A 22-year-old Masters of Economics student, Jordan Rochester, was at the University of Warwick still when former Prime Minister David Cameron made his pledge to hold the Brexit referendum.

Now, at 28 years of age, he has become known as Mr. Brexit to his clients and colleagues. Working as a currency strategist at Nomura International Plc, he is the person to go to for analyzing the twists and turns in how Brexit will affect the UK markets. He is combining the complicated and often thankless role of pound forecaster with the political analyst.

For around four years, Rochester says he has written an email or piece on Brexit every couple of days as a rough guess. Over 300 of his own research reports are published online on the investors part of the bank’s web page. This excludes those notes that have been emailed or papers that were co-authored.

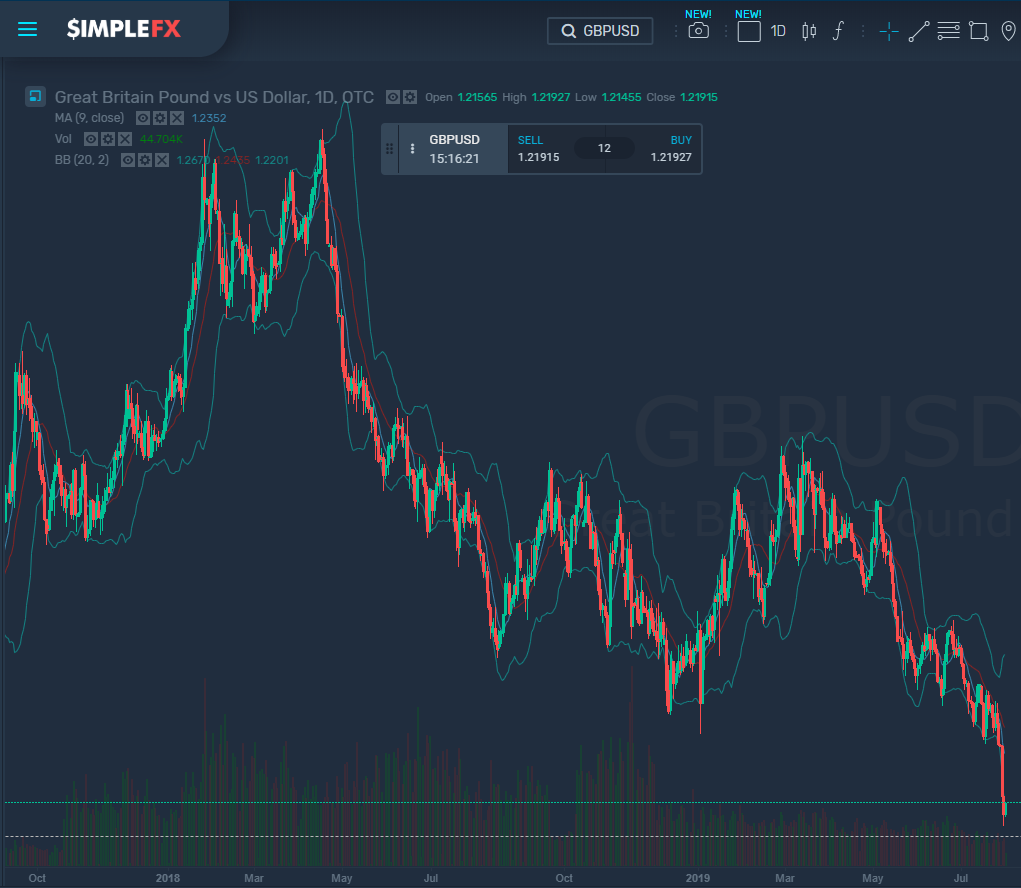

At the moment, the pound sterling is looking to post a four-day losing streak, the worst since 2016. This is allegedly due to the intensifying fears of a no-deal Brexit and new PM Boris Johnson’s tough stance. Boris has an ultimatum for the EU: he won’t start talks unless they are willing to re-open the withdrawal agreement.

Mr. Brexit believes that the chances of leaving with no deal are at around 30%. If this happens, he thinks it could mean the pound drops as low as $1.15. The pound is already at its lowest against the dollar at $1.22 since 2017.

However, we can’t count our chickens before they’ve hatched. Even though Mr. Brexit and his colleagues have predicted some big things, like 2017’s hung parliament, they have also had some less promising predictions, such as a 2018 pound comeback.

Yet, Rochester’s obsession with British political minutiae and his relentless output means he’s someone who Andrew Swaine and others turn to if they get a bit flummoxed.

“Jordan’s insight into British politics and his ability to decipher the narratives and political actors has been extremely solid,” the money manager told Bloomberg. “It’s not easy to trade politics. What politicians say and what they ultimately do can produce a series of entirely different market outcomes.”

And Mr. Brexit’s rather prolific output is set to continue. Boris John’s arrival as PM has fanned the flames in the country’s fear that it could leave with no-deal by October end.

The pound is sliding. Currency volatility bets are rapidly climbing. The stock exchange in Britain is shrinking slowly. Investors are looking for safe assets, and gilts are going up as a result.

The pound reached Jordan Rochester’s end of year forecast the day after Johnson was proclaimed leader of the Conservative Party with a figure of $1.25. He believes the pound is trapped in this range for the remainer of 2019 until politicians in the UK negotiate a deal with the European Union or leave without one.

Traders are wanting to protect their assets. They are not so worried if there’s a devaluation of the pound of 5% or even 7%. They want to protect against 20% devaluations.

Rochester agrees that his clients don’t like to discuss Brexit due to what he terms as “Brexhaustion.” Their interest does revive when a volatility event occurs, and he will always be there when it does.