This week, several well-known companies will release earnings reports with important updates on the housing market and inflation. Additionally, the Federal Reserve will release meeting minutes from their most recent meeting. With so much going on, traders must consider the various assets’ prices. So let’s check TOP3 investing opportunities this week (February 20–24).

Earnings, FOMC, PCE Price Index, Housing Data

This trading week will be shorter because the US stock markets will be closed on Monday. Several well-known companies, such as Walmart, Home Depot, Nvidia, Alibaba, Coinbase, and Moderna, will share their earnings reports during this time.

In January, there will also be updates on the housing market, specifically new and existing home sales. The Federal Reserve will release meeting minutes from the latest FOMC meeting on Wednesday. Last, the Personal Consumption Expenditures (PCE) Price Index, which is how the Fed measures inflation, will give us an important update on Friday.

The expected numbers show that sales of already-owned homes will rise slightly, from 4.02 million units in December to 4.1 million units in January. This increase marked the first rise in sales since January of last year, when they totaled 6.49 million. Here are some assets you should consider trading:

DAX40

The Dax 40 is going up and down due to worries about interest rate increases. The price previously tried to go higher than 15650 but couldn’t, making two high points and dropping below 15380.

However, the Dax 40 bounced back up from 15300, close to the low point of 15250 on the 30-day SMA (which means a Simple Moving Average). This suggests that there is enough power to keep the short-term increase going. If the Dax 40 goes back above 15650, that would stop the selling and start the increase again. But if it goes down instead, it could cause a correction to the previous range of numbers above 15,000.

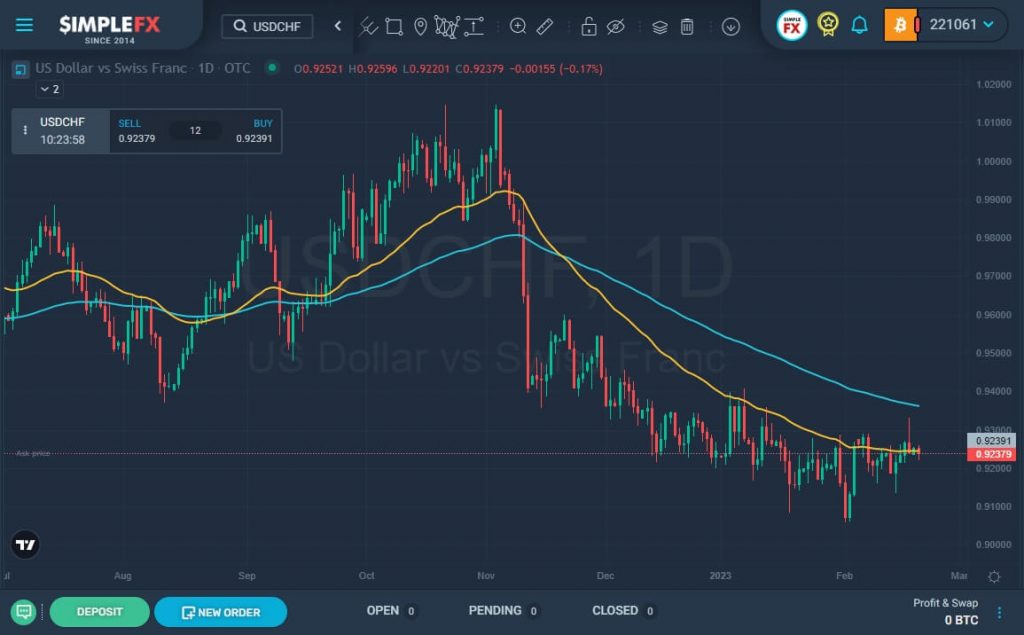

USDCHF

The USDCHF pair recently hit the target of 0.9316 and tested a support level called the EMA50. At the same time, a technical indicator called stochastic is showing positive signals. All these things suggest that the price will go up. The following targets are 0.9400 and 0.9475; if the price falls below 0.9220, the expected rise will stop and decrease. Today, we expect the price to trade between 0.9190 as a support level and 0.9330 as a resistance level.

AUDUSD

The AUDUSD pair recently came close to our target of 0.7680 and then reached a fundamental resistance level of 0.6925. The EMA50 also meets this resistance, which makes it even stronger and increases the chances that the price will start going down again. This is part of a more significant trend on the chart that appears as a downward channel.

The stochastic indicator shows that the positive momentum is decreasing, which adds to the expectation of a price decline. However, if the price breaks above 0.6925 and 0.6975, the expected downward trend will stop, and the price will increase again.

Today, we expect the price to trade between 0.6810 as a support level and 0.6925 as a resistance level.

TOP3 Investing Options This Week (February 20–24). A Take-Home Message

DAX40, USDCHF, and AUDUSD are the symbols to watch this week. These three currencies are expected to show strong movements due to pending economic news and reports from major retailers, tech companies, and pharmaceuticals. The Dax 40 will move back above 15650, while the USDCHF and AUDUSD will likely test their respective resistance levels.

SimpleFX traders can look forward to dozens of market opportunities this week as major retailers, tech companies, and pharmaceuticals report their earnings. If you still need to fund your account, now is the time to prepare for a week of trading action.