Bank failures in Europe and US trigger drop in crude oil prices. Investors have become concerned about the state of the global economy, which has caused a drop in prices. Despite this, the demand from China continues to grow, and Goldman Sachs has forecast Brent to hit $97 a barrel in the second quarter of 2024.

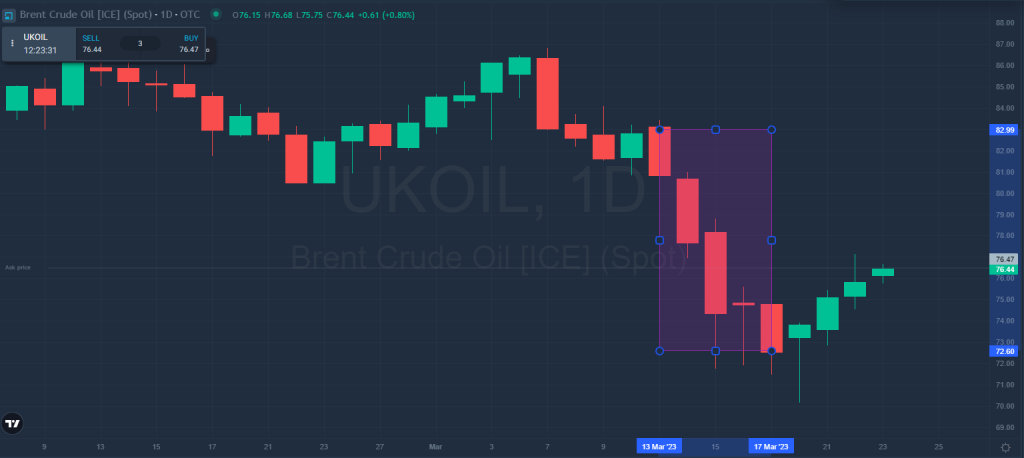

UKOIL Hits Lowest Price Since December 2021

One of the consequences of the recent bank failures in Europe and the US is cheaper fuel. Brent crude (UKOIL) fell from USD 82 to USD 72 per barrel last week and fell by USD 8 per barrel (-9%) in March. On Monday, March 20, the price of UKOIL was the lowest since December 2021 and amounted to. The prices of fuel products also fell, including gasoline, which fell by 8% over the last week. WTI crude (USOIL), on the other hand, fell from $77 to $67 last week, only to recover slightly this week. On Thursday, March 23, USOIL traded at $70 a barrel. There are three main reasons for these declines, and banking is first.

Bank Failures in Europe and US Trigger Drop in Crude Oil Prices

Both WTI and Brent posted slight gains today after their recent declines. Analysts saw fears of a recession in this, reinforced by the collapse of Silicon Valley Bank and the troubles of the Swiss Credit Suisse. This causes a lot of nervousness in the oil market. Hence the clear declines of US and UK OIL on the stock exchanges. Investors began to worry about the state of the global economy after the recent turmoil in the banking sector. They fear aUKOI slowdown in economic growth and lower fuel demand.

Weaker US Currency & Higher Inventories Lower Oil Price

Second, the US Dollar fell to a seven-week low against other currencies. On Thursday, EURUSD reached 1.086 – the level last seen in early February 2023. The US currency thus secured a minimum oil price, as the weaker dollar makes it cheaper for holders of other currencies.

In addition, according to the latest Energy Information Administration (EIA) data, U.S. crude oil inventories rose to 481.2 million barrels (+1.1 million barrels) last week. This is the highest level in almost two years. This also causes a drop in the price of a Brent or WTO crude barrel.

GS Bank Predicts Brent Crude to Reach $97 a Barrel by 2024

Is there anything positive for investors betting on the bull market? Yes, these are optimistic demand figures from China. On Thursday, Goldman Sachs bank officials said that demand from China, the world’s largest oil importer, continues to grow after the relaxation of the Zero-COVID policy and exceeds 16 million barrels a day. GS Bank also forecasts Brent to hit $97 a barrel in the second quarter of 2024.