In this article, I have prepared a list of the TOP 5 Asia stocks to trade on SimpleFX. These stocks have demonstrated strong performance in the last year and have shown solid fundamentals and positive growth in the years ahead.

Table of contents:

More and more investors and traders looking to diversify their portfolios are finding Asian stocks the way to go. Many Asian countries have implemented pro-business policies and have lower labor costs, making it easier and more cost-effective for local companies to operate and expand. If you are considering expanding your portfolio with some Asian Tigers, here are our tips for the TOP 5 Asia stocks to trade on SimpleFX.

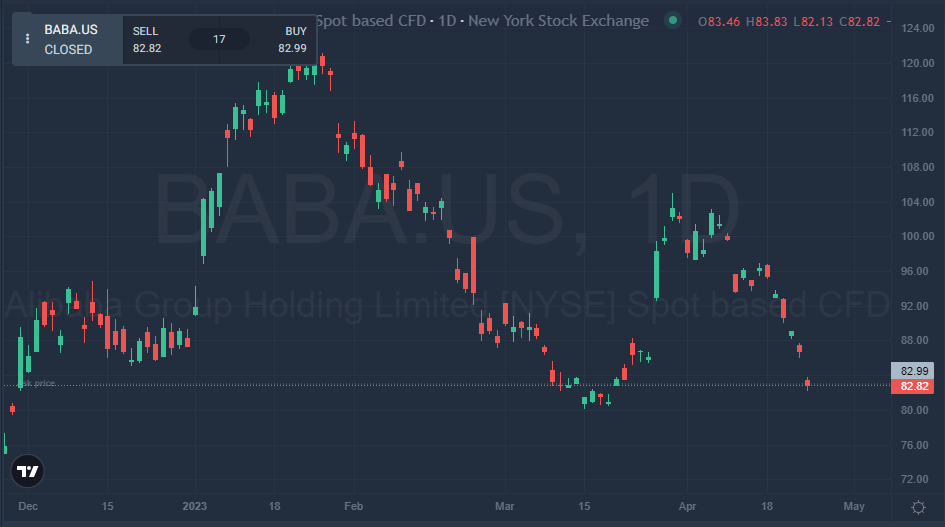

1. Alibaba Group Holding Limited (BABA)

The Alibaba Group is going through significant changes. Following its biggest reconstruction yet, the company is planning on splitting into six units:

- Cloud Intelligence Group

- Taobao Tmall Commerce Group

- Local Services Group

- Cainiao Smart Logistics Group

- Global Digital Commerce Group

- Digital Media and Entertainment Group

Chinese Tech Giant Developing Its Own AI Chatbot

More importantly, the Chinese tech giant has set its sights on developing its own artificial intelligence (AI) ChatGPT-style product called Tongyi Qianwen. BABA stock went up 14% on March 28 following the reports of separation into six subgroups. The news follows Baidu’s (BIDU) AI chatbot launch last month.

2. Baidu, Inc. (BIDU)

Baidu is a Chinese technology company that specializes in Internet-related services and products. It is often referred to as the “Google of China” because it dominates the Chinese internet search market. Baidu was founded in 2000 by Robin Li and Eric Xu, and its headquarters are in Beijing, China.

- Baidu Search: This is China’s flagship product and the most popular search engine. It allows users to search for web pages, images, news, videos, and more.

- Baidu Maps: This is a mapping service that provides users with accurate and detailed maps of China, including street maps, satellite imagery, and real-time traffic information.

- Baidu Baike: This online encyclopedia allows users to create and edit articles on various topics.

- Baidu Tieba: This is an online forum where users can discuss a wide range of topics, including entertainment, sports, and current events.

- Baidu Cloud: This cloud storage service allows users to store and share files online.

- Baidu Wallet: This mobile payment platform allows users to pay for goods and services using their mobile devices.

Baidu Joins the Race to Develop AI-Powered Solutions

Recently, Baidu has also launched the AI cloud, strengthening its position as a Chinese tech leader. The technology is based on Baidu Brain 6.0. Baidu promotes it as a complete AI solution for improving products and services.

It’s important to remember that investing in Chinese stocks also comes with certain risks and challenges, such as political instability, regulatory risks, and lack of transparency. As with any investment, it’s important to do your own research and seek professional financial advice before making any investment decisions.

Read also: How to Start Trading Stocks: A Quick Starter’s Guide

3. Sony Group Corporation (SONY)

Sony’s recent stock performance can be considered positive, reflecting the company’s success in key markets such as gaming and its ongoing efforts to adapt to changing industry trends.

While there are still challenges facing the company, including increased competition from rivals and the ongoing impact of the COVID-19 pandemic, Sony’s strong brand and solid financial position suggest that it is well-positioned to continue delivering strong results in the years ahead.

Read also: How To Build a Stock Trading Strategy?

Sony Shows Strong Recovery Despite Chip Shortages from Pandemic

Like many other companies that base their business on gaming, Sony has suffered losses and delays due to chip shortages during the recent pandemic. That said, it does appear that the worst has already passed, and Sony has been showing consistent growth for over a year.

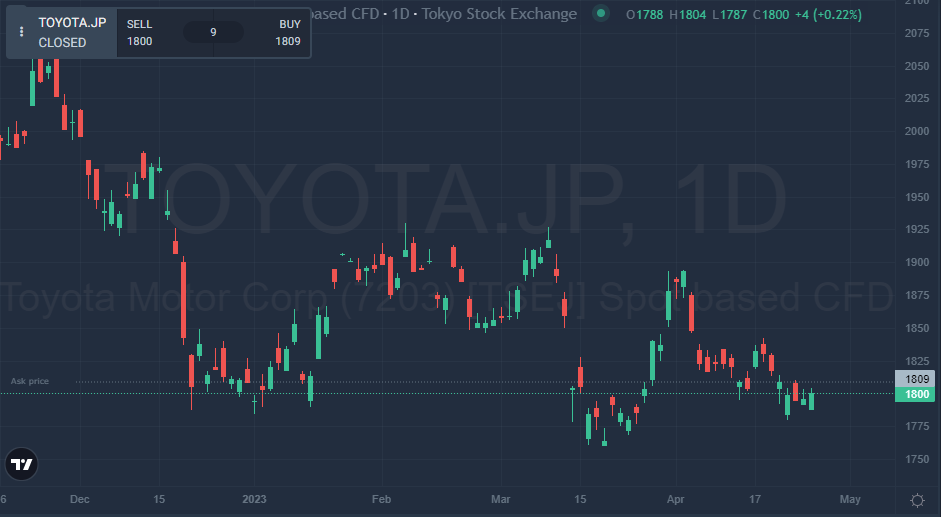

4. Toyota Motor Corporation (TM)

Like many companies, Toyota’s stock price was heavily impacted by the COVID-19 pandemic in 2020. In the early months of the pandemic, global supply chain disruptions and factory shutdowns led to a decline in production and sales for many automakers, including Toyota.

This resulted in a significant drop in the company’s stock price, as investors worried about the long-term impact of the pandemic on the automotive industry.

However, as the global economy began to recover in the latter half of 2020, Toyota’s fortunes improved. The company was able to ramp up production and sales, thanks in part to strong demand for its popular SUVs and pickup trucks.

Toyota’s Stock Price Soars After Investing in Hybrid and Electric Vehicles

In addition, Toyota’s investments in hybrid and electric vehicles helped to position the company for future growth as consumers increasingly look for more environmentally friendly transportation options.

As a result of these factors, Toyota’s stock price rebounded in the latter half of 2020 and has continued to perform well in 2021.

Read also: How to Trade Stocks with Little Money Using SimpleFX

As of today, Toyota is looking good. It has ambitious plans for its EV program, as it plans to launch 70 new electric models globally by 2025, including 15 new battery electric vehicles (BEVs).

Moreover, the company aims to have 100% of its global sales be electrified vehicles, including hybrid electric, plug-in hybrid electric, battery electric, and fuel cell electric vehicles, by 2050, ensuring a smooth transfer towards the new era of car transportation.

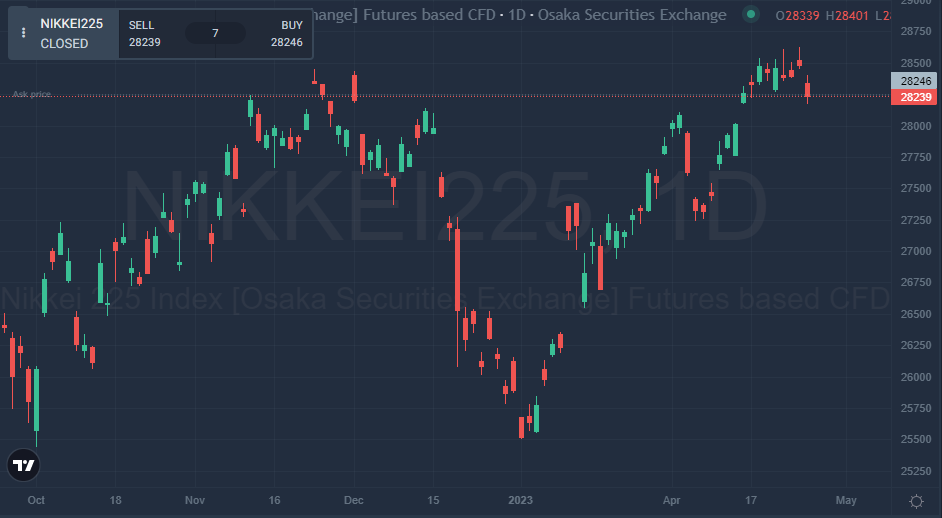

5. Nikkei 225

Nikkei 225 is a stock market index that tracks the performance of 225 large publicly traded companies listed on the Tokyo Stock Exchange in Japan. The index is calculated by Nikkei Inc., a Japanese media company, and is considered one of Japan and Asia’s most important stock indices.

Although you can’t buy Nikkei 225 directly, you can trade it through an ETF (Exchange-Traded Fund)

Taking a Closer Look at the Reliability of the Nikkei 225 Index

Nikkei 225 is often used as a benchmark for the overall performance of the Japanese stock market and is closely watched by investors and financial analysts around the world. The companies included in the index represent a wide range of industries, including technology, automotive, financial services, and retail.

Nikkei has been showing consistent performance and is a comparatively safe stock to consider.

In conclusion, the TOP 5 Asia stocks to trade on SimpleFX have demonstrated strong performance in the last year, solid fundamentals, and positive growth in the years ahead. These stocks can provide good investment opportunities if you want to diversify your portfolio.