Investing in energy stocks offers an excellent opportunity to make huge profits in the current market. If there is one sector that has the most significant impact on the global economy, it is the energy sector. As an investor, staying updated on how this sector is performing is important. It can help you determine its direct impact on several other stocks.

I recently highlighted the 8 most undervalued stocks available on SimpleFX. Today I want to focus on energy companies worth taking to the workshop in the new trading year.

While most companies are going upward, some are showing incredible potential and have done so during this year. With economies and countries reopening fully after the Covid shutdowns, people are looking for both conventional and renewable energy sources. We share some of the best energy stocks you can trade on SimpleFX and join the winning group.

1. Shell (SHEL.UK)

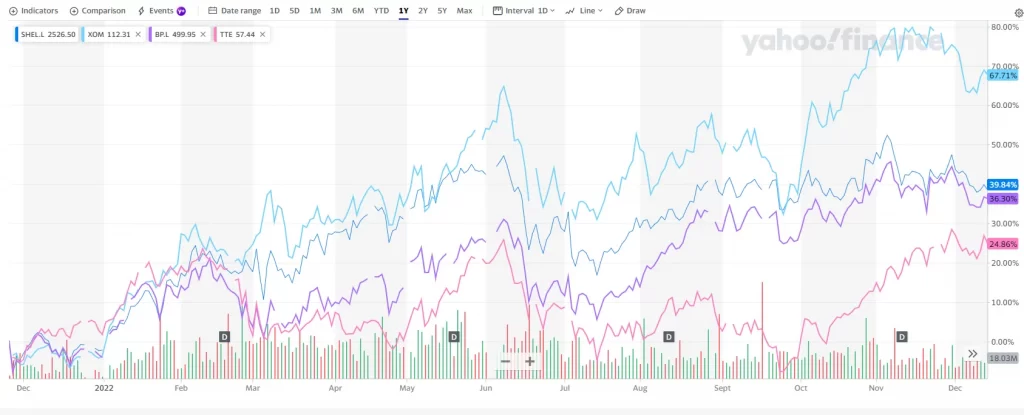

Shell has shown an incredible level of performance during 2022, and analysts think this trend is expected to continue shortly. Starting the year around 1,500p in value, the company experienced a steady increase in share value. It was mainly due to the strategic steps taken by its European establishments, especially the entity in the Netherlands.

A huge surprise that helped the company affect public perspective directly in a positive way was its decision to work more on renewable energy projects and decrease some of its spending on oil and gas exploration and sales. The positive response is visible in the company’s share value history for 2022.

Many analysts provide a strong buy rating for the stock, with forecasts showing a possible high value of as much as 3,500p. Even with a low rating of 2,360p and an average price target of 2,915p, it is a highly desirable option for anyone exploring energy sector stocks.

Trade Shell

2. Exxon Mobil (XOM.US)

Exxon Mobil has led the American oil and gas industry for a long time, and the breadth of operations covers everything from chemical, upstream, and downstream. The company recently posted incredible share earnings for the third quarter, with $4.45 being earned per share and revenue of $112.1 billion. Even though the revenue was slightly below Wall Street estimates, the revenue income exceeded the estimated value of $3.88 per share. It is also worth noting that, compared to Q3 previous year, this Q3 had a 51.9% increase in revenue.

Speaking of the stock price, it has seen a dip in the last month and a half. It is primarily because of the enormous investments the company has made in long-term projects for energy production. The decreased cash flow might concern traders, but they are banked on the oil prices and see an increase in the future. With the possibility of such an event being considered authentic by many analysts, it could be a great time to get your hands on XOM stock and enjoy the upcoming rise when oil prices increase.

Trade Exxon Mobil

3. TotalEnergies SE (TTE.FR)

Being the most significant energy company currently operating in France, TotalEnergies SE has been getting a decent buy push from analysts at the end of the year. The upward trajectory that the company has shown since September is expected to continue into the following year. The experts also expect it to provide a great investment opportunity.

It is especially true given the dip in price that it saw during Q3 before picking up the pace again at the beginning of Q4. What is especially worth noting here is the latest shift in the company’s focus. It could have a long-term impact on its presence and value.

TotalEnergies SE

The company announced last year that it would focus more on the renewable energy segment. Let’s mention that the company has already made significant investments to focus more on gas and renewable energy.

Changing its name from TotalEnergies and adding the SE at the end was also a part of its rebranding effort. As for the earnings estimates, the forecast shows a range of $3.04 to $4.30 per share. Moreover, the last quarter’s $3.83 also put more hope for actual earnings at the higher end of that range.

4. BP PLC (BP.UK)

BP’s primary business has been oil and gas since it found oil in Iran in 1909. Even though the company continues to earn most of its income from the hydrocarbon market and is doing so quite well, it is also currently working on a significant shift in strategy. Given the importance of renewable energy to the company’s stock price, the company is looking to make significant investments in that sector. Not only that, but the company has also set a goal for itself to become a net-zero carbon producer by the year 2050.

For the most part, the company’s share value has seen an upward trajectory during the last quarter of 2022. Analysts are optimistic about its performance in the coming period, and the expected high price for shares is around $700. The low end of the forecast range is 490 p, with an average of 578.92 p.

The average value shows an increase of 25% from the last price, which was recorded at 462.70 p. The per-share earnings during Q3 were 0.35 p, which beat the estimates by 100%. It also means it outperformed competitors in terms of EPS estimates. The forecast for the next quarter sits at 0.22p to 0.37p.

Trade BP PLC

Top 4 Energy Stocks: A Take-Home Message

The energy stocks mentioned here provide an excellent opportunity to enter the energy market at a good time using a stable stock with high-performance expectations. Of course, how it would turn out would be anybody’s guess. However, with analysts’ strong buy ratings for all these stocks, there is a lot of assurance to enjoy. With SimpleFX, you can easily buy any of these stocks seamlessly and become a profitable investor in the energy sector.