It’s Brexit vote again. Nothing was established on the exceptional Parliament session on Saturday. We are going to have the crucial vote on the Brexit deal this week.

[button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#df4444″]SELL GBPUSD[/button] [button link=”https://app.simplefx.com/login” size=”medium” target=”new” text_color=”#eeeeee” color=”#3cc195″]BUY GBPUSD[/button]

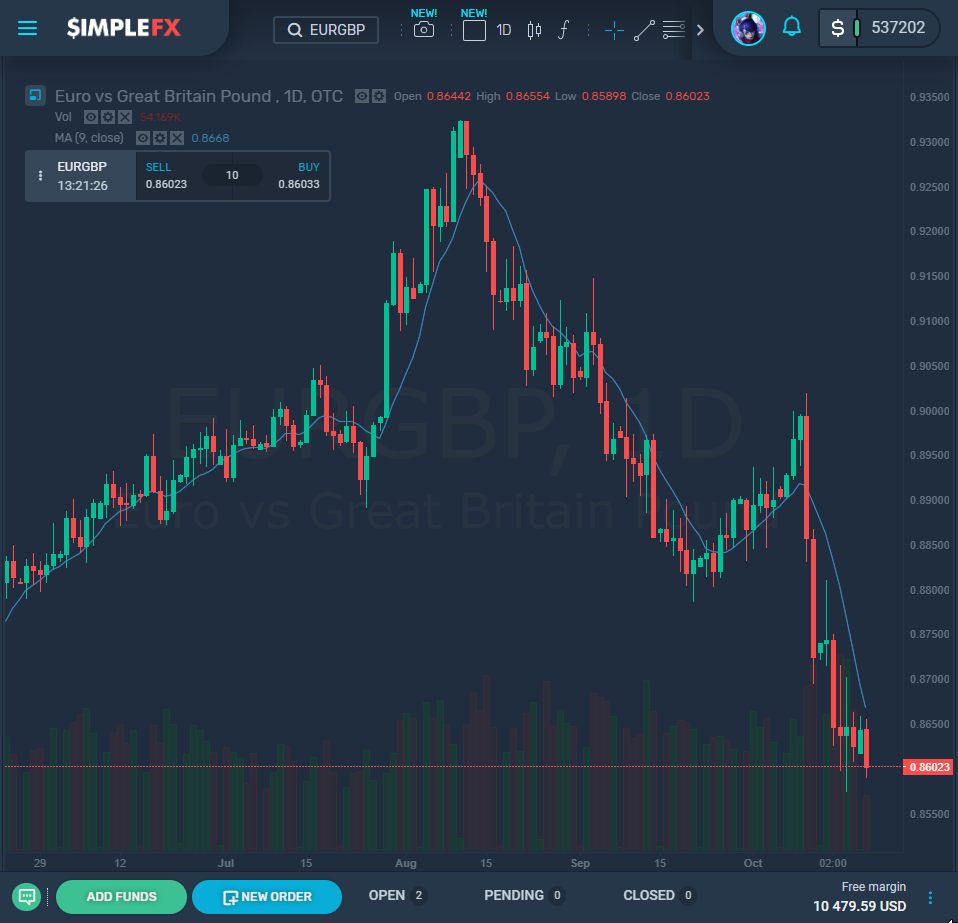

One thing is sure – the uncertainty on every pound sterling cross-pair in the next days. It can go either up or down, as no one knows how markets are going to react, and what scenario and risk worries are already there included in the price.

The analysts agree that if the UK MPs are able to accept the Brexit deal proposed by Prime Minister Boris Johnson the GBP could test the new heights, especially against the Euro.

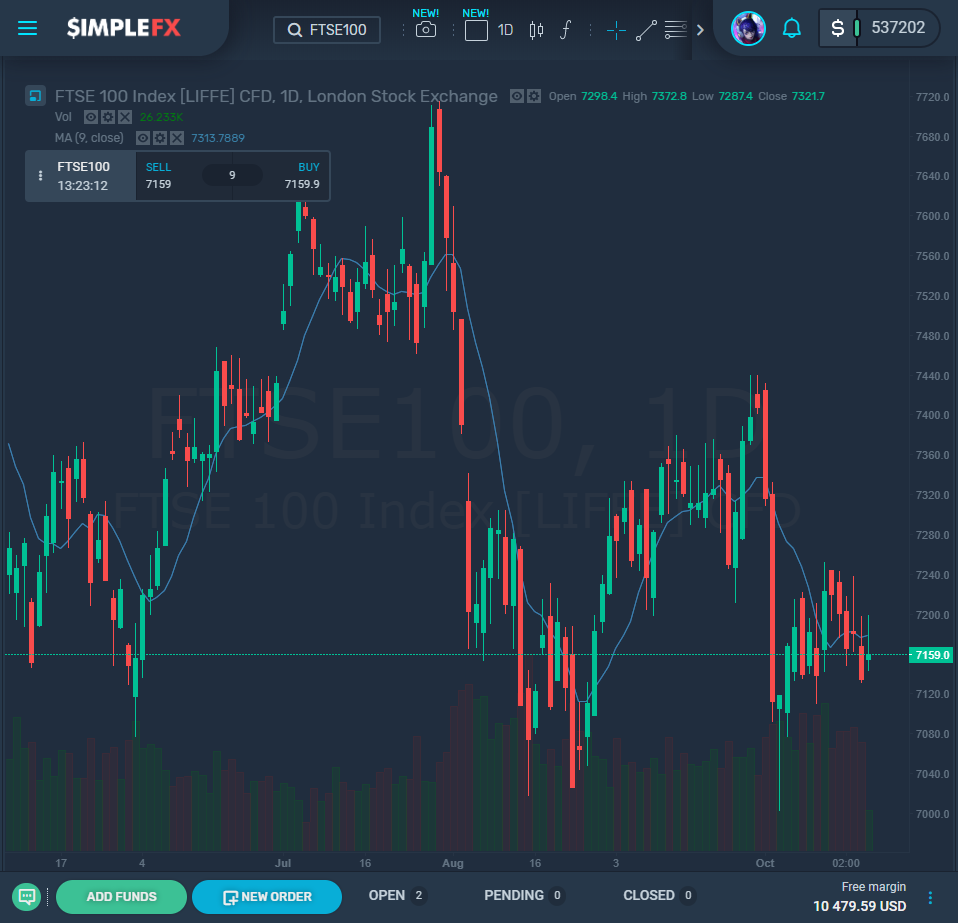

Is such a scenario possible? Some political commentators point that the government could be able to pass the deal Johnson negotiated in Brussels. If it happens not only the pound could go up, but also other British assets.

So what’s the timetable? The UK Government should try to bring the deal to voting on Monday, as on Saturday the Parliament voted to delay the vote on the deal.

Prime Minister Johnson is nevertheless determined to push on with delivering Brexit by October 31, and this keeps open the prospect of a ‘no deal’ Brexit happening at the end of the month.

The Boris Johnson government representatives keep on confirming they are determined to leave the European Union by the October 31 deadline. This declaration was recently repeated by the minister in charge of no-deal Brexit preparations Michael Gove. “We are going to leave by October 31, we have the means and the ability to do so,” he said on Sky News.