There were three exceptional events active day traders could use to make huge earnings in October. Read about them and use the experience to make money in November.

As always with the end of the month, we discuss the greatest daily and hourly price moves on virtual currencies in the past month. What’s the point? First, we want you to get ready for the next trading opportunities to come in November. Second, looking back at these events may help you predict similar moves when the cycle repeats and trade at the time when buying and selling assets with a leverage really pays off.

A sideways trend with three major events

As many people have noticed on the Bitcoin Group on SimpleFX WebTrader Shoutbox, the second part of 2018 is not great for Bitcoin day trading. Cryptocurrencies didn’t lose value, but margin traders wouldn’t mind if they did. All they want is the prices to change a lot. They want volatility that allows them to open a short or long position, hedge and take profit.

As you can see on the chart, Bitcoin in October was quite boring most of the time drifting sideways. However, there were three big price movements that for sure brought fortune to smart investors. Let’s take a closer look at them and see what we can learn from the cryptocurrency markets in October.

Global economy outlooks causing a wide market crash

October the 10th was an exciting day for Bitcoin and other digital currency short sellers. On this day the market capitalization of the crypto industry shrank by roughly $13 billion in just three hours. Ethereum and Ripple lost the most that day as the Bloomberg Galaxy Crypto Index fell by 11 percent in just a few hours.

Bitcoin plummeted below the $6,300 threshold, which created additional opportunities for traders reading the market trends with technical analysis.

Was it predictable? The cryptocurrency sell-off happened at the time the global stock market hit the eight month-low. The Nasdaq tech giants – Amazon, Facebook, Netflix, and Apple – were leading the falls.

The impulse came from the International Monetary Fund published “World Economic Outlook” report where it downgraded the forecast of the global economic growth for 2018 and 2019. IMF chief economist Maurice Obstfeld underlined to the threats of US-China trade war and the uncertain future the UK and Brexit.

Additionally, in the report IMF warned about the cybersecurity threats and attacked the crypto market directly stating:

“Continued rapid growth of crypto assets could create new vulnerabilities in the international financial system”.

This caused some attractive short time price movements. However, as you can see on the Ripple 15M chart below the situation soon stabilized, and the day traders who missed that day could regret it.

A flash spike on the 15th of October

The second major crypto price movement in October was much more unexpectable. Suddenly on October the 15th Bitcoin skyrocketed and broke $7000 limit. The rise in price was remarkably short term as in the next couple of hours the price came down to $6,500 and drifted on.

Once again the traders that were active during these four hours could profit from the dynamic price movements. Ideally taking a long position first, and then shorting Bitcoin or other cryptocurrencies. On the other hand, the move was so unexpected and brief it was very risky to open any bigger position during this time. It was an ideal moment for speculative orders with high leverage.

Surprised by taxes?

October ended with one more interesting event you could use to trade cryptocurrencies. This time, savvy traders could predict it easily.

On the 29th of October Bitcoin investors who made huge profits in 2017 during the crypto bonanza had to file their capital gain taxes in the US. As it usually happens the inexperienced investors were surprised by the amount of taxes they needed to pay. As a result, some of them had to get rid of their coins, causing a local price slump.

Traders who were able to predict this scenario or at least remembered to stay active at the end of October during the tax-filing period could have opened some lucrative positions on practically any tradable cryptocurrency: Bitcoin, Ripple, Ethereum, Litecoin or Bitcoin Cash.

November outlook

It looks that in the near future the price of Bitcoin and altcoins will stabilize, which is a good sign for long-term direct cryptocurrency investors and enthusiast, but not so good for the traders that are looking for exciting trading opportunities that come with price volatility.

One interesting takeaway from the October events is the growing correlation between Bitcoin and Nasdaq index. It seems that big market players are seeing similarities in the two assets. Both are tech-based and both aim at disrupting old business models and fiat currency systems.

November may be the time of steady growth for cryptocurrency coins and tokens with several random high volatility events similar to the ones we saw in October.

For the time being Bitcoin, Ethereum, Litecoin, Bitcoin Cash, and Ripple investors should stay plugged into the crypto related news and watch closely the biggest Nasdaq companies.

Make sure that when the opportunity happens you have access to a fast trading platform with some funds in the deposit so you can benefit from price movement even opening some small positions with high leverage. SimpleFX WebTrader is a perfect tool for reactive cryptocurrency trading.

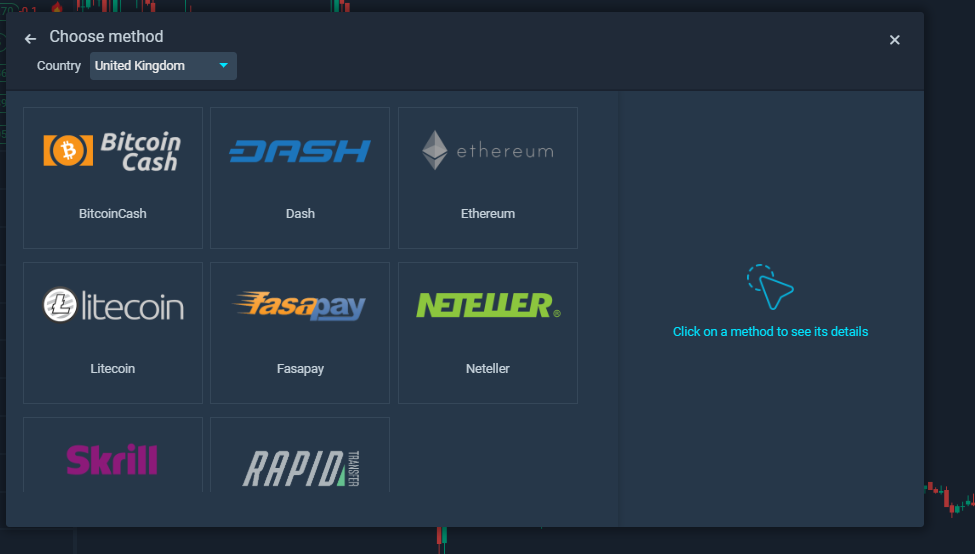

What’s the most important, with SimpleFX you can trade with no minimum deposits. Just choose the most comfortable payment method and get ready to profit from crypto events in November.