So far, the majority of the coronavirus cases have been primarily limited to China. However, developments over the weekend show that the spread of the disease has become more global, leading to mixed reactions in stocks, oil, gold, and bonds.

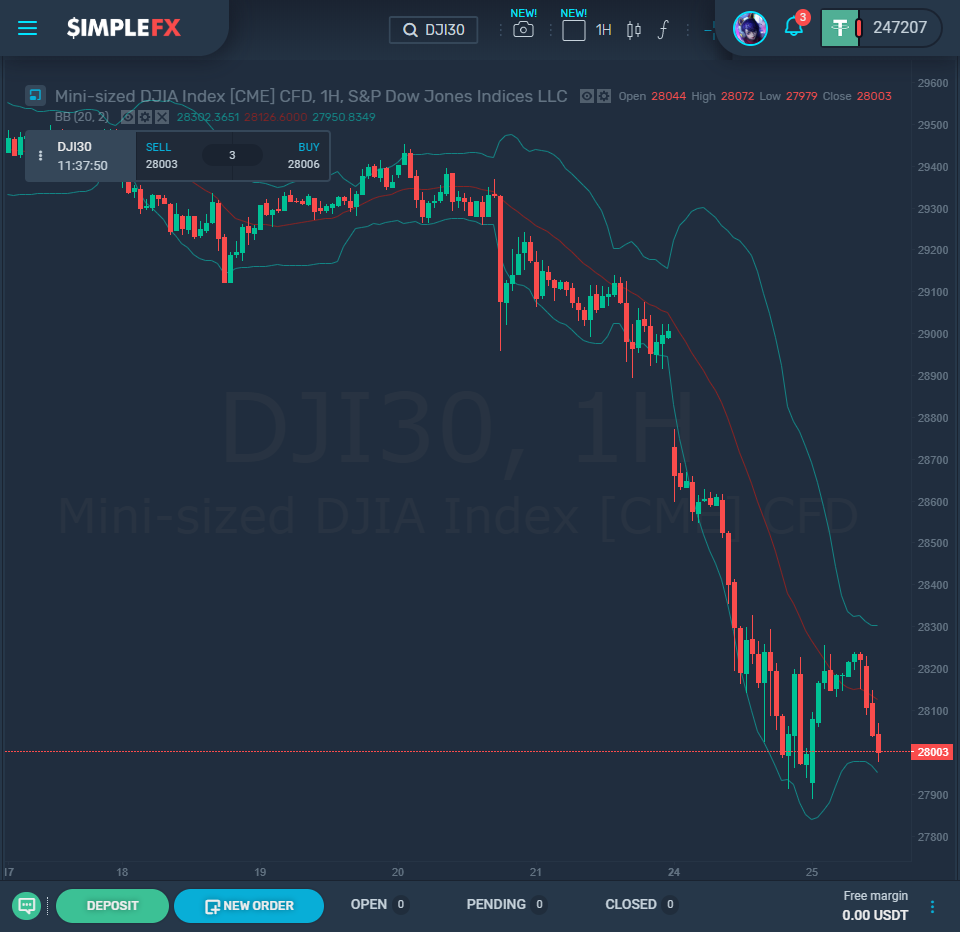

There was a massive drop in the U.S. stocks last night, the worst in two years. This is also due to the threat of global infection from the coronavirus, which appears to be getting steadily worse. Cases have now been reported in over 30 countries, and there are fears it could continue to spread. The Dow Jones did manage to gain back 150 points when it opened today, but things are looking grim.

The market still lost 3.56%, to fall to 27,960.8 points. Nasdaq lost 3.71%, sitting at 9,221.28 points. S&P 500 lost 3.35% to end the day at 3,225.89 points. These losses are the biggest single-day drops since February 2018, and they bring serious concerns about an economic recession. These massive drops came just after the highs of last week when the threat of the coronavirus appeared to be over.

Oil was another loser at the end of the day, falling by 4%. U.S. Crude oil fell to $51.35 when the stock markets closed, representing losses of 3.8%. Brent fell even more, by 3.97%, to end the day at $56.18. These losses come after hedge funds have been selling barrels in response to fears of a global recession for weeks now, starting back in January.

Oil experts do believe that this trend is slowing down, and they predict it will end before it causes a complete recession in the industry. Despite this slowdown, oil still reached its lowest value in seven weeks and doesn’t look ready to climb back up just yet.

One of the only winners of the day has been gold. Gold is reaching peak levels as investors remain worried about the effects of the coronavirus on global economies. It rose as much as 2.8% today as the number of infections outside of China continues to increase.

Spot gold peaked at $1,688.66 during the day, the highest it’s been since 2013. As stocks become more and riskier, investors are turning to safer, more reliable options like gold. Because these gains are the result of scared investors, it will likely continue to rise, but these increases are likely to be only temporary.

Bonds are another steady bet when other investments seem shaky. They have jumped, and this mass buying has lowered the yield on 10-year Treasury notes down to 1.37%, down by ten basis points. This is also extremely close to the overall low that was hit in 2016, at 1.321%. Bonds also fell to lows of 1.6% for 30-year debt. This helped to keep the dollar steady, even though it’s been experiencing recent gains.