Cryptocurrency enthusiasts are going through tough times. Bitcoin seemed to be priced at a bargain above $20, and Ethereum was poised to make a strong run before the Merge, which has just officially begun and is said to end sometime between September 13 and 16.

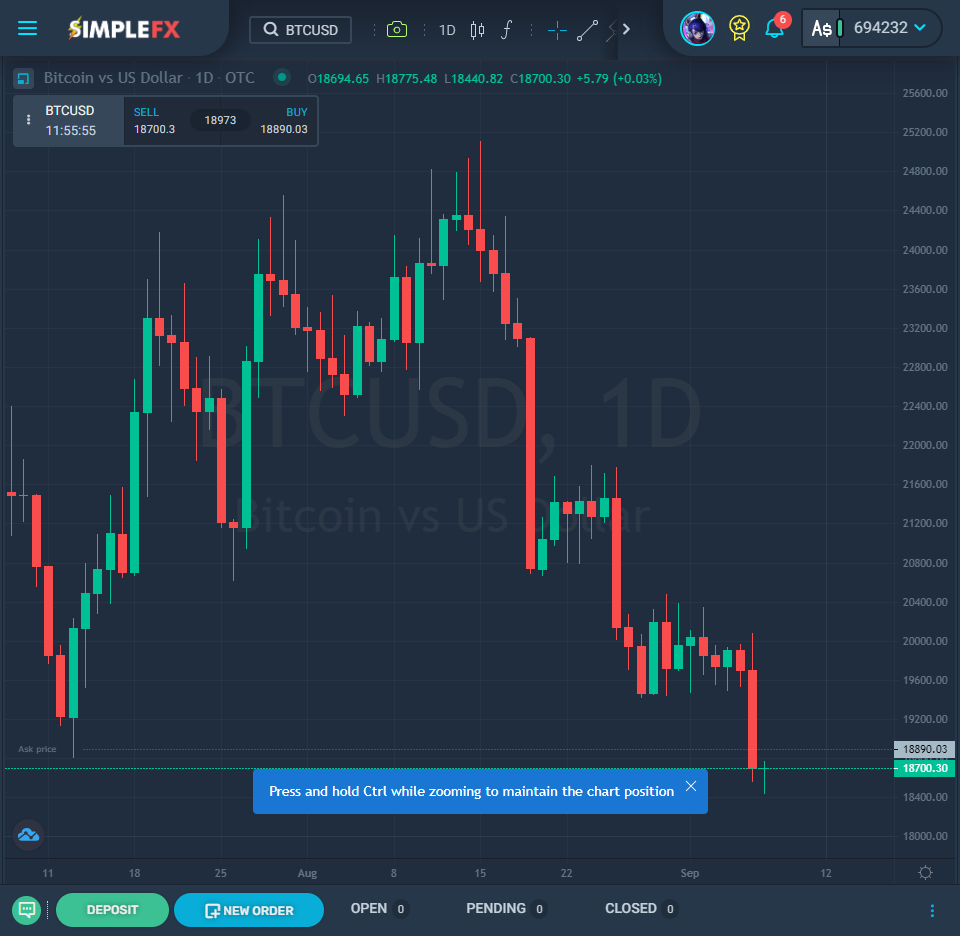

While there seem to be millions of retail investors ready to hop onto the crypto bandwagon, the prices slide. BTCUSD hit the lowest since June on Wednesday at $18,440, while Ethereum is testing the $1,500 support. Even worse, bitcoin’s market capitalization fell below the symbolic amount of $1 trillion.

What happened on Tuesday when Bitcoin lost over 5% of its value?

The main reason is the recent correlation between cryptocurrency prices and equities. Big investors seem to treat these assets as the same risk category. Fed, and other leading central banks, continue to tighten their fiscal policies, raising the interest rates to fight inflation. As a result, markets turn more risk averse, and the capital flows to the safest asset – the US dollar. The US currency has been the only asset that increased its value recently, breaking the parity with the euro for good. At the same time, the yield on the US treasury is also rising high.

It turns out 2022 was too early for cryptocurrencies to become effective inflation hedges. Over the last decade, the fear of rising prices and the protest against the central banks printing money on the politicians’ demand was the main engine behind the cryptocurrency movement. Unfortunately, when the time came, bitcoin, ehtereum, and the others failed to do the job. The reality is less romantic – significant capital treats crypto as another highly volatile asset fuelled by cheap credit and loose value during more challenging times.

As a result, in 2022, almost $2,000,000,000,000 has disappeared from the cryptocurrency market since its peak in November 2021. The leading crypto has lost over 60% since it set the all-time high at $68,990.

When will the bleeding end?

We need to look closely at the stock market to answer this question. The European markets started in red, but since then have recovered. The US macroeconomic data caused the move. The services industry accelerated in August. This seems to be a piece of good news, but investors read it the other way. A strong economy means a higher probability of the Fed raising interest rates in September. On Tuesday, analysts gave a 73% chance for a 75 basis point raises during the Fed’s next meeting, which is supposed to happen on September 20. We still have two weeks of speculation.

While the US economic performance and interest rates policy is the key to the stocks and crypto prices, traders should also keep a close eye on China. In the Asian superpower, the exports and imports slowed down, which poses a big threat to the economy, especially with the accelerating inflation and more COVID lockdowns lurking on the horizon.

Japanese yen dropped to a 24-year low against the dollar, while the Chinese yuan hit a two-year low.

Given the volatile global macroeconomic outlook, it’s challenging to predict when could the cryptocurrency downtrend end. We are entering uncharted territory in the globalized world. Geopolitical tensions, the war in Ukraine, and climate change don’t help estimate the direction.

SimpleFX margin traders should not worry, though. You can make big profits using technical analysis and reacting to the news in the short run. Remember to follow the key data releases in your economic calendar. The following key event is the European Central Bank interest rate decision. The board will meet tomorrow, September 8, at 12:15 UTC, and the press conference is scheduled at 12:45. The previous benchmark rate was 0.5%, and the forecast is a 75-point rise to 1.25%. Stay tuned, listen to the comments of the president of the European Central Bank, Christine Lagarde, and trade accordingly.