Stock trading is a great way to grow capital. It is a preferable option among various assets in a diversified investment portfolio. Stock traders earn a lucrative amount by buying and selling stocks on-point as they paddle around market shifts. The trick is always to buy low and sell high. Mixing in stock trading in your investment portfolio will safeguard you from unpredicted market setbacks.

When you trade stocks, you capitalize on its price fluctuations. In short, you take advantage of the market volatility and trade in the right direction at the right time.

Determine what kind of trader you are. Stock traders differ on how they handle their trades and how long they prefer to cash in profit. Day traders tend to open orders to buy or sell stocks, expecting results in a matter of minutes, hours, or days. Whereas, active traders opt to consider more the timing of the market and take profit within weeks or months.

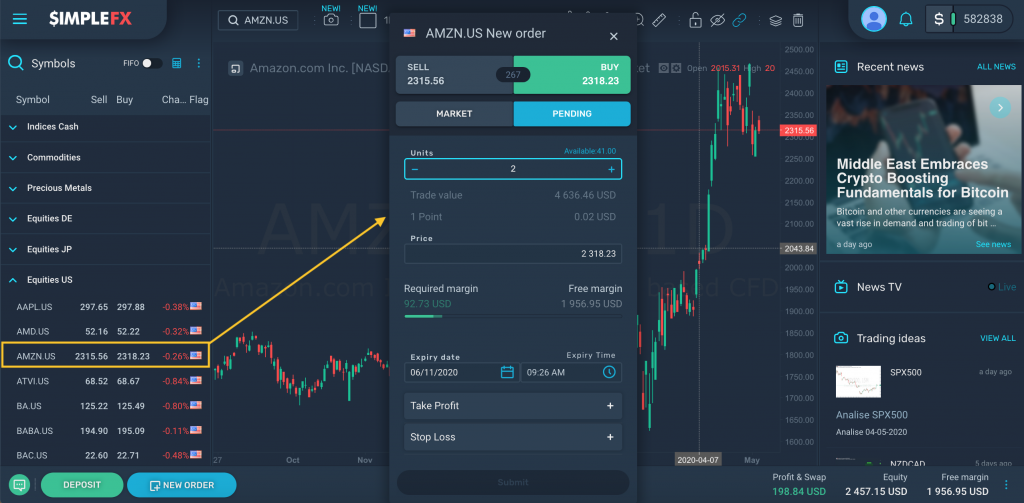

Get familiar with order types. Order types play a big role in a successful trade. Market orders let you buy or sell stock almost instantly and at the best available price. This way, the order has guaranteed execution but there could be slippage. On the other hand, pending orders or limit orders let you buy or sell stock at a specific price that you set. This means that your order will be filled once the stock’s price matches your specific price. Unlike in market orders, pending orders guarantee the price but not the execution. Between the two, pending orders are usually preferred because you can exit trades with more profit.

Do your stock research. There is no shortcut to finding out which company stocks to invest in. There are tons of metrics and ratios that a trader can use. However, you can start with the basics. Look into the company’s financial status. How much revenue did it bring in the last quarter? Is it making more money than usual? What is its competitive advantage? Is the management team good? As Warren Buffett advises, “Buy into a company because you want to own it, not because you want the stock to go up.”

Choose a reliable broker. The fastest way to get you started with stock trading is to open a brokerage account. In finding a broker, carefully evaluate its features. Does it offer stocks from a wide range of markets? Does it have proficient trading tools? Are the fees transparent and reasonable? Does it have robust customer service? How much is the minimum deposit requirement? A broker with a demo account is preferable because you can practice trading without any risks.

Stick to a trading budget. Carefully planning out your trades and allocating a budget are great success indicators. Brokers with no minimum deposits let you take control of how much you want to put in. If you are a beginner trader, start with a low budget and work your way up. Only invest the amount you can afford to lose.

Maximize profit through leveraged trading. Leveraged trading is a trading mechanism that allows you to increase your exposure to the market by borrowing funds from your broker to do bigger trades. For example, you can buy a stock worth $2,500 with only a capital of $50 traded at 50x leverage. With leveraged trading, you can carefully allocate your funds to enter higher positions or open more positions. It is a great way to diversify your stock portfolio and maximize profit.

Easy Stock Trading with Low Capital

SimpleFX is the fastest-growing trading and investing app that provides an excellent environment for stock trading. Anyone can easily trade stocks even with low capital, thanks to its no minimum deposit requirement. Traders can execute trades instantly using only their computers, tablets, or mobile phones. Enjoy commission-free trading and take advantage of its lucrative affiliates program that gives up to 25% revenue sharing to referred users. It is a robust and easy-to-use trading tool even for beginner traders.

To get started with stock trading, follow these simple steps.

Step 1. Create a trading account.

Registration at SimpleFX is fast and easy. All you need is your email address. Head on to the SimpleFX website and create an account. Verify your account by clicking on the verification link that comes with the confirmation message sent to your email address. Once verified, you can now use your account to start trading.

SimpleFX provides users with a demo account. This feature is not available to most brokers. In a demo account, traders are given dummy funds that they can use to practice trading without any risk to their capital. When you feel ready, just switch to your live account and make a deposit for live trading.

Step 2. Deposit funds to your live account.

When trading stocks, you do not need to cash in a fortune to start. You can start trading with as low as $5. SimpleFX requires no minimum deposit to open an account so everyone can access stocks trading in no time. Users can easily deposit in cryptocurrency, Tether, or fiat.

Step 3. Start trading

After deciding on an asset to trade in, allocate a budget, and start a new order. SimpleFX offers a wide selection of stocks from markets around the globe, including the US, France, Japan, UK, among others. If you want to trade stocks from Apple, Facebook, Amazon, Netflix, and others, just look for it under “Equities US.”

Remember that stock trading can be done only during market hours. Do not forget to set the Take Profit and Stop Loss levels to limit any risks. If you are feeling confident, you can change the leverage so you have higher profit potential. Leveraged trading lets you borrow funds so you can enter higher positions with only small capital. This means that you can buy a unit of stock worth $10,000 with only $100 as capital, traded at 100x leverage.

The leverage level can be changed by going to “Accounts & Deposits” on the main menu.

Final Note

Stocks trading is not meant to be intimidating. The SimpleFX WebTrader is an award-winning app that provides traders with excellent tools to get started. It offers the best trading conditions out there. Traders enjoy commission-free trading with no minimum deposit requirements. It features lavish leverage of up to 500x for adventurous traders. There are no hidden fees, and the spreads and swaps are fully transparent. Moreover, it has a lucrative affiliates program that gives traders a generous up to 25% revenue share for referrals. Its affiliate manager is top-notch. Look out for special promotions as well.

Want to start trading stocks? Just sign-up at SimpleFX using your email address and get access to a wide range of stocks available. Our demo account will help you navigate the murky waters of trading without any risks. Try it out today!