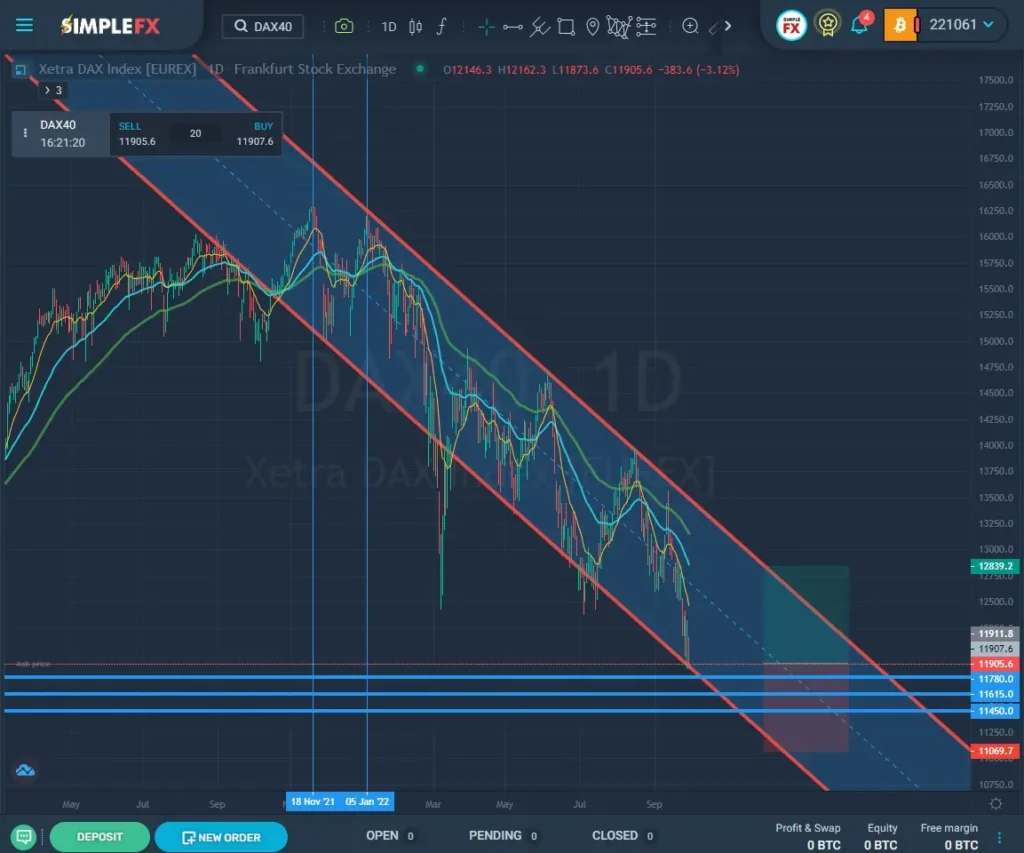

The Frankfurt Stock Exchange index is roughly down 27% in 2022. We are undoubtedly in a bear market preceded by a double top pattern in November and December 2021. The tops came at 16289 and 16287 on November 18 and January 5.

Since then, DAX40 fell to 11902. The 12000 was necessary psychological support. Currently, the index is at a level unseen since November 2020. The chart is at a critical point as we should expect a rebound for the candles to return inside the long-term channel.

Traders assuming a rally is coming, may consider opening a long position with a target around 927 points above the current levels and a stop loss around 842 points below.

Today DAX40 fell 3.1% in response to central banks speakers’ rising yields on bonds. Remember that the German economy is also susceptible to unexpected price shocks with growing geopolitical tensions and controversies around the Nord Stream 1 and Nord Stream 2 pipelines being damaged with no timetable for repair.

The GfK consumer confidence came at -42.5, a new record low. People may stop spending, prepare for a brutal winter, and pull the growth even lower.

To make things even more bearish, ECB is probably planning another 75 basis points interest rate hike in October.

DAX40 fell below 12k for the first time in 21 months. Here are some reasonable candidates for the following support levels: 11780, 11615, and 11450 (marked with blue lines in the chart). Traders who think the situation will get worse should consider shorting DAX40 with a take profit around these levels.