Even though the volatile crypto market is part and parcel of all financial markets, there is no hiding that the trading cryptos is in a different ballpark. Some traders are scared away by the extreme ups & downs, while others view them as opportunities. Whether you’re scared or not, this article will help you understand the basic rules that will help you achieve much better consistency when trading crypto and other assets.

I recently showed you how to trade crypto and get the most out of it. Today it’s time to tackle the aspect that stops many people from investing: the cryptocurrency market’s volatility. Below you will find some of my reflections on how to approach the unpredictability of the crypto market to minimize losses and increase the possibility of earning. So let’s get started.

Table of contents:

1. Inflation: You’re Already Losing Money Every Day

Let’s be real: if you’re not making your money work for you, you’re simply losing it. You probably know some people who decide to hold all their assets in their savings accounts, thinking they’re gaining money yearly.

The same people usually view traders, particularly crypto traders, as reckless. At the same time, these are the same people who lose their hard-earned money daily. Can their 1.25% APY savings accounts make up for double-digit inflation?

On the other hand, a level-headed approach to trading and investing might not make you a millionaire overnight but will help you save yourself from growing inflation.

2. Market Volatility: Good, Bad, or Neither?

Even though there is a lot of fear-mongering surrounding volatility, in reality, it’s neither good nor bad. It just is.

Price fluctuations are a natural phenomenon in the market for various types of assets, not just for cryptocurrencies. As long as these fluctuations are within the limits of widely-approved norms, we generally pay little attention to these changes and treat them as natural, cyclical corrections. The more experienced traders know how these cycles go, so they’re far more comfortable with price changes.

On the other hand, beginner traders are far more prone to make panic purchases and sales, often resulting in needless losses. But more on that soon.

That said, there are periods of increased volatility in the markets, which can introduce anxiety due to the greater deviation of prices from their historical fluctuation ranges. In the end, volatility is best viewed as a neutral, immutable element of all trading. All you can do is accept its existence and learn how to benefit from it the most.

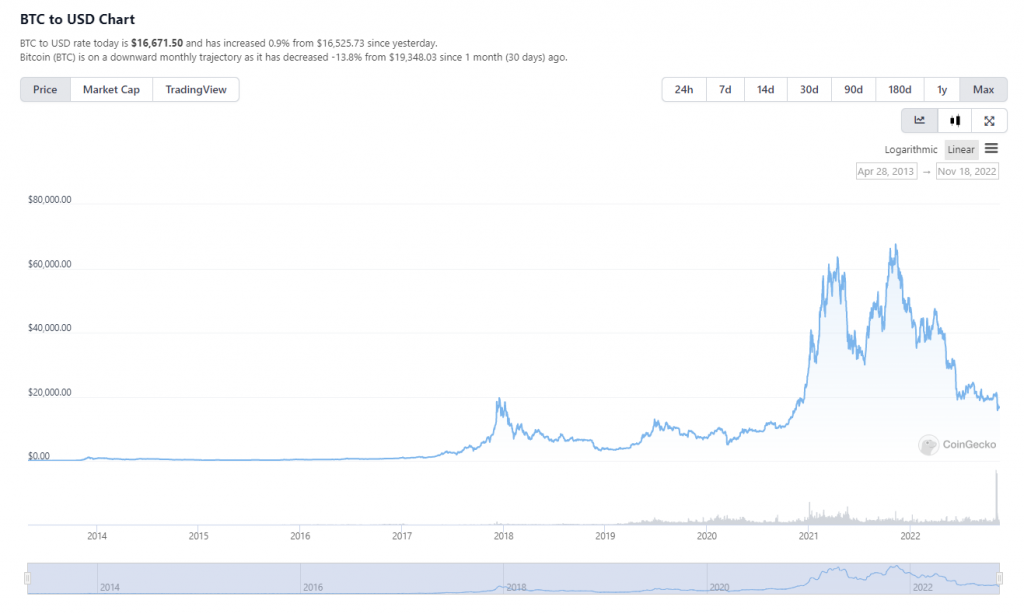

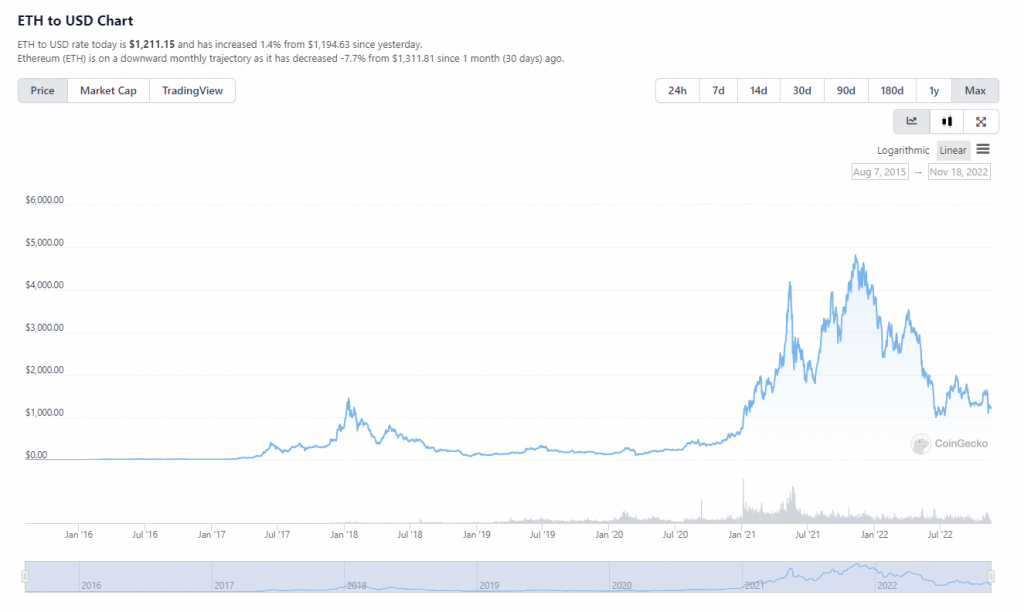

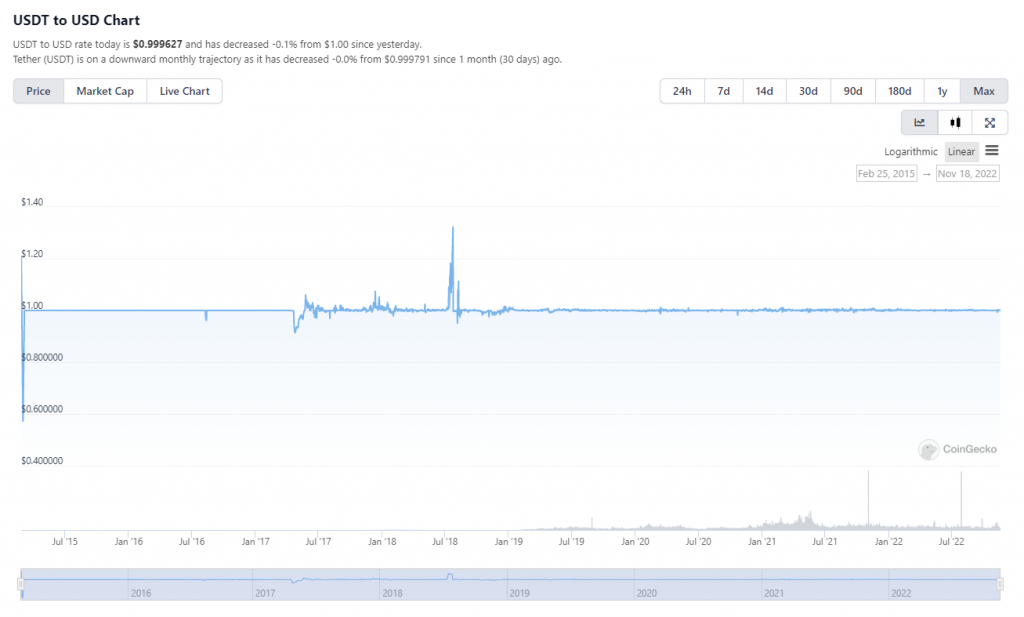

a. Current TOP3 Cryptos: Value Volatility From the Beginning

3. How to Get the Most Out of Crypto Market Volatility?

What differentiates new traders from experienced ones is that experienced traders can take advantage of emerging changes. They have learned to observe global events and understand how they can influence market prices. That way, they can open and close positions accordingly.

Crypto, still a comparatively young market, is more volatile than the better-established ones, like Forex. The crypto market also has lower liquidity than the classic, centralized markets. In most cases, the level of liquidity directly affects the technical analysis data. The more liquid a market is, the more effective technical formations and breakouts can be.

So, how do you benefit from all of this chaos?

a. Prepare a Trading Strategy and Stick To It

A goal without a plan is just a wish. – Antoine de Saint-Exupéry.

You’ve already heard this one. Much of the crypto market’s volatility comes down to the fact that many crypto traders and investors consist of young and inexperienced traders. To many crypto traders, DeFi is the first point of contact with the world of trading. This naturally translates to poorer and more emotional trading and investing decisions. Many crypto traders simply follow fear, greed, and whatever they think is currently in vogue. Most new traders fall victim to scam marketing, investing based on what others tell them rather than following their carefully-devised strategies.

On the other hand, this presents some of the most unique opportunities for those who took the time to learn the basics of trading and have prepared a strategy. A trading strategy allows you to set your entry and exit points beforehand. You already have your budget, which is just a fraction of your assets. For one, you are not too afraid of losing it, making your decisions less emotional. And two, you can make your investments based on data rather than marketing, which allows you to choose the right projects.

b. Diversify and Reduce Risk in Your Crypto Portfolio

To the moon! Right? Guys? Where did everybody go? – your average beginner crypto trader

Diversification is one of those things you wish you’d known about earlier. Folks making their first steps in trading usually fall victim to marketing and hype. And that’s completely understandable.

- In short, diversification can be understood as the number of assets in your portfolio. The idea behind diversification is to put your money into different assets – crypto, stocks, and Forex, ideally from different asset classes. In theory, holding on to a wider variety of assets should reduce risk.

- Since different types of assets are characterized by varying volatility, by trading more than one instrument, you can average out this volatility, thus reducing the level of potential risk. You’re not putting all of your eggs into one basket. And that’s what you should be doing at all times.

- Of course, you should not limit yourself to just crypto. As you grow more comfortable with trading and investing, why not branch out and diversify your portfolio further through other, more traditional assets?

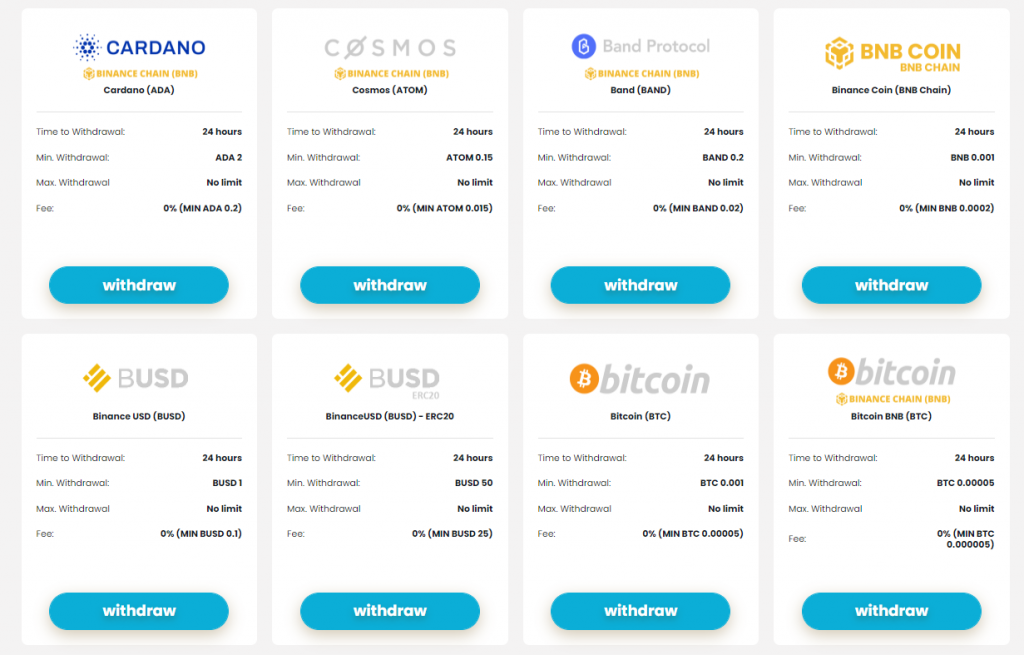

Nowadays, you can trade Crypto along Forex, SPX500, and all the commodities in one app, making diversification easier.

c. Hold On To Your Savings—Don’t Trade It All

As tempting as it might be, using all of your assets for trading crypto is never a good idea. In fact, it differs very little from gambling. And, if you’re trying to benefit from the volatility rather than lose to it, you should avoid making irrational, emotion-driven financial decisions.

When trading or investing in anything, you want savings that you can comfortably return to without fearing for your financial well-being. This is as psychological as it is practical. Owning a certain amount of just-in-case money gives you the comfort of making more level-headed decisions that are not fueled by emotions.

You should establish how much you are willing to lose before you start trading. That way, you will have the comfort necessary for successful trading. Furthermore, I highly recommend trading through a demo account if you are a beginner trader. You can learn to understand the market better without losing money.

4. Volatile Crypto Market. What to Expect?

- Markets are simply the reflection of the outside world. They follow somewhat predictable patterns, trends, and news. Some of the best traders are also great visionaries who understand how the world works at a higher level.

- In a way, financial markets can be seen as animate organisms. Since their ups and downs are determined by the decisions of millions of people, it is safe to say that they are driven by human emotions.

- That’s why as a trader, you need a solid trading strategy that you can return to whenever the unexpected happens. It’s key to closely observe the market and understand the phases of panic selling and greed-driven buying.

- Buying in those moments of panic can be incredibly effective. However, you can’t be too cheeky, as even experienced investors will often face trouble judging the perfect timing of price bottoms. And that is exactly why they diversify and allocate their asset accordingly.

- As mentioned before, if you are a beginner trader, I highly recommend you get the feel of the market using a demo account and only start investing real money once you’ve grasped the basics.