It’s been almost 17 years since the UK saw its manufacturing output fall as much as it did in April. Brexit stockpiling gave a boost, and car producers carried out planned shutdowns.

There was a decline of 3.9%, which is the largest since mid-2002. This also means the economy as a whole has shrunk for the second month in a row, according to the Office of National Statistics. There was a plunge of one quarter in vehicle production.

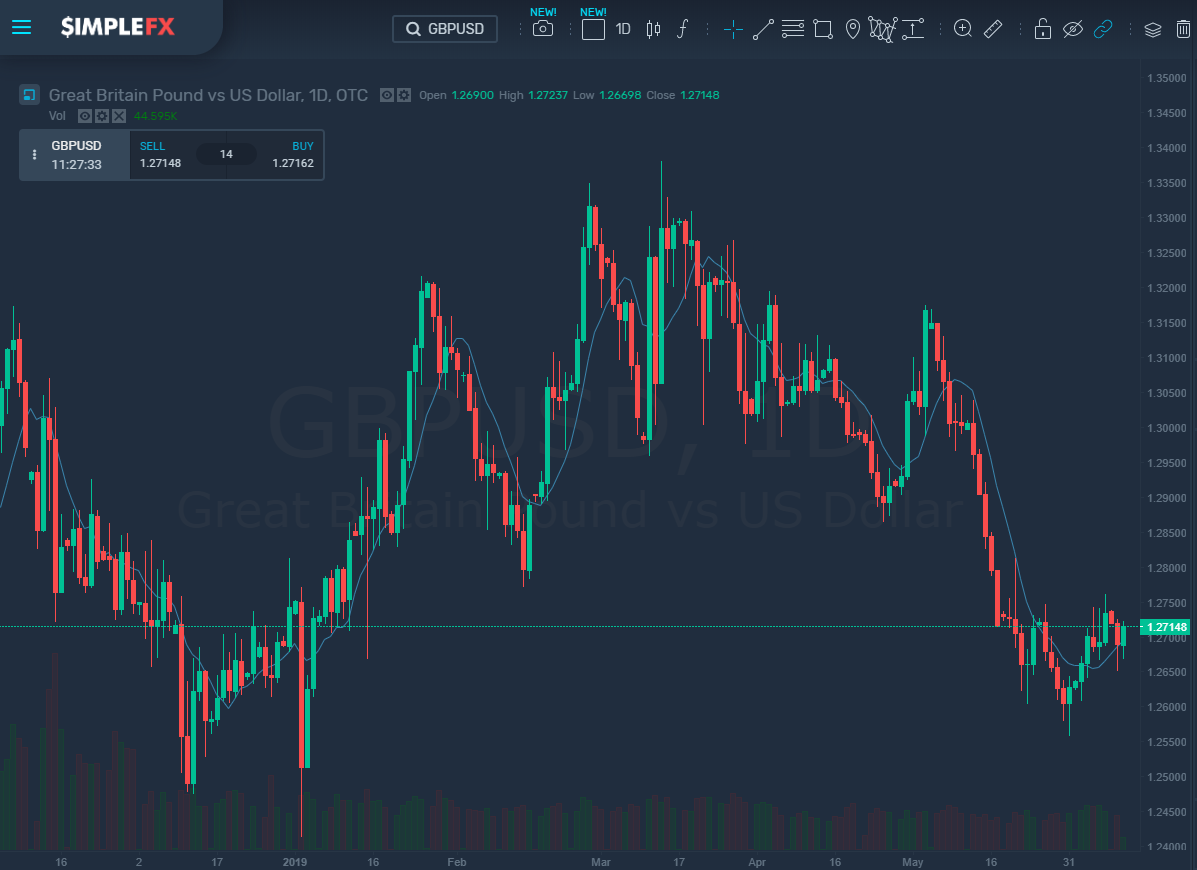

[button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#df4444″]SELL GBPUSD[/button] [button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#3cc195″]BUY GBPUSD[/button]

GDP fell by 0.4%, which is the most significant monthly drop for over three years. This means that the U.K. economy is at risk of having a sharp slowdown during this quarter. The U.K.’s growth over the last three months has been weaker than predicted at 0.3%. This is down 0.2% compared to the first quarter.

After these figures were published, the pound sterling dropped by 0.4% making £1GBP worth $1.2688 at 09:36 in London.

In the first few months of this year, factories in the U.K. boomed as companies created stockpiles to avoid any disruptions to supply that would potentially occur with the U.K.’s departure from the European Union on March 29. However, with a now-delayed Brexit on the cards, companies are scaling back orders and are meeting their demands with products stockpiles in their warehouses.

There has been a further blow to the car sector too with car manufacturers like Peugeot and BMW bringing forward their planned shutdowns for the summer months that were organized in case of Brexit disruptions. Output in-vehicle products slumped by 24%, which is the most since records began back in 1995. Economists predict this loss to be recovered at least partially in May. Other sectors also demonstrated widespread weakness, including metals and chemicals and pharmaceuticals.

These figures show how fragile the U.K.’s economy is under the uncertainty of Brexit. There is also the weakening political backdrop to add as the Conservative Party looks set to choose a new leader, a successor to Theresa May who insists that a no-deal Brexit should still be an option for the U.K., which is what U.K. businesses fear the most.

The dominant services industry, as well as construction, were not able to give any support in April and the data from PMI last week is suggesting that there was not much improvement during May either.

March saw construction fall by 0.4%. Services remain unchanged. The total production in the industry fell 2.7%, which is the biggest fall since 2012. Maintenance work caused

Gross Domestic Product saw a rise of 1.3% from the previous April but was 1.9% down from March’s figure. The yearly growth was 1.1% for the last three months.

The U.K.’s trade deficit narrowed a gap to 12.1 billion pounds (equivalent to $15.4 billion) since exports and imports fells after the stockpiling of EU and British companies during the first quarter.

In terms of volume, exports saw a fall of 10.9% during April, which is the highest figure since 2006. Imports, on the other hand, declined by 14.4%, which is the most significant fall since 1998 when records began.

Transport equipment output fell by 13.4% as a whole, which is the most significant drop in 45 years, since 1974.