Are you among the smart (or lucky) ones who have been margin trading over the last two weeks? Many SimpleFX traders have struck gold with short positions as markets lost roughly ⅓ of the value, 3-4 years of growth.

Gold, oil, cryptocurrencies prices have been falling as extreme volatility is back. It’s the best time to make money.

Forex has been no less exciting as investors turned to cash buying dollars, euro, and yen.

Here’s a closer look at what happened over the last days, and what’s going on now.

At first, euro appreciated, but it has been falling against the US dollar over the last days, however, this changed, and now is back on the bullish side for the second day in the row.

The global stocks experienced a radical sellout. NYSE was not an exception. There has to be floor somewhere below, but still, there’s no safe bet we have reached it already.

The stimulus packages released by practically every government that decides to act against the pandemic makes the situation even more intriguing for reactive margin traders, who want to benefit from the news that affect markets.

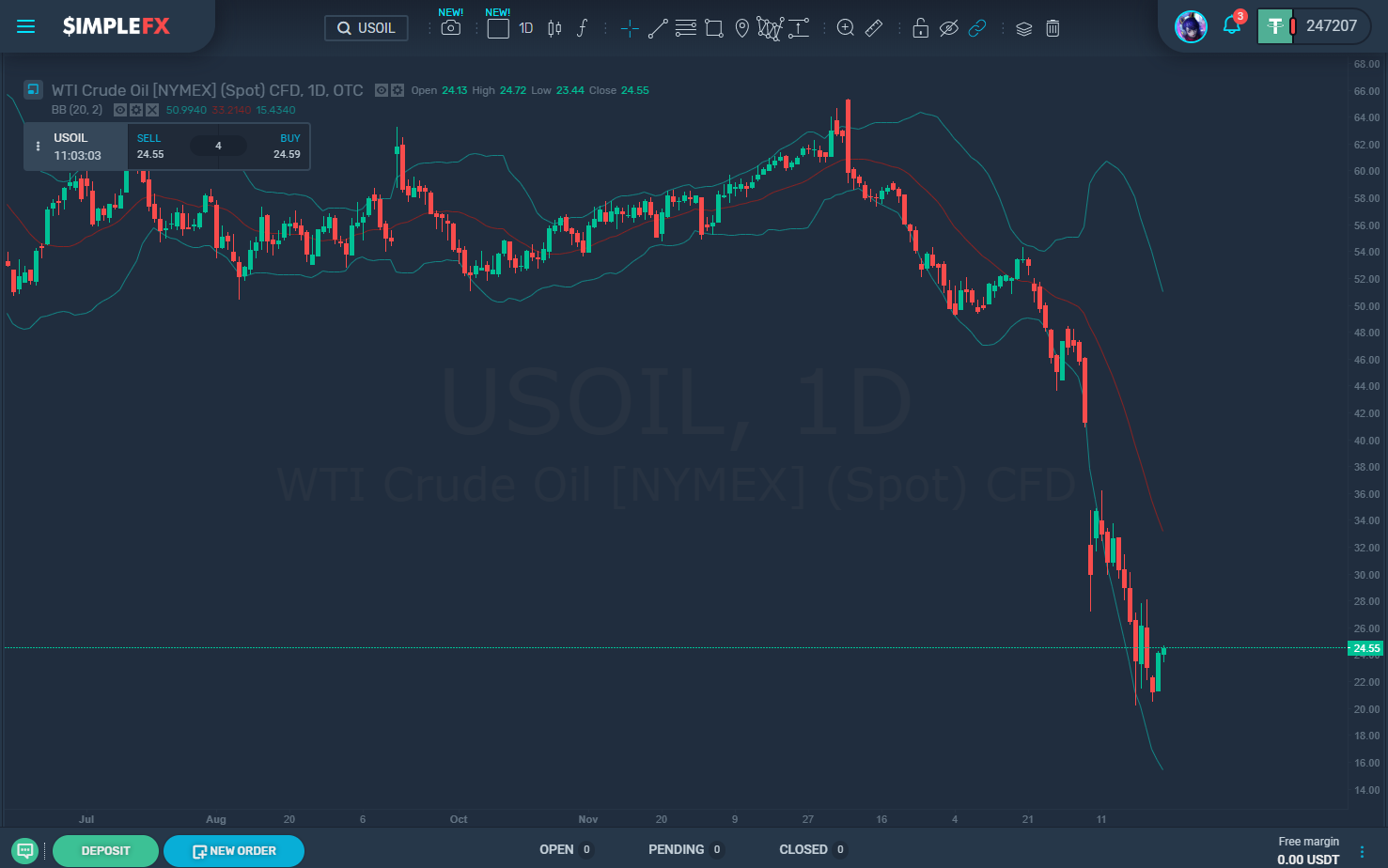

Oil prices are another great instrument for profiting. Shorting oil futures proved to be the right strategy over the last days.

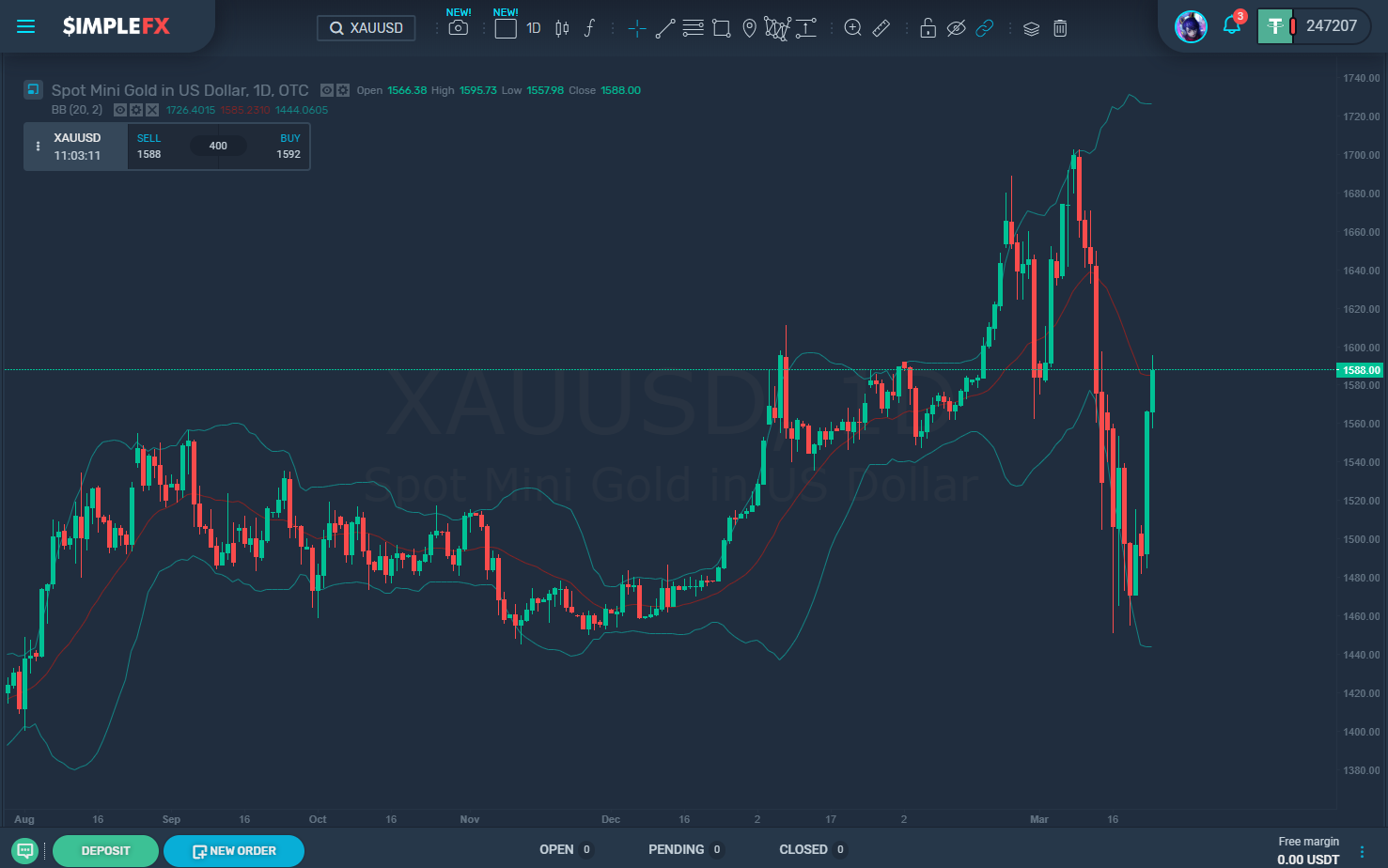

Gold and bitcoin are intriguing assets. They are supposed to be a safe haven against the turmoil. However, investors all went in for cash during the first days of global lockdown. As a result, both gold and cryptocurrencies plummeted. This has changed this week. Just take a look at the mighty rally on XAUUSD in the past days (chart below).

Finally, bitcoin. This is the most exciting journey as nobody knows the intrinsic value of crypto. There were some really scary moments with the bitcoin falling below $4,000, but for now, it’s attacking $7,000 resistance level.

Finally, bitcoin. This is the most exciting journey as nobody knows the intrinsic value of crypto. There were some really scary moments with the bitcoin falling below $4,000, but for now, it’s attacking $7,000 resistance level.

You have to #stayathome for your own safety and for the safety of your community. Don’t spread the virus, make a profit, and come out stronger from the market turmoil.