Using stop loss is essential in a successful trade. It protects you from costly mistakes and pushes your profit rate further up. However, setting a stop loss, especially in a volatile market, can be a bit tricky. More so, if you want to move your stop-loss point to cash in more profit, you can predict significant market moves.

SimpleFX uses stop loss to automatically close an open or pending position once the price dips to your stop loss point – a price that is less profitable than the original price of your order. This will protect you from incurring further losses in case the market goes against you.

If you open a buy order, place your stop loss below the asking price. In case of a sell order, set a stop loss above the bid price.

How To Change Stop Loss Levels

Let’s say that after much deliberation, you think the market will continue moving up. In this case, you think of moving your stop loss level a bit higher to make the most out of the price increase. Stop-loss levels can be modified for open orders and pending orders.

To modify your stop loss level, follow these simple steps.

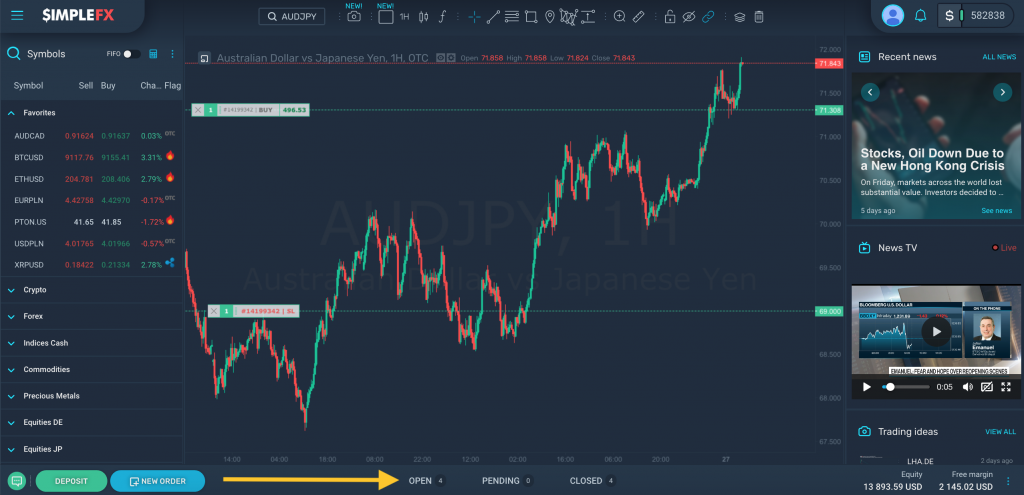

Step 1. Click on the “Open” or “Pending” order tabs at the bottom of the page.

Step 2. Click on the order.

In this case, we will modify the stop loss for an open position of 1 buy order of AUDJPY. The “Take Profit” and “Stop Loss” sections are checked, meaning that we’ve already set these levels upon placing this order. The chart shows that the stop loss (SL marker in red text) is currently set at $69.

Step 3. Set a new Stop Loss.

Click the pencil mark beside “Stop Loss” and enter a new stop loss level. Once done, click on the checkmark on the right to finalize your change. You can also modify your “Take Profit” level here.

After placing your new stop loss level, you will see a confirmation message at the top of the screen. The stop loss mark on the chart has changed as well.

Alternatively, you can change your stop loss level by dragging the stop loss marker on the chart to your desired level. After pulling, a confirmation window will pop-up showing you the changes for review.

Click on “Confirm” to finalize your change.

When to Move Your Stop Loss?

Some traders move their stop loss to break even and lure in more profit when exiting a trade; others don’t move their stop loss at all. It all boils down to what kind of trader you are and your risk tolerance. Nevertheless, if you decide to move your stop loss, here are some tips for you.

Give time for the market to move. In other words, don’t change your stop loss too soon. Wait for a defined length of time that gives the market enough room to develop. When you move your stop loss too quickly, you might miss significant gains in case the market goes up after a short dip.

Calculate your stop-loss policy. It is essential to know how much you are willing to lose. The most sensible approach is to risk only 1–3% in every single trade. This is a good indicator of stop losses. Wait for the price to make ample room and apply your percent risk rule, so you are sure to keep losses low but allow more significant returns.

Keep a trade record. Take note of your profitable trades and those that did not farewell. What types of stop-loss strategies that you use was the most effective for you? Traders’ attitudes toward risks differ, so study what acceptable risks and rewards work best for you. Don’t linger on losses. Take time to research and improve your trading strategy. You can do mock trades using a demo account to navigate the murky waters.