The rise of oil consumption in the U.S. and the rest of the world is a well-known fact. But, as the percentage of electric vehicle sales continues to grow, there will eventually be a turning point on many fronts. Firstly, manufacturers will ultimately be investing more into EVs to overtake the traditional combustion engines eventually. This is happening right now with companies like Tesla, Porsche, and General Motors.

The more significant turning point will an inevitable peak in the consumption of oil from which the earth would most likely never recover. It is not known when this peak will arrive, but due to the reduction in the cost of EV and the renewed focus on reducing carbon emissions globally, it is just a waiting game.

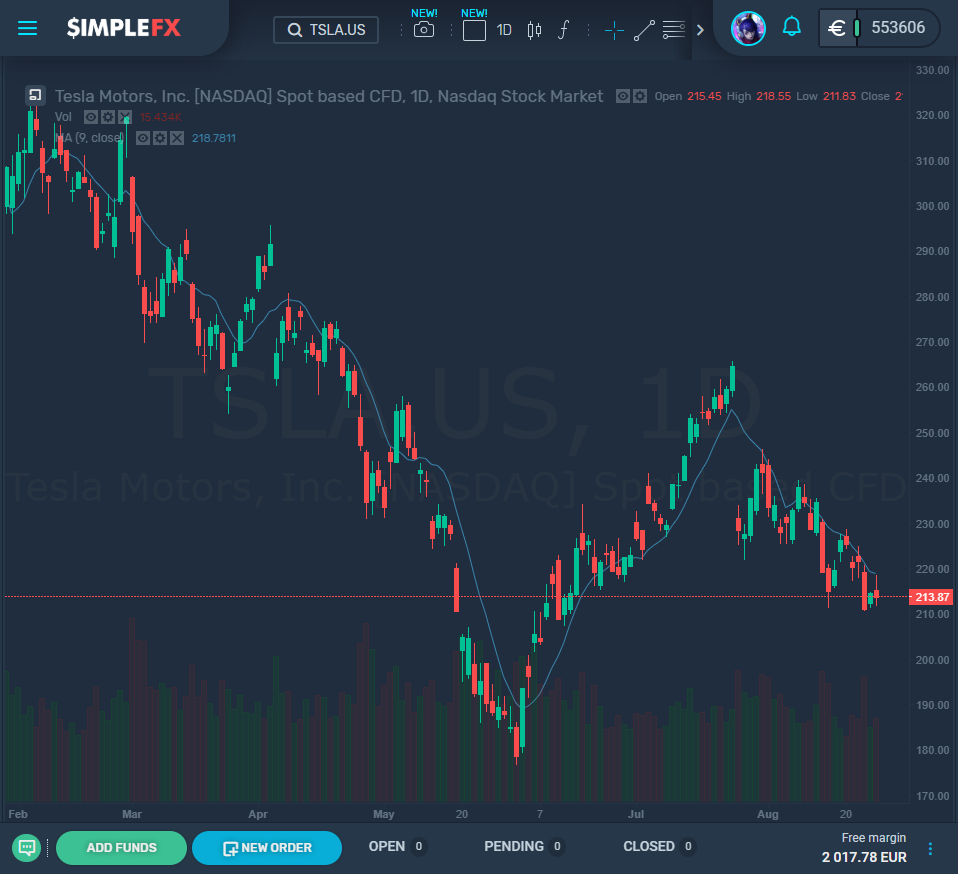

[button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#df4444″]SELL Tesla[/button] [button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#3cc195″]BUY Tesla[/button]

Sales of EVs are booming

There is little doubt that the EV uprising has been led by Tesla over the last ten years, with a continuous push to drive growth in the industry. Inside EVs website states that, in the U.S., Tesla has sold almost 100,000 of its EVs (the Model 3, X and S) in July 2019. The total EV sales in the U.S. from all manufacturers was 176,174 throughout seven of 2018’s months, which is an increase of 14.5% from last year (153,854 EVs).

Globally, EV sales in the first two quarters of 2019 were up to 1,105,405, which was an increase of 46.9% from one year ago, when it was 752,690. This global-level growth is what is going to bring forth the turning point.

In all directions, the sales of EVs are increasing, and the costs of EVs are reducing too. Next year and the after will see other options on the market from manufacturers like Ford, Mini, Kia, Porsche, and others.

However, car sales generally are falling

With EV sales increasing, generally, auto sales are declining. According to the CAR (Center for Automotive Research), global car sales are predicted to fall this year overall, to 75 million from last year’s 79 million.

[button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#df4444″]SELL General Motors[/button] [button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#3cc195″]BUY General Motors[/button]

EVs, though, are only a small percentage of the total sales globally, with around 2-3 million EVs predicted to be sold in 2019. As the sales decline overall, EV sales are still growing.

Why is the rate of oil consumption increasing?

It would be wrong to believe that oil consumption is on the decline, thanks to a reduction in auto sales and an increase in EV sales. There are two main reasons for this: larger vehicles form a more significant percentage of sales (SUVs and trucks, for example), and people are driving further with the cars they have already.

Trends can change quite quickly, though. A few years ago, oil consumption was declining in the U.S. due to the weak economy and an increase in fuel efficiency. The reversal could happen quickly again. Only time will tell.