On Friday, markets across the world lost substantial value. Investors decided to cash in on the recent bullish run. Oil went sharply down, while investors were looking for safety in the US and other countries’ bonds. European stocks started Friday with sellouts. The indices went down 1.5% in response to the news.

The second part of the Thursday trading day in the US was also bleak. Even such stars of the last days of trading as Amazon or Facebook have lost value substantially at the end of Thursday’s New York trading session.

The incentive for the bears to step in turned out to be a new security law in Hong Kong, which experienced a series of democratic protests and civil unrest. Hong Kong has increasingly been an object of tensions between the superpowers – the US and China.

President Donald Trump responded the US would react “very strongly” to any further limitation of Hong Kong’s autonomy by China.

Another incentive to sell came when the Chinese reduced the annual GDP growth rate due to the pandemic effect.

On Friday, Japan’s central bank uncovered a lending program. The goal is to give $280 billion to small businesses hit by the coronavirus. In the response to global downturn India cut interest rates for a second time this year.

China failed to set an economic growth target for the first time since 1990 when they started to publish these data. Investors understood this as a sign that the effect of coronavirus pandemic is still to be noticed.

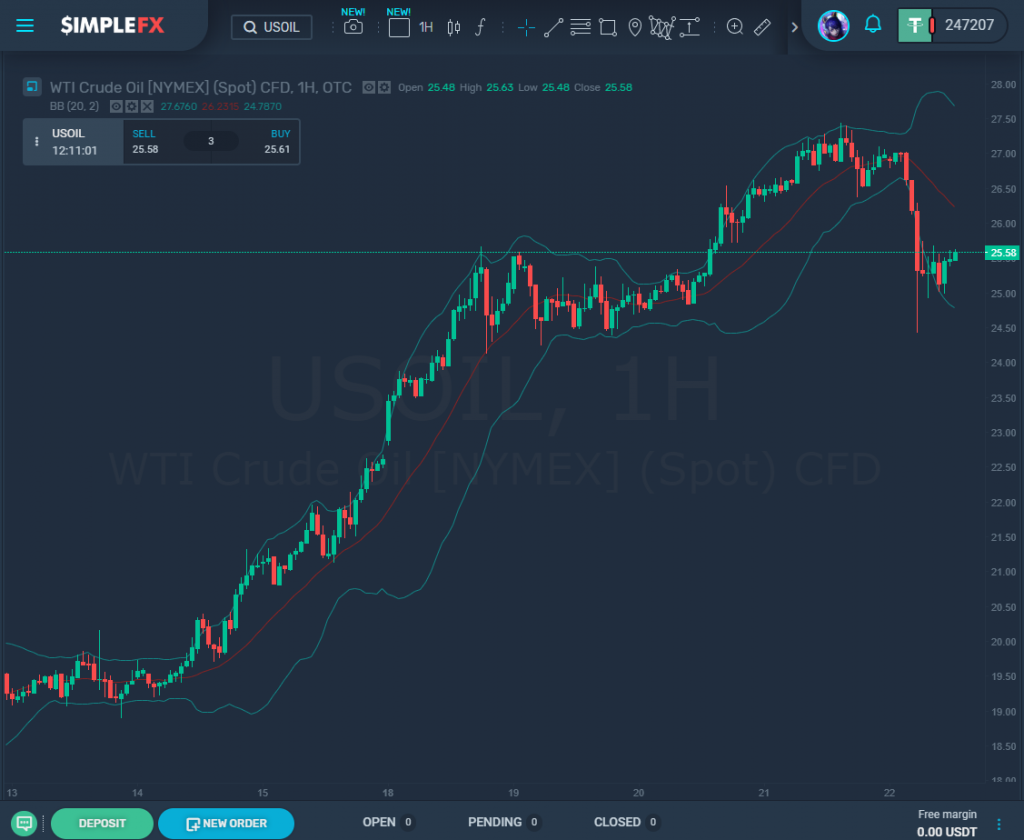

You can benefit from market turmoil. While the downturn harms long term stock investors, margin traders enjoy the volatility. You can invest in European, American, and Asian stock exchanges from anywhere. All you need is a handy mobile-friendly trading app.

During the pandemic, individual traders need access to the global stock market, as it offers excellent opportunities. The easiest way to do it is to create a free trading account on margin trading apps. You can easily BUY any stock worldwide (including indices Dow Jones, S&P 500, NIKKEI225, FTSE100, and more) and make a profit when the price goes up or when it goes down. Yes, you can profit directly from a market crash. All you have to do is use the SELL option if you think the price will go down. You don’t need to own the stocks to SELL them, as the apps offer you an opportunity to open so-called “short positions.”

The global financial markets are going to experience much more turmoil in the nearest future. Give yourself a chance to profit from this extraordinary situation. Don’t miss out on this once in the lifetime opportunity.