SimpleFX Trade Calculator is an easy-to-use and very helpful tool that helps you can check all the important parameters before you set up an order.

Trade Calculator will give you the answer to the two key questions:

- How much money you need to open a position you want.

- How what will be your exact profit (or loss) – including the spreads and SWAP – if a certain scenario happens.

Here’s a short guide on how to use it.

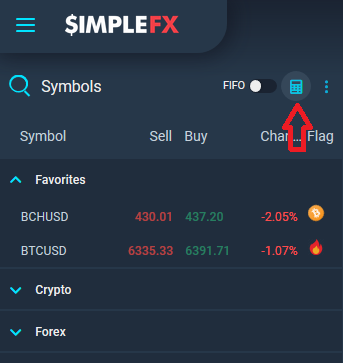

To open the Trade Calculator, click on the blue icon above the symbols list.

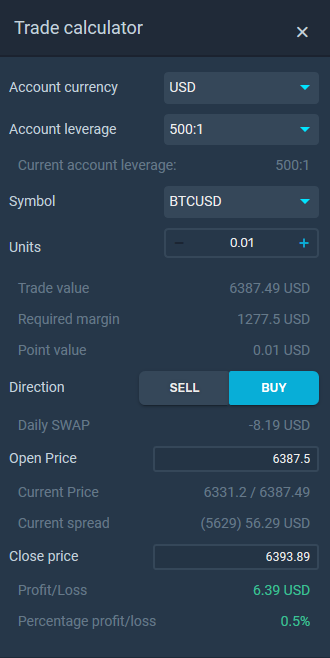

That’s it. Now you can use the Trading Calculator. First, set the account currency and account leverage. Let’s say we are interested in calculations for a USD account with the highest 500:1 leverage.

Let’s calculate a BUY order for 0.01 lot of BTCUSD. The trade value is 6387.49 USD, which is a price of 1 Bitcoin at the end of October 2018, when we are writing this tutorial. The reason is that the contract size for Bitcoin vs US Dollar is 100 and 100*0.01 = 1 Bitcoin.

The calculator shows you that for this trade you’ll need 1277.5 USD on your account.

Here’s the formula behind it:

required margin= size of order*contract size*current exchange rate* margin%*leverage rate

For an account with 1:500 leverage, an order of 0.01 lot BTCUSD, and a price $6387.49 calculation goes as follows:

0.01*100*6387.49*1*0.2=1277.5

The point value shows how the profit or loss changes when the price moves for one point. Since this is a USD account it’s 0.01 USD.

“Daily SWAP” is a fixed interest rate for an instrument. It’s usually different for long and short positions. Changing the trade directions shows you swap calculations for your positions and allows you to simulate a trade, showing how much you can earn or lose if the price moves in the desired direction.

We are calculating a trade with the open price at the current market price and the close price at 6393.89 since we expect BTCUSD price to rise 0.5%. The result of our calculations is 6.39 USD profit.

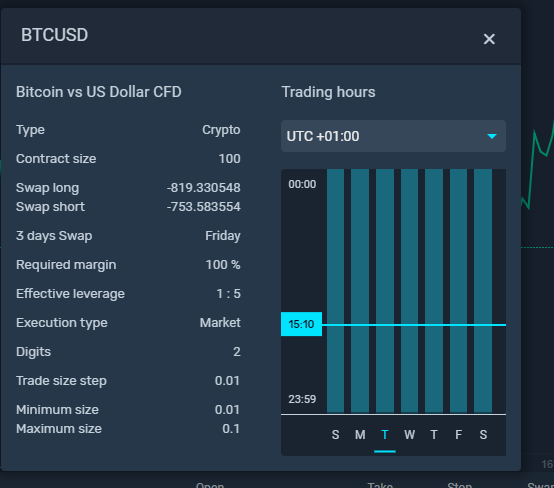

To understand the calculations better, take a look at the BTCUSD symbol information.

If you have any questions, log into SimpleFX WebTrader and contact our Support Team.