocurrencies, SimpleFX WebTrader is the right app to start. It’s effortless and has a fully functional demo account and live accounts with no minimum deposits. You can run in 22 currencies (e.g., USD, AUD, GBP, EUR, CHF, NZD, DKK, CAD, and JPY).