The decision on the direction of the political march is still ahead of the Turks. The presidential election in Turkey did not bring a clear result, and citizens are waiting for the second round of voting, which will take place on May 28, 2023. After the vote, one thing is known for sure: Turkish voters will have to decide whether Turkey will go further east or west. Both politically and economically. Let’s take a closer look at Turkey’s economic landscape in 2023.

Table of contents:

Erdogan and Kilicdaroglu Set for Second Round of Presidential Election

The Supreme Election Commission of Turkey, after counting 99% of the domestic votes and 84% from abroad, reported that in the presidential election, Recep Tayyip Erdoğan received 49.4% of the votes, the opposition candidate Kemal Kılıçdaroğlu received 44.9%, and the anti-system and nationalist Sinan Oğan received 5,2%. Therefore, it will be resolved only in the second round, in which Erdoğan and Kılıçdaroğlu will face each other on May 28.

In the parliamentary elections, three parties crossed the threshold, i.e., the ruling People’s Alliance (49.37%), the opposition National Alliance (35.12%), and the Kurdish-left Alliance of Labor and Freedom (10.53%). The turnout was record-breaking and amounted to approx. 88%. All political parties in the nation accepted the election result.

Turkey’s Vital Role in Global Economic Stability

Turkey’s direction is also of great importance to the whole world. In the ongoing Russian-Ukrainian war, Ankara played the role of negotiator for the grain agreement. Thanks to it, Ukrainian grain leaves the Black Sea ports despite the Russian blockade. Many of Asia and North-East Africa owe Turkey and Erdogan relatively stable bread prices and social peace.

But let’s focus on economic issues. Even though Turkey is one of the world’s largest emerging markets, its citizens have had to cope with the highest inflation in recent decades. 20 years ago, however, it looked completely different.

The ‘China of Europe’: Turkey’s Economic Transformation

Let’s go back to 2002. Recep Erdoğan came to power in Turkey in 2002, and the country is now gaining one of the most important positions in NATO. With this, deal the geopolitical cards, from the European Union to Russia, to Syria. Turkey is developing economically, offering good conditions for doing business and having well-educated employees. In 2010, it even gained the nickname “China of Europe” because it ships almost everything to Europe, from furniture to clothing, cement, and DVD players.

In the first decade of the 21st century, Turkey is the largest economy on the outskirts of Europe. It has a wide range of industrial production, is an important center of the automotive industry, and is the main exporter of cars to Europe. The largest car manufacturers, including Ford, Toyota, and Mercedes, have factories there.

That is how it was, but how is it now?

Turkey’s Economic Landscape In 2023: Economic Crisis

21 years later, Turkey’s economic landscape looks very different. Erdogan has been in power in the nation for over 20 years. There is no trace of the economic successes of the first term, and Turkey has been falling into a crisis in recent years with very high inflation.

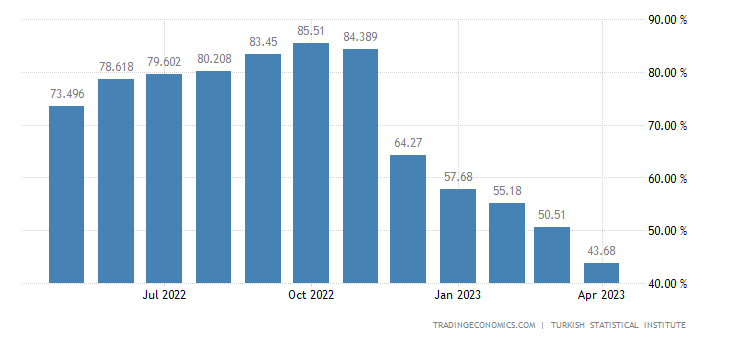

The worst was in October 2022, when inflation in Turkey was 85.3%. This year it has fallen by almost half, and the latest data for April 2023 showed an inflation rate of 47.3%. Nowadays, many Turks need help making ends meet.

Once the world’s 16th economy, it will move up to 12th by 2050. But in fact, it fell in almost all economic rankings. Turkey is back to square one. How did it happen?

The Lasting Legacy of Erdogan’s Economic Reforms

In place of assisting the outgoing reforms 20 years ago, the previous team had to grab the lifeline that the International Monetary Fund (IMF) threw after the currency crisis and stock market crash. Among other things, an independent central bank, control of the banking and financial system, and reduction of the budget deficit were established. Erdogan’s team initially took over this course, and within a few years, inflation, initially reaching 50%, fell to the single digits. However, the following years marked a departure from this course, and adopted a new interest in policy.

Is Erdogan’s Monetary Policy Fueling High Inflation in Turkey?

According to some experts, the unconventional economy and high inflation result from Erdogan’s unconventional approach to monetary policy. It is about regulating interest rates to depress prices. In Turkey, the Central Bank is acting on the president’s advice and has consistently lowered interest rates rather than raising them as the conventional approach would have predicted. This monetary policy in Turkey was supposed to fuel the country’s development, but the opposite is true. As a result, interest rate cuts from over 18% to over 8.5% today brought the aforementioned inflation record of 85.3% in October 2022.

Turkey’s Economic Landscape 2023: The Currency

The Turkish lira also collapsed. Its value against the US dollar (USDTRY) fell by over 80% over 5 years. Two years ago, one dollar bought eight Turkish liras; today, it buys 18. Let’s add that the Turkish central bank spent tens of billions of dollars to keep the Turkish currency alive. Why is it so important?

The economy is one of the most important electoral topics in Turkey. A possible change in the ruling team would be a change of course towards Europe, which is Turkey’s most important trading partner. It is also necessary to optimize interest rates to over 30%, i.e., 4 times higher than today, and to accept the recession. And this is all happening at a time when Turkey must spend money rebuilding the city that the recent earthquake destroyed.