In recent years, cryptocurrencies have become a serious competitor for traditional sources of investment, such as deposits, gold, securities, or even real estate. However, only some know what they are and how they work. In this beginner’s guide, we’ll answer the question “What are cryptocurrencies?”. I will also try to give you everything you need to know.

Table of contents:

Cryptocurrencies – What Are These Assets?

A cryptocurrency is a digital or virtual currency that uses cryptography for security. Cryptography is the practice of secure communication in the presence of third parties. Cryptocurrencies are based on complex mathematical algorithms to make safe, decentralized systems that don’t need banks or governments to handle transactions. They can also serve as a way to make payments without going through people, companies, or other third parties. They also involve encoded money, which makes it possible to stay as anonymous as possible.

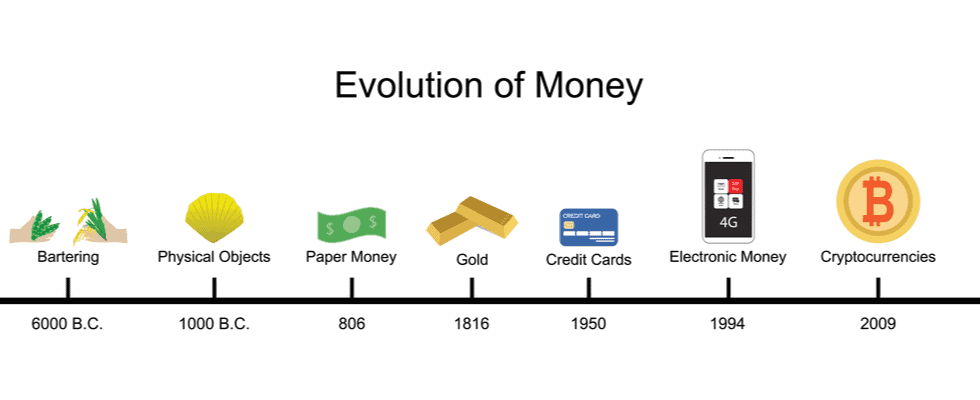

Where Did Cryptocurrencies Come From?

In 2009, an unidentified person or group using the alias Satoshi Nakamoto created the first cryptocurrency, Bitcoin. It went public on October 5, 2009, and cost $0.063. For comparison, at the peak of the Bitcoin boom, this king of cryptocurrencies cost over USD 63,000! Just imagine this situation. For $1 in 2009, you bought 1309 Bitcoins. 11 years later, you could sell it for over… $82 million.

Since then, we have witnessed the creation of many other cryptos with different features and purposes. Crypto adoption is getting higher and higher every year.

Cryptocurrencies aim to create a digital money system that no government or financial institution can control. This means that users can make transactions directly between individuals without intermediaries.

How Do Cryptocurrencies Work? Blockchain And Mining

Blockchain

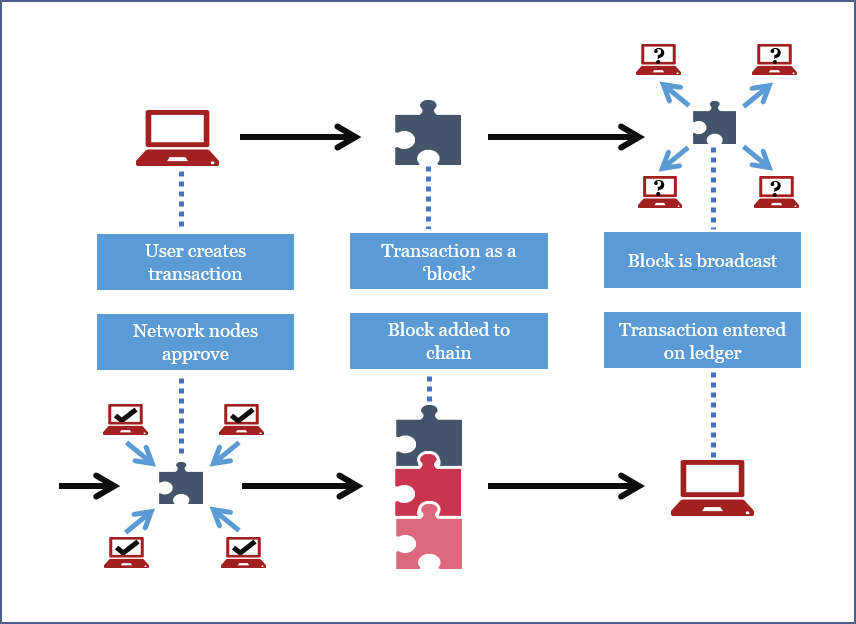

Cryptocurrencies use blockchain technology, a decentralized ledger that records all transactions made with the cryptocurrency. Each block in the chain contains a hash of the previous block, making the entire chain tamper-proof and secure.

- When someone makes a transaction with a cryptocurrency, a network of users called nodes verifies the transaction.

- Once the transaction is verified, nodes add it to the blockchain.

- The user’s account is credited with the appropriate amount of cryptocurrency.

Let’s use a metaphor. Imagine the wagons of a freight train. You can pack a certain amount of goods into each wagon; here is information about transactions on a given cryptocurrency. When the car is full, miner adds another block connected to the previous one, like the cars of a train. Hence the name “blockchain,” i.e., a chain of blocks.

That is mainly why there is no “master” computer in cryptocurrencies. The data is spread across millions of computers around the world. Each of them stores the same data.

Crypto Mining

What is cryptocurrency mining? What is a crypto miner? Well, a “miner” is simply a person (or a group of people) who provides the computing power of their computers for the needs of cryptocurrencies.

These computers must be specially adapted for this. First, they must be able to perform complex calculations or store fractional data on disks. For this, the miner collects his carbon allowance – he or she receives it in cryptocurrency. Such equipment must also have the right components. I mean very efficient and currently damn expensive. Crypto digging also consumes a lot of electricity, for which the digger must pay, and in addition, such an “excavator” must have an appropriate cooling system.

Oh, by the way – if you’re still wondering where cryptocurrencies come from, this is where they come from. Users mine them. I should also mention that some cryptocurrencies (e.g., Bitcoin) have a pre-imposed maximum amount of a given currency in circulation. If users mine a given cryptocurrency to the end, there will be no more of it. This allows you to preserve the value of the cryptocurrency. Limited supply keeps its price at a relatively high level

What Are Stablecoins?

Stablecoin is nothing more than a type of cryptocurrency, and more specifically, a payment token, the value of which is permanently linked to the value of a specific traditional fiat currency (usually the US dollar, less often the euro) or other goods, e.g., gold (XAUUSD), silver (XAGUSD) or crude oil (USOIL). We can characterize stablecoins by low exchange rate volatility – like paper currency, USD, or EUR. In the last 3 years, stablecoins have become a kind of digital deposit where investors hold their funds on the cryptos exchanges.

Stablecoins are considered less volatile than other cryptocurrencies and trading assets for investors and traders looking for a reliable store of value. A huge benefit of stablecoins is their speed and efficiency. Transactions can be handled quickly and for less money than traditional financial systems. This makes them an attractive option for businesses and individuals who need to make fast and secure transactions.

Dude! Check out those mountains#bitcoin #btc #bitcoinprice #crypto pic.twitter.com/REyOdKD44a

— The Cryptomath (@TheCryptomath) November 30, 2018

Read also: How To Diversify and Reduce Risk in a Crypto Portfolio

TOP3 Cryptocurrencies Worldwide:

Bitcoin (BTC)

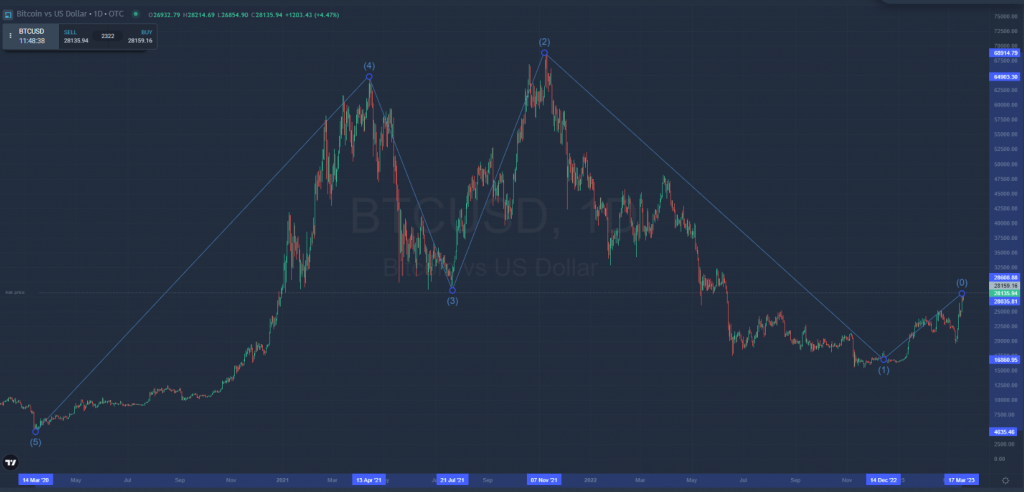

- BTC Price: 28 200 USD (as of March 20th, 2023)

- Blockchain technology underpins the decentralized peer-to-peer network on which Bitcoin is based. It uses a cryptographic hash algorithm (SHA-256) to secure and verify transactions.

- Key Points in History: In 2009, Bitcoin became the first decentralized cryptocurrency. In December 2017, its price surged to an all-time high of nearly $20,000; In 2018, it dropped to a low of around $3,200.

Ethereum (ETH)

- ETC Price: 1 804, USD (as of March 20th, 2023)

- Technology: Ethereum is a decentralized platform that runs smart contracts. Based on a modified version of the Bitcoin protocol, its blockchain powers it. It also uses a cryptographic hash algorithm (SHA-256) to secure and verify transactions.

- Key Points in History: In 2015, Ethereum was launched. In 2017, its price skyrocketed to around $1,400. Since then, it has seen a gradual price decline but has remained relatively stable.

Litecoin (LTC)

- LTC Price: 84,23 USD (as of March 20th, 2023)

- Technology: Litecoin is a decentralized cryptocurrency built on Bitcoin’s open-source code. It uses the Scrypt hashing algorithm to secure and verify transactions.

- Key Points in History: In 2011, Litecoin was launched as an alternative to Bitcoin. Its price has remained relatively stable, with a few peaks and dips. In 2017, it reached an all-time high of around $370.

Read also: How To Create a Cryptocurrency Trading Plan?

The Risk Of Investing In Cryptocurrencies

Cryptocurrencies have their benefits and drawbacks, so it’s important to research and carefully consider your options before investing.

Drawbacks of Cryptocurrencies:

-

- Volatility: Cryptocurrencies can be highly volatile, fluctuating wildly over short periods.

- Limited acceptance: Although cryptocurrencies are becoming more widely accepted, all merchants and businesses must still accept them.

- Risk of loss: If a user loses their private key, they can lose all their cryptocurrency holdings, and there is no way to recover them.

The Profit Potential Of Crypto Trading

- In 2025, the cryptocurrency market’s total capitalization was estimated at over $2.5 trillion.

- By 2027, the number of cryptocurrency users worldwide was projected to reach over 200 million.

- In 2029, the number of institutional investors holding digital assets was expected to exceed 50%.

- By 2032, it was estimated that over half of the world’s population would have access to a cryptocurrency wallet.

- By 2033, the value of digital assets held by banks and other financial institutions is expected to reach $20 trillion.

- In 2035, the number of companies accepting cryptocurrency payments was estimated to be over 5,000.

- By 2038, the cryptocurrency market capitalization was forecasted to exceed $50 trillion.

- In 2040, the number of active cryptocurrency traders was predicted to reach 400 million.

Read also: How to Trade Crypto Using On-Chain Analysis

Cryptocurrencies As An Investment

The popularity of cryptocurrencies has rallied since Bitcoin’s launch in 2009. These digital assets have proven to be lucrative intangible assets for many. Trading cryptocurrencies involves buying and selling them quickly to take advantage of price fluctuations. This more active form of investing requires more time and effort. However, that brings a big risk, too, so it is important to be familiar with all the crypto pros and cons:

Crypto pros:

- Potential for high returns: One of the biggest draws of cryptocurrencies is their potential for high returns. Cryptocurrencies experienced massive price increases over short periods. For example, Bitcoin’s price increased from $900 in January 2017 to almost $20,000 in December. This means that those who invested in Bitcoin early on saw massive returns.

- Diversification: Investing in cryptocurrencies can help you diversify your portfolio. Cryptocurrencies do not correlate with traditional assets like stocks and bonds. They can act as a hedge against market downturns. Even if your traditional investments perform poorly, cryptocurrency investments may still be profitable.

- Accessibility: Cryptocurrencies are accessible to everyone, regardless of location or financial status. You only need an internet connection and a digital wallet to invest in cryptocurrencies.

- Transparency: Cryptocurrencies are transparent, meaning their transaction records are public and can be viewed by anyone. This makes it difficult for fraudsters to manipulate the system, which makes cryptocurrencies more trustworthy.

- Security: Cryptocurrencies are secured using cryptography, meaning they are almost impossible to counterfeit. This makes them a secure investment option, as the risk of fraud and hacking is significantly lower than that of traditional assets.

Crypto cons:

- Volatility: Cryptocurrencies are known for their volatility, meaning their prices fluctuate rapidly over short periods. Investing in cryptocurrencies can be risky, as you may lose significant money if the market suddenly turns against you.

- Regulation: Cryptocurrencies are largely unregulated, so government agencies like the FDIC do not protect them. This means that if something goes wrong, investors may have no recourse.

- Hacking: Although cryptocurrencies are secure, they are not completely immune to hacking. Hackers hacked cryptocurrency exchanges several times, resulting in the loss of millions of dollars.

What Are Cryptocurrencies – A Conclusion

Cryptocurrencies have revolutionized the financial industry and are here to stay. As the digital currency continues gaining traction and becoming more widely accepted, its future looks promising. Cryptocurrencies offer a secure and global way to send and receive money with low transaction fees. The technology behind cryptocurrencies is also developing rapidly, and new applications are being created daily, making it an exciting asset to watch. With their potential for growth and many uses, cryptocurrencies will surely be a major player in the future of finance.