The IBEX 35 is the benchmark index of the Spanish Stock Exchange, also known as Bolsa de Madrid. It consists of the 35 most actively traded stocks on the Madrid Stock Exchange and is used to gauge the performance of the Spanish equity market. Let’s introduce the most essential IBEX 35 information & metrics.

Table of contents:

1) The Mirror of the Spanish Economic Landscape

The IBEX 35 is an essential benchmark for the Spanish economy and is one of Europe’s most significant stock indices. It was first launched in 1992 and is a free float-adjusted market capitalization-weighted index.

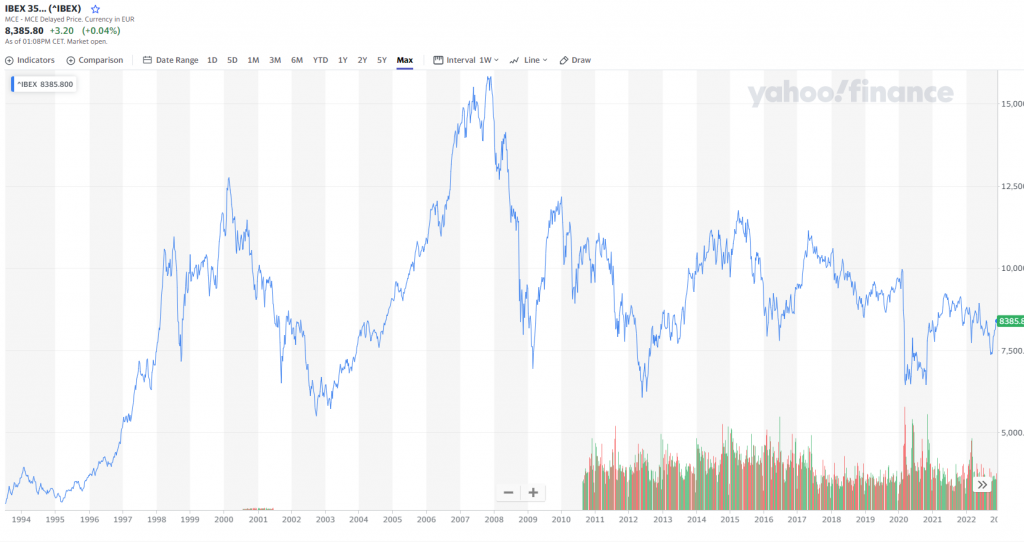

On December 29, 1987, the index value was set at 3,000 points. On December 2007 the indice reached approximately 16,000 points. The lowest value was recorded at 1862 points in the early 1990s.

It is used as a barometer for the performance of the Spanish economy and is closely followed by investors and analysts worldwide.

Read also: What is NASDAQ?

2) IBEX 35 Important Metrics

As of June 2020, the Ibex 35 has a price-to-earnings ratio of 12.8, a price-to-book ratio of 1.3, a dividend yield of 4.2%, and a market capitalization of €715 billion.

3) IBEX 35 Companies List

The index represents companies from various industries, including banking, insurance, telecommunications, and construction. In terms of its components, the IBEX 35 consists of the following companies:

| Company Name | Industry |

| Acciona | Construction |

| Acerinox | Steel |

| ACS | Construction |

| Aena | Airports |

| Amadeus IT Group | Tourism |

| ArcelorMittal | Steel |

| Banco Sabadell | Financial Services |

| Santander | Financial Services |

| Bankinter | Financial Services |

| BBVA | Financial Services |

| CaixaBank | Financial Services |

| Cellnex Telecom | Telecommunications |

| Enagás | Natural Gas |

| Endesa | Electricity |

| Fluidra | Industrials |

| Ferrovial | Infrastructures Management |

| Grifols | Pharmaceuticals |

| IAG | Aviation |

| Iberdrola | Electricity |

| Inditex | Clothing |

| Indra | IT Services |

| Inmobiliaria Colonial | Real Estate |

| Mapfre | Insurance |

| Meliá Hotels | Tourism |

| Merlin Properties | Real Estate |

| Naturgy | Natural Gas |

| PharmaMar | Pharmaceuticals |

| Red Eléctrica | Electricity |

| Repsol | Oil and Gas |

| Laboratorios Rovi | Pharmaceuticals |

| Siemens Gamesa | Wind Power |

| Solaria | Photovoltaic |

| Telefónica | Telecommunications |

The IBEX 35 is widely followed by investors and analysts worldwide and is an essential indicator of the performance of the Spanish economy. As the index is comprised of the most liquid stocks traded in the Madrid Stock Exchange, Bolsa de Madrid, it is an excellent way to track the performance of these companies and the Spanish economy as a whole.

Investors, including SimpleFX users, can use the index to diversify their portfolios and benefit from the potential of the Spanish stock market by having access to a wide selection of companies. Here you can trade IBEX35 and find important IBEX 35 Information.

4) An Essential Benchmark For The Spanish Economy

Due to its importance as a benchmark index, the IBEX 35 is closely followed by global investors. It is a free float-adjusted market capitalization-weighted index and is regularly reviewed and updated to ensure it accurately reflects the performance of the Spanish stock market. The index also offers investors access to an international range of companies, allowing them to diversify their portfolios and take advantage of the opportunities offered by the Spanish stock market.

In conclusion, the IBEX 35 is an essential benchmark for the Spanish economy and is closely followed by investors and analysts worldwide. It is a free float-adjusted, market capitalization-weighted index and consists of the 35 most liquid stocks traded in the Madrid Stock Exchange.

4.1) What is a free float-adjusted, market capitalization-weighted index?

- The free float-adjusted, market capitalization-weighted index is a type of stock market index based on the total market capitalization of all the stocks within the index.

- It considers the free float, the number of shares available to investors and weights each stock in the index based on its total market capitalization.

- This index is used to measure the performance of a particular group of stocks in a market and provide a gauge of the overall market performance.

- The index offers investors access to a broad range of companies, allowing them to diversify their portfolios and take advantage of the opportunities offered by the Spanish stock market.

5) The 2008-2009 Financial Crisis

The IBEX 35 index, one of the leading stock indices in Spain, was significantly affected by the financial crisis of 2008-2009. During this period, the index saw its most significant one-day drop, falling 22% on October 29th, 2008.

This drop resulted from the global financial crisis and the contagion of the Spanish economy. During this time, the Spanish banking sector was particularly hard hit, leading to a significant decrease in investor confidence and a sharp decline in the IBEX 35 index.

As a result of this crisis, the index fell over 60% from its peak in 2007 to its low in 2009 before eventually recovering and reaching new highs in 2017.

6) IBEX 35 Information: Related Indices

The IBEX 35 has several associated indices, such as:

- IBEX Medium Cap – includes the 20 largest Spanish companies whose capitalization is more significant than those included in the IBEX 35;

- BEX Small Cap – includes the 30 largest Spanish companies whose capitalization is more significant than those included in the Medium Cap;

- IBEX Top Dividendo;

- BME Growth – a sub–market of Bolsas y Mercados Espaoles (BME) for smaller companies whose shares are floated under a more flexible regulatory system than the primary market.

Main photo: bolsademadrid.es