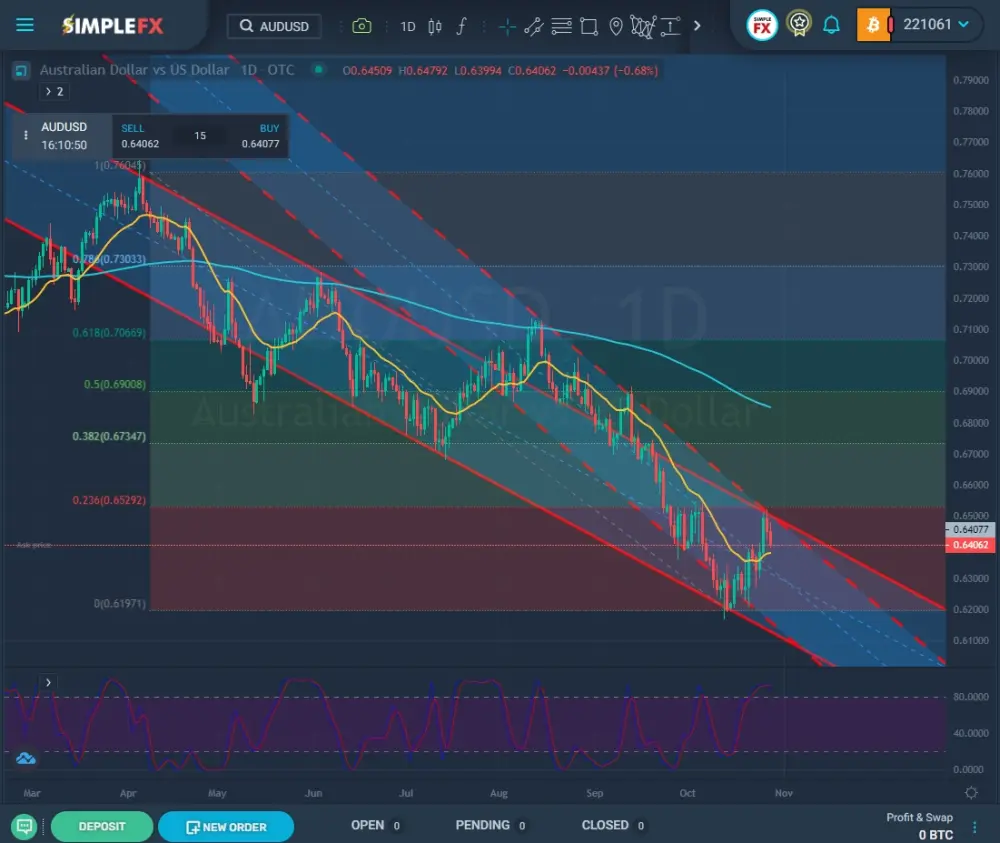

The Australian dollar rallied for almost two weeks. Bearish AUDUSD was trending and went up from $0.617 on October 13 to $0.652 on October 27. A solid technical signal (Fibonacci retracement 0.236 ratios) stopped the run and a substantial drop in iron ore prices. AUD is a currency strongly tied to the price of commodities exported by Australia. Then news broke out that China’s steel export dropped by 20%, and the iron collapsed.

Reserve Bank of Australia’s Impact on Bearish AUDUSD Technical Outlook

On November 4, at 00:30 UTC, the RBA will present its statement on the monetary policy. So far, the Reserve Bank of Australia has been reluctant to significant interest rate hikes. The analysts expect RBA to go for a conservative 25 basis points increase, despite high inflation data.

Such a policy doesn’t help the Australian dollar in the short term, but in the long run, if the country manages to curb inflation without stifling the economy, AUDUSD may benefit in the long run.

A Bearish AUDUSD Technical Outlook. Looking For Long-Term Trends

The long-term bearish AUDUSD channel (red line) was established at the local high on April 4, when the Australian dollar hit $0.766. Since then, the USD has been appreciating globally as governments, corporations, and individual investors have sought a safe haven in times of economic and political turmoil.

The trend accelerated in mid-August then the global sell-off began. Stocks, commodities, crypto, and currencies other than USD collapsed. We market this channel with dotted red lines.

Trading Retracements For The Australian Dollar

We might have seen a trend reversal around October 16. However, we assume we experienced just a retracement for this analysis. The rally ended at the 0.236 Fibonacci level when the AUSDUSD hit $0.652 and has declined for two consecutive days since then.

If the trend continues, we may expect retracement rallies around the $0.62 support. If breached, $0.606 looks like the next level.

Despite the two-day decline, bearish AUDUSD is still trading above the 50-day moving average, which suggests there’s still some room for the price to decline. The stochastic RSI remains above 80, signaling an overbought of assets.

Watch out for prices of iron, coal, natural gas, gold, and aluminum. These are the commodities that Australia exports. If they go up, the AUD benefits; if they fall, the Australian dollar often follows.

Read more:

- Has GBPAUD Found the Bottom? Rebound Possible But Unlikely

- Binance & a16z Collaborate With Musk On Twitter

- How To Start Trading FOREX Within Minutes