We’ve recently added three attractively volatile stocks: DoorDash, Magalu, and B3 S.A. Trade these new symbols with a maximum of 50x effective leverage and with a minimum investment of less than $1!

With our current promotions, you can even grab a $50 and a $100 reward. Read on to learn more.

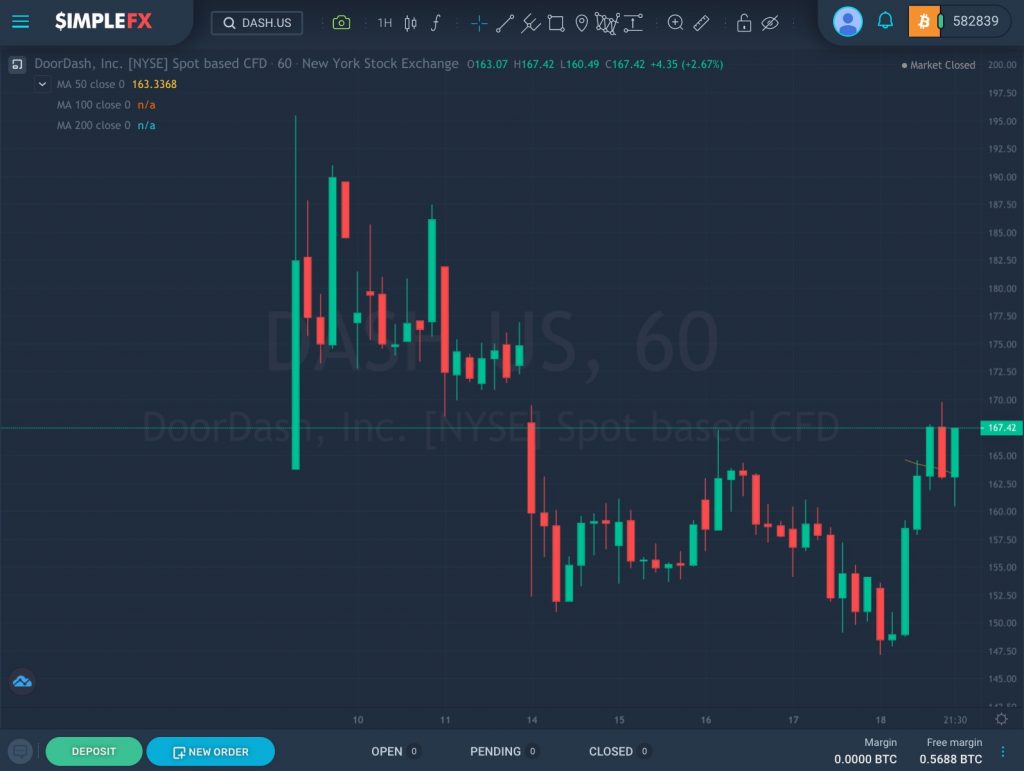

DASH.US (DoorDash Inc.)

DoorDash, the leading food delivery service in the US, has one of the most controversial IPO of 2020. On its Wall Street debut on Wednesday, it made a massive 85% surge from trading at $102 to reaching $189.51 per share. The company ended up with a $60 billion valuation at its peak.

This volatility is just another opportunity for margin traders to profit. Long or short DASH.US with up to 50x effective leverage. You need only a minimum investment of $50 to open the smallest trade. Try it now!

B3.BR (Brasil, Bolsa, Balcão)

B3 S.A. (Brasil, Bolsa, Balcao) is a global company based in Brazil. It operates as a regional exchange that offers financial products for trading in markets like equity, commodity, and derivatives. It also has an integrated business model, covering clearing and settlement transactions and central depository services.

B3 S.A. has the ticker B3.BR on SimpleFX. It is up by 43% this year to date and trades at around R$60. Use a maximum of 50x effective leverage. You can open the smallest order with even less than $1 required margin.

MAGALU.BR (Magazine Luiza SA – Bovespa)

Magazine Luiza (or Magalu) is one of the largest retail platforms in Brazil. It has a 1000-store department store chain, 9 distribution hubs, and over 40,000 employees.

The leading e-commerce and retail company is still considered early in its growth. The market still has to recognize the potential of Magalu’s credit and service business. Although the company’s liabilities could be problematic, its net cash of R$1.24 billion can also be reassuring.

Don’t Miss the Promos!

While you’re thinking of your trading strategies for these stocks, why not share them as Trading Ideas? You might just win an instant $100!

Just post your chart analysis on SimpleFX, share them on social media, and you can win an easy $100 reward.

Win another $50 by looking and following clues! As you browse our blogs, social media posts, and any communications, you may chance upon our hidden message. Just read it carefully, follow the easy instructions, and you might just win $50 even without making a deposit.

Good luck trading!

[button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#3cc195″]Go to SimpleFX[/button]