The Canadian dollar and Australian dollar have become intriguing forex margin trading targets. The currencies are heavily affected by commodity prices. Today we analyze both of them against the American dollar. Take a look at our AUDUSD and USDCAD analysis.

The current formation of the AUDUSD currency pair shows the construction of a horizontal trend with a slight downward slope.

The last rebound of the price from the lower green wall describes a small ascending channel of yellow color.

We can see that the price is gradually moving towards the top. Perhaps in the short term, the market will reach the resistance level of 0.786, which is on the upper yellow wall. If that level is broken, the growth may continue to the upper green line and the resistance level of 0.797.

However, it is likely that the bears will take the initiative and lead the market in a downward direction. If they manage to bring the market to the support level of 0.766, which is located on the lower yellow line, and break it, then there will be no obstacles for them to go down to the lower support level of 0.751, which is on the green line.

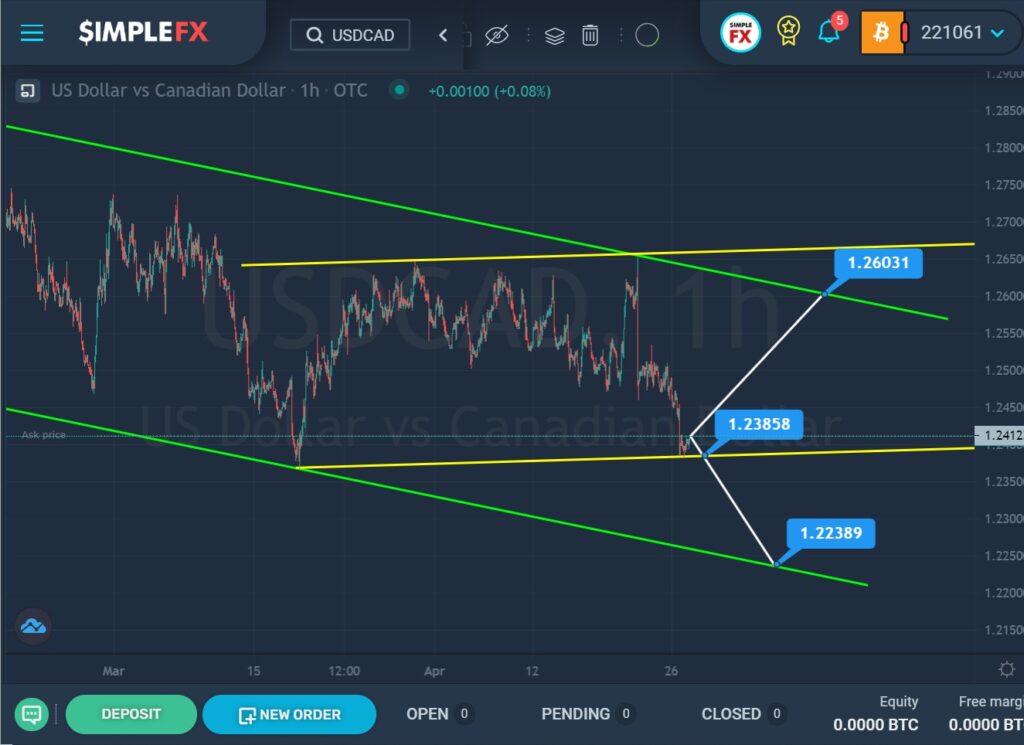

For the USDCAD currency pair, we see the development of a large downtrend that moves inside the green channel. In the last section of the chart, we see the development of a bullish figure, the formation of which began after the price rebounded from the lower green line. This section describes the ascending yellow channel.

Currently, the price is near the lower yellow line and a support level of 1.238. If the bears push and do not weaken their positions, they will not have any difficulty breaking through this level and leading the price to the lower support level of 1.223, which is on the lower green wall.

Otherwise, if the lower yellow line is not broken, we can expect a price increase in the direction of the upper green line and the resistance level of 1.260.