Chinese shares gained huge since Monday amid China’s regulatory crackdown.

E-commerce giant Alibaba got a sharp rebound of 6.60% on Tuesday as investors look for opportunities after a clearer regulatory outlook. Alibaba shares (BABA.US) closed at $171.62 on Tuesday, with a 6.3% increase since Monday.

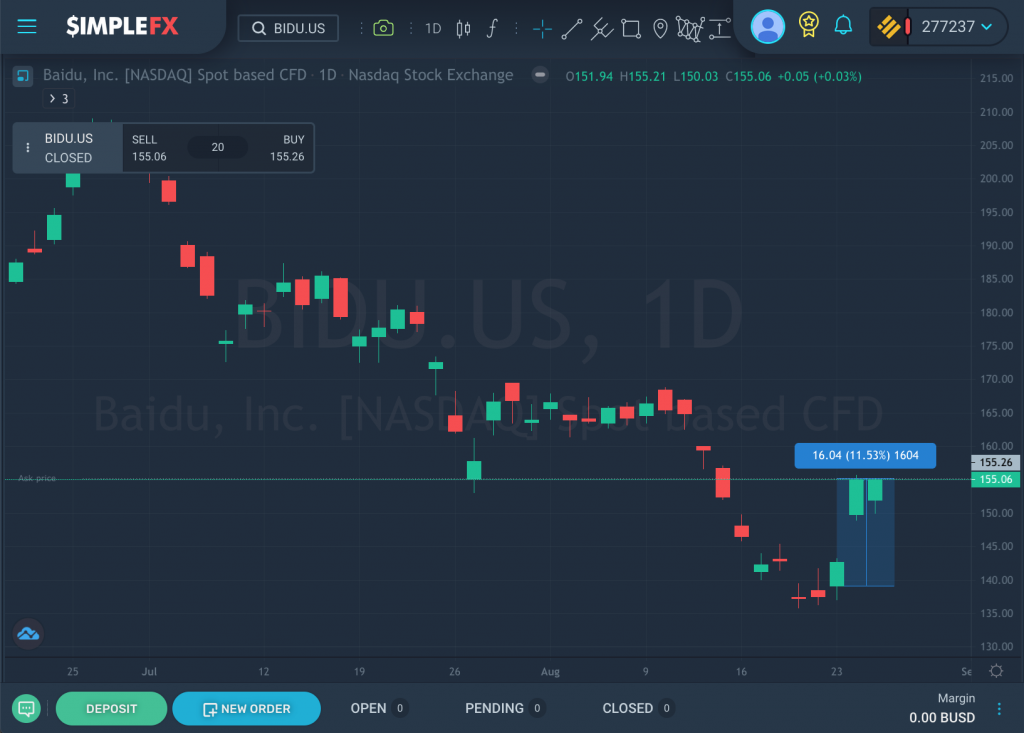

The Chinese market attracted investors even with a murky regulatory climate. After all, the country’s rapidly progressing per-capita income and robust spending power indicate continuous growth. Alongside Alibaba, Baidu (BIDU.US) also posted a massive 11% gain since Monday and closed at $155.06 on Wednesday. The Hang Seng Index (HSI50), a benchmark that tracks Hong Kong’s top 30 biggest technology firms, climbed by 1.7% in 3 days, closing at 25,659 on Wednesday. However, it backed down to 25,384 on market close today.

This August, China revealed its 5-year plan to strengthen policies and boost essential fields such as science and technological innovation, culture, and education. The Chinese authority will be tightening regulations for businesses, and new laws will be laid on the table soon. The move started early this year, with shares in several Chinese companies plummeting as investor sentiment worsened.

Anti-monopoly investigations hit some of China’s leading tech firms, and legal actions were underway against many businesses. Last April, tech giant Alibaba got a $2.8 billion fine due to market dominance abuse.

Meanwhile, NVIDIA (NVDA.US), trending at Reddit’s WallStreetBets, is on a 5-day winning streak, recording a huge 14% increase since last Thursday. It moves above the 50-, 100-, and 200-day moving average lines, indicating bullish momentum.

The top GPU maker attracted retail investors, Reuters reported, as Britain’s Competition and Markets Authority (CMA) spoke out on potential anti-competitive concerns about NVIDIA’s $40 billion purchase of Arm Ltd.

Marijuana stock Tilray (TLRY.US) ended its third day of gains with nearly 9%. Another trending symbol this week is NDX100, which is now fighting for its 7th day of gains. NDX100 opened at 14,864.33 last Thursday and has gained 3.26% as of 11:38 UTC on Thursday.

This week, GameStop (GME.US) and AMC (AMC.US) were big gainers as prices skyrocketed by nearly 28% and 20% intraday, respectively, on Tuesday.

Don’t get left behind. It’s time to trade the hottest symbols on SimpleFX with up to 1:500 leverage at your disposal.

Exciting bitcoin rewards can be yours this September. Stay tuned for our upcoming cashback offer!