When it comes to digital coins’ price tags, their trading volumes play a crucial part. Thus, when crypto exchanges see the low turnout on a daily basis, it is not good news. According to a recent analysis, trends point out that crypto market is facing exactly such situation right now.

It seems that trading at crypto exchanges is facing the lowest volume since 2017. Unfortunately, the bear trend pushed the price down, forcing many investors to sell-out their balances. Thus, the trading volume decreased substantially. Some reports suggested that market manipulation might be at play.

Crypto exchanges pushing the limits – the other way

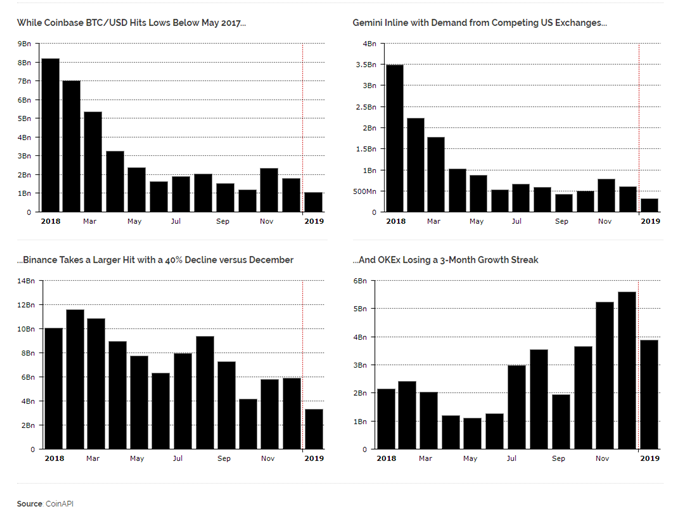

In a report by Diar on February 4th, data shows that volumes in biggest crypto exchanges face low volume turnout. Although loans brought the market up after the debilitating bear trend, things do not look rosy for the market.

Coinbase, Gemini, Binance, and OKex have all suffered increased number of short orders, pushing buyers off the market. The worst off was Binance, losing 40 percent of its daily trading volume since December 2017.

Coinbase managed to keep the loss down to a minimum, while OKex experienced the first decline after three-month growth. The Hong Kong-based saw its daily trading volume sink down below 1$ billion mark in January 2019.

Furthermore, it seems that many new trading projects did not help the situation. The decline of the bitcoin’s price [pushed investors off the crypto exchanges, forcing many to liquidate their balances. With the announcement of CoinbasePro and Gemini’s own stable coin, it seems that market needs time to react properly.

However, at the same time, it seems that leaders of crypto exchanges are not overly concerned with the market movement. Binance’s CEO, Changpeng Zhao stated on CNBC Africa’s “Crypto Trader” show that the decline does not concern him and although the volumes are much lower than two or three years ago, the business is “still profitable”.

“When we see an increase in BTC holdings over time, that means that most likely people are not moving BTC to us,” he said.

However, to add to the speculation, there are also voices that raise concerns over market manipulation by major crypto exchanges. Research by the Blockchain Transparency Institute (BTI) stated that many of the largest platforms played up their trading volumes. The data mostly concerns the top 25 BTC pairs on CoinMarketCap.

Heading into 2019 we will continue collecting true volume data on individual pairs in an effort to curb further manipulation. We will also be contacting all exchanges to implement the best security controls, with the hopes of seeing media reports on the decline of stolen crypto funds in 2019 – concluded the BTI report.

The report also suggests that other top crypto exchanges now provide real data, including Binance, Bitfinex, Coinbase, Kraken, and few others. According to the report, the trading volume downturn volume may be not as strong as the numbers imply as we may be finally getting the real data.