As we enter the new year, we can’t help but feel excited about the opportunities that await us in the markets. It is an exciting time to be a trader, and we can’t wait to see what the markets have in store for us. What assets will be the best deals to trade this week? Here are this week’s trading opportunities to consider.

S&P 500 Sees Gains in November as Investors Gain Confidence in Lower Fed Rate Increase

The major indexes mainly finished down after two weeks of slow holiday trading. Still, the S&P 500 Index exceeded its intraday low from the previous week. The S&P 500 saw gains for the second month in November as investors grew more confident that the Federal Reserve would raise interest rates by a lower amount in December.

The benchmark US index increased by 5.4% in the month. The last session saw a 3.1% increase thanks to some incredibly dovish remarks from Fed Chair Jerome Powell.

Still, the S&P 500 is trading 20% below where it was a year ago, which signifies that bargain hunters are likely to return next week now that tax-loss harvesting season is over.

Stay Informed: Must-Know Data Releases for the Week Ahead

On Tuesday, January 3, we’ll get to know the US Construction Spending for November. This analysis can forecast future housing and commodity activity, indicating an expanding economy.

On Wednesday, January 4, it’s time for the US ISM Manufacturing Index for December. A rising value is typically seen as good for stocks since it suggests that manufacturing sector earnings are rising.

Finally, on Friday, January 6, the Bureau of Labor Statistics will release the Monthly Employment Situation for December. This critical report pack includes Non-farm Payrolls and Labor Force Participation Rates.

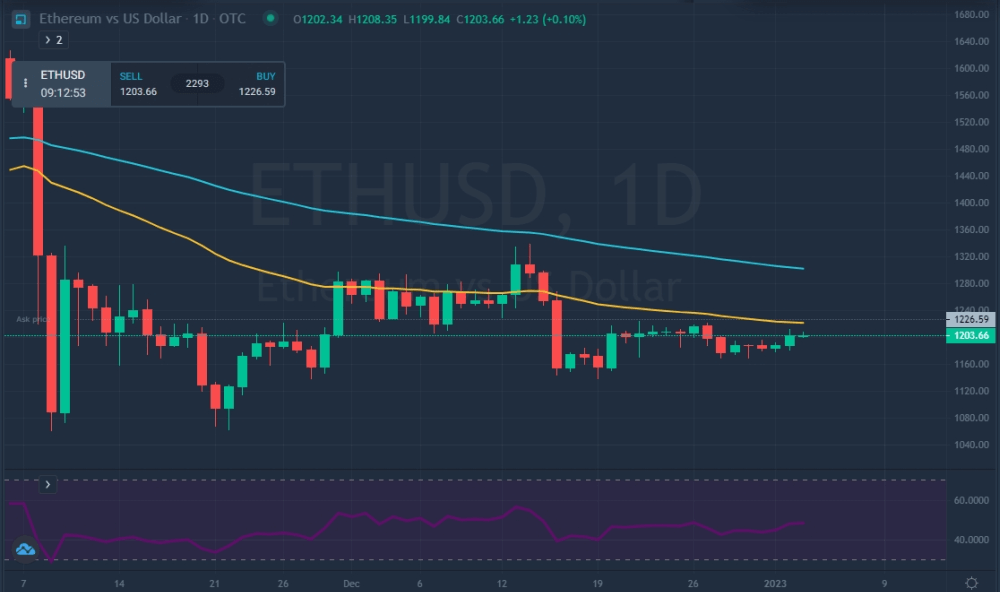

ETHUSD

Will 2023 be the year of Ethereum? It’s not impossible. The network started the long-awaited Merge in 2022, starting the proof-of-stake consensus algorithm. The blockchain’s energy utilization decreased by 98% when validators were utilized in place of miners.

A hundred days after the merger, ETH is only worth $1,218. The network now has over 490,000 validators; by 2022, that number is only expected to rise.

XAGUSD

The year 2022 has undoubtedly increased market players’ confidence concerning gold and silver. Market players will also be adversely impacted by slower global economic growth, the ongoing conflict between Russia and Ukraine, concerns about inflation, and the ongoing health crisis in China due to COVID-19.

Weekly, XAGUSD has been strongly trending since mid-October, going up from $18 to $24.4 per ounce. We will likely see a solid run on the precious metals. Margin traders often opt for silver due to its higher potential for appreciation due to its volatile nature.

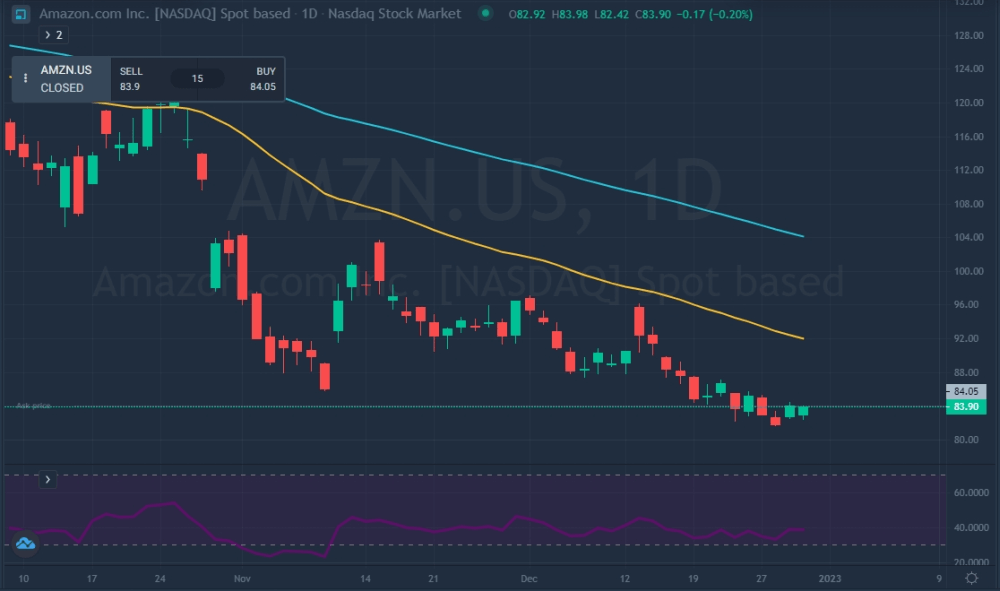

Amazon

Despite continued fast revenue growth, Amazon’s shares fell by nearly 50% in 2022. Amazon is one of the few growth companies that are already profitable. It can use its resources to overcome the capital market difficulties that many growth companies without profits may face in the years to come.

Although we have yet to determine where the market will be next week, next month, or at the end of 2023, we can expect Amazon and a few other leaders in the growth stock space to trade significantly higher in the long run.

Amazon has been trending down, and $83 per share may be a bargain if the bottom is near.

This Week’s Trading Opportunities. Is 2023 The Year to Make Strategic Trades?

Looking ahead to 2023, we must remember that market conditions can change quickly and unexpectedly. However, many analysts believe that we may be approaching a market bottom. If this is the case, it could present a unique opportunity for traders to get in on the ground floor of the next market upswing.

Of course, it’s always important to research and make informed decisions. Still, it’s worth keeping an eye on market trends and considering whether now might be a good time to make strategic trades, such as a cryptocurrency trading plan. We hope you have a successful and profitable year, regardless of what the markets have in store for us.