The upcoming week will be filled with trading opportunities. Here’s a list of events you should pay attention to and three assets you should add to your watchlist.

On Tuesday at 6:00 UTC, we’ll get to know the UK employment change for June and the unemployment change for July. The data will affect pound sterling forex pairs and UK stocks. The British economy is on the verge of recession, and any harmful data from the labor market could trigger a panic sale of GBP and equities.

Additionally, on Wednesday at 6:00, the UK will release inflation data for August. The inflation rate should stay above 10%, with the forecast consensus at 10.2%.

On Thursday at 1:30 UTC, Australia will release the unemployment and employment rates for august. The economy and the Australian currency are better than in Britain. The country benefits from the growing commodity prices, and the unemployment rate is just 3.4%.

Finally, on Friday at 9:00, we’ll get to know the core inflation rate in the euro area year-to-year for August. The expectations are 4.3%, and you should follow closely if the actual data diverge from the forecast.

Here are three assets we recommend watching closely this week.

GBPUSD

The pound sterling has been in a freefall since August, as the US dollar started outperforming all other currencies and assets. It created a strong rally of almost 2% in five days last week. It’s trading at $1.162 on SimpleFX. Some analysts point out that the new PM Liz Truss will increase public debt to finance her new energy support package worth £100bn. The macroeconomic data mentioned above will be critical.

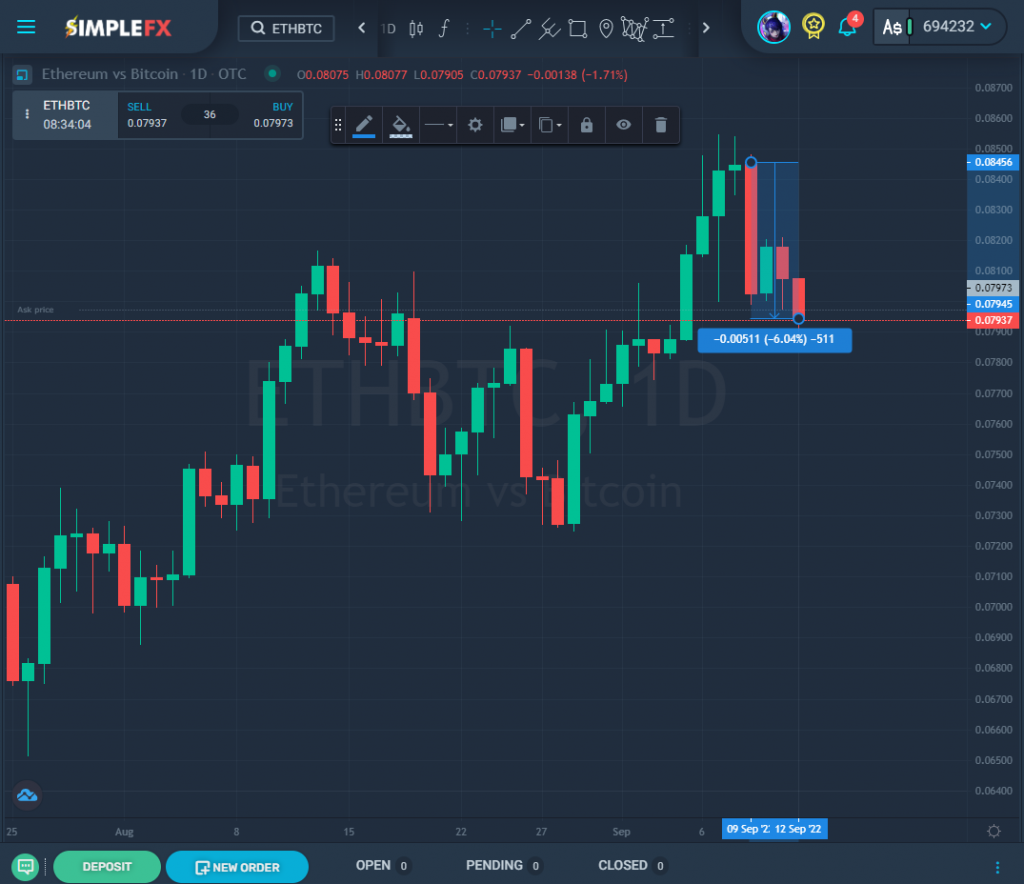

ETHBTC

Cryptocurrencies have bounced back as bitcoin gained 16% in just a few days. With the Ethereum merge set around September 15, we recommend trading ETHBTC. Ethereum switching from proof-of-work to proof-of-stake will make it more exciting. ETH was on a solid run, but this changed on Friday, and ETHBTC has lost over 6% since then.

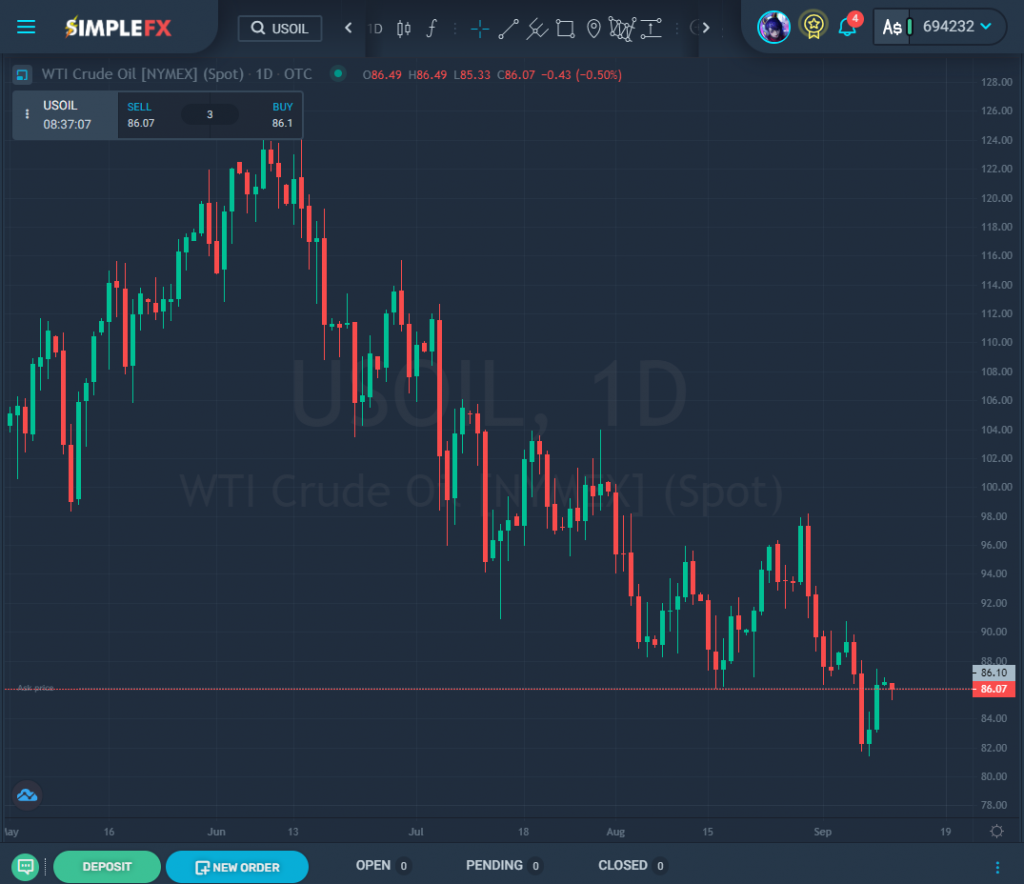

USOIL

Oil prices show a strong downward trend. USOIL fell from $123.8 per barrel to $82 in just three months. If you are looking for an asset to trade using your insight into the world’s geopolitical situation, add USOIL to your watchlist.

Prices of the commodity fell again on Monday, as COVID-19 restrictions and expectations of interest rate hikes in the US and Europe put pressure on a global slowdown. China may reduce its old demand for the first time in history. If this happens, expect USOIL and UKOIL to fall even lower.

These are just three out of hundreds of assets you can trade with SimpleFX. Buy and sell cryptocurrencies, stocks, commodities, and forex pairs with no limits. Remember, you can get up to a $2,500 bonus for the first deposit to any account.