Oil fell almost 2% on Monday morning. Asian stocks closed in red and down European markets are struggling to take off, as the pandemic shows no sign of slowing down yet. Stock market bulls hope the NYSE opening can change the trend.

Over the past few weeks, it would seem as though the U.S. stock markets were finally on the rebound after the disastrous few months caused by the COVID-19 pandemic. However, the negative end of the trading week on Friday would suggest that not everything is out of the red just yet.

The Dow Jones fell by 2.8% down to 25,015.55 points, Nasdaq fell by 2.6% down to 9,757.22 points, and S&P 500 lost 2.4% to end the trading day at 3,009.05 points. All three major indexes also saw significant weekly drops. The Dow Jones posted the biggest losses, falling by 3.3%. S&P 500 fared slightly better and only lost 2.9%, and Nasdaq only lost 1.9%, buoyed somewhat by all of their tech companies that are still posting gains.

Many factors suggest that this kind of downward turn seen in the stock exchanges will continue, and suggest that it is not just a short-term sell-off. The number of COVID-19 cases continues to increase drastically in the United States, with no apparent vaccine soon. The risk of ongoing lockdowns or the second wave of lockdowns will threaten the economy, which is not prepared. Until the rate of coronavirus infections in the USA decreases, the economic concern it causes is unlikely to let up.

The United States presidential election is also coming up, which could have potentially adverse effects on the economy. Currently, Joe Biden, the Democratic nominee, is considered to be the favorite to win. If this is true, it means that a Democratic government could impose more robust tax measures and regulations to harm the U.S. stock exchanges. Investors may already be looking ahead to the November election and maybe acting accordingly.

Although the stock exchange appears to be struggling, there are still ways that investors can get ahead if they use their money wisely. Gold and gold stocks are always a safe option thanks to their haven status, but now even more. Gold has gained 16% in value since the beginning of the year, and the Bank of America predicts that this rise will continue throughout the pandemic. Gold prices are nearing the 2012 highs of $1800, which could come as early as next week. Investing in gold has both short term and long term benefits, and can protect investors against an economic recession if one occurs.

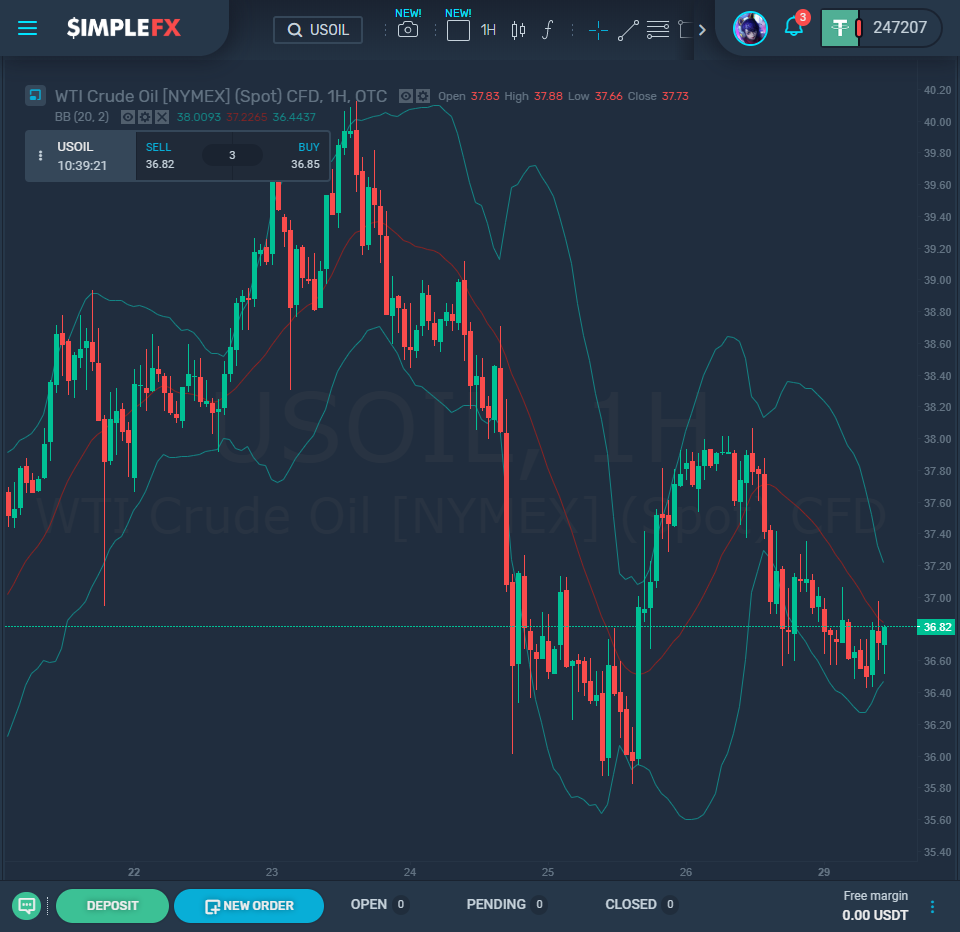

Investing in cyclical stocks is also a great way to make good money. The energy industry was perhaps one of the most heavily hit by the coronavirus pandemic and therefore has the most to gain when its prices go back up. Most energy stocks are low in value, as demand has been severely reduced during global lockdowns. These industries are very cyclical, and prices will increase drastically when more countries begin to reopen, and the market reaches its full scale again. Getting in now offers you the best chance of making a good profit from stocks widely believed to swing back soon.